2021 Is Back on Track for Being the Year of CBDCs

Welcome to the 14th edition of Shrimpy’s weekly newsletter, a place for staying up to date on the latest trends, news, and events in the cryptocurrency industry.

Digital assets evolve and move faster compared to any other market. For those who do not have time to constantly scroll Crypto Twitter, we wrote a special weekly update covering everything major that happened this week.

Summary

The SEC delayed WisdomTree’s Bitcoin ETF application

Reports indicate that the EU will soon share its plans for a digital wallet

Dogecoin is now available on Coinbase Pro

Two brokerage firms from China have applied for crypto trading licenses in three major blockchain hotspots

Okcoin integrated L2 solution Polygon

The Biden administration investigates the use of cryptocurrencies in ransomware attacks

Mt. Gox victims can vote on the latest reimbursement plan until October 2021

DeFi protocol Belt Finance announced that it will reimburse users who lost money after a recent hack

SEC delays another Bitcoin ETF application

The Securities and Exchange Commission decided to delay WisdomTree’s Bitcoin ETF application by 45 days. This is their second postponement as the regulator also moved VanEck’s very own application in April, which now awaits a decision in June.

As a reminder, the SEC is free to delay all applications for a maximum of 240 days. Given the agency’s history, it is likely that all applications will be delayed indefinitely until the legal time limit is reached - after which most analysts expect a wave of rejections.

European Union to reveal digital wallet plans

A report from Reuters indicates that the European Union is about to announce its plans for a digital wallet, which will allow citizens of the old continent to facilitate payments via digital currencies rather than fiat money. It was noted that the approach is to issue a single identity from which users can view payment details, store passwords, access local government platforms, and send payments.

If we consider the European Central Bank’s report on a digital euro from last year, the digital wallet is likely in development for the purpose of boosting, innovating, and unifying Europe’s vibrant digital payment system. However, we don’t expect any cryptocurrencies to take part in the network as the aforementioned report focuses on central bank digital currencies.

Coinbase lists Dogecoin

Coinbase listed Dogecoin this week, fulfilling CEO’s Brian Armstrong promise, which was made during the company’s last earnings call. After revealing that Coinbase Pro starts accepting DOGE deposits starting from June 3, the meme crypto project experienced a sharp rise in value that led the community to believe that the hype is not over.

Armstrong’s decision to list DOGE is potentially a part of the exchange’s latest policy to grab liquidity from the DeFi sector and other attractive parts of the crypto market as well. For most, the newest listing comes as a surprise as Coinbase is known for being strict on which projects it lists.

Two major brokerage firms from China open up to the rest of the world

Amid China’s cryptocurrency crackdown, Chinese brokerage firms Futu and Tiger Brokers have decided to look into ways to expand overseas. Both will focus on clients outside of mainland China, which was announced for the first time during their earnings call.

Futu’s senior vice president Robin Li Xu stated last month that the brokerage platform is in the process of applying for digital currency-related licenses in three major crypto hotspots: Singapore, the U.S., and Hong Kong.

Okcoin integrates Polygon to provide cheaper Ethereum gas fees

Cryptocurrency exchange Okcoin integrated layer-2 scaling solution Polygon in a bid to save investors from Ethereum’s expensive gas fees. Users can now access the diverse DeFi ecosystem without an Ethereum wallet simply by using the Polygon sidechain. By doing so, the exchange notes that it is possible to save approximately 25% in gas fees.

According to COO Jason Lau, the next steps for further integrations with the Polygon platform involve enabling investors to access decentralized financial instruments like yield farming directly via Okcoin by using the Polygon ecosystem.

U.S. administration to investigate ransomware attacks involving cryptocurrencies

The latest wave of high-level ransomware attacks in the U.S. prompted President Joe Biden to expand the country’s analysis into cryptocurrencies and their criminal use cases. The Democrat-run administration will also put additional efforts into tracking down and identifying criminals who requested and received payments.

