Crypto Enters a New Era of Regulatory Scrutiny

Welcome to the eleventh edition of Shrimpy’s weekly newsletter, a place for staying up to date on the latest trends, news, and events in the cryptocurrency industry.

Digital assets evolve and move faster compared to any other market. For those who do not have time to constantly scroll Crypto Twitter, we wrote a special weekly update covering everything major that happened this week.

Summary

FCA approves its first crypto custodian

Argentina imposes stricter monitoring for crypto exchange customers

Coinbase approves new policy to fast track crypto token listing

A Bloomberg report reveals that the IRS and DOJ investigate Binance for money laundering

Samsung integrates Ledger’s Nano device to Samsung Galaxy blockchain wallet

Brave now supports .crypto blockchain domains

Huobi invests $100M in DeFi

Ethereum briefly reached $500B market cap this week

UK’s FCA approves first crypto custodian

Diginex’s custodial arm Digivault is the first crypto wallet provider to receive regulatory approval from the UK’s Financial Conduct Authority (FCA). Digivault will comply with the nation’s 2017 anti-money laundering and counter-terrorism financing laws.

According to the company