Per the words of Deputy Press Secretary Karine Jean-Pierre, counteracting ransomware attacks became a priority for Biden after the launch of several attacks on key American infrastructure.

This week’s CBDC news

1.The prospect of a digital dollar should be actively explored, states former CFTC chairman. Timothy Massad notes that the U.S. is not China and that it should place user privacy as one of its fundamental concerns.

Massad believes that a CBDC ecosystem shared with private institutions is attractive because innovation comes more often from the private sector than the government.

The former chairman has also commented on the potentially disruptive effect of Tether’s instability.

2. The ECB outlined in a recent report that certain risks exist if a CBDC is not launched. Europe’s central bank noted that private digital currencies could dominate domestic and cross-border payments if it does not launch a digital euro.

The report mentions how Facebook’s announcement of its Libra stablecoin scared financial institutions as they held the belief that it would destabilize the global financial system.

CBDCs can also improve the global status of fiat currencies if implemented, states the ECB.

3. Former head of China’s digital yuan shares that CBDCs could run on Ethereum. Yao Qian stated that CBDCs could one day become smart by integrating scripting abilities, which would make them compatible with the Ethereum ecosystem.

Qian believes that CBDCs should not be digital representations of cash and that they must evolve by utilizing smart contract functionality.

Earlier this year, Qian noted that smart contracts are still prone to security incidents and that blockchain technology must mature to solve these vulnerabilities.

Mt. Gox victims vote on new reimbursement proposal

As of this week, victims of the infamous Mt. Gox hack can vote on the newest reimbursement proposal, a process that lasts until October 8. The case’s trustee revealed that even if a majority accepts the plan, the vote can still fail if it does not reach a quorum of 50% of votes.

If successful, the Tokyo Court will proceed to reimburse victims at the price of $7,000 per Bitcoin, which is the asset’s price at the time of the civil rehabilitation plan’s early onset in 2018. Moreover, claimants who have filed a bankruptcy claim at the time of the hack will be prioritized for the payments.

Belt Finance to repay users after flash loan exploit

DeFi protocol Belt Finance plans to pay back users who were affected by a recent hack in which an anonymous individual stole tokens from the project’s liquidity pools. The plan only includes investors who hold BELT tokens or were part of 4Belt and beltBUSD pools at the time.

As a reminder, Belt Finance suffered a flash loan exploit which led to a total of $50 million in losses. This marks not only the newest hack but also one of the biggest hacks in DeFi history.

Quote of the week

The Good News

Japanese crypto exchange BitFlyer decided to let its U.S. clients trade the BTC/JPY trading pair, which executes more than $30 billion in trading volume.

Retail trading platform eToro received 3.1 million new clients in the first quarter of 2021, likely as a result of Crypto’s new bull market.

Solana launched a $20 million fund to expand the project’s expansion in South Korea.

The Bad News

Analysts from MRB Partners believe that Bitcoin’s bull market “may have come to an end.”

Apple co-founder Steve Wozniak lost his lawsuit against Youtube after a Californian court ruled that the video streaming company is not responsible for its users’ content.

The new OCC head Michael Hsu announced during a virtual press conference that his team would take a look at all decisions related to digital assets that were made by former Acting Comptroller of the Currency Brian Brooks.

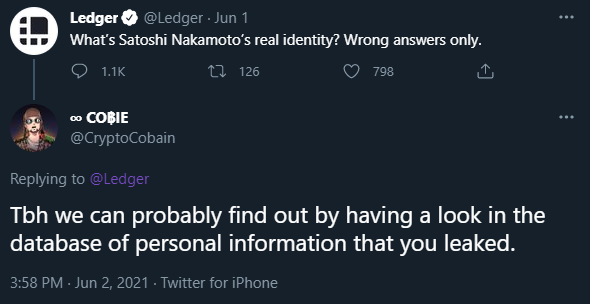

Crypto Twitter Highlights

Ouch! Source

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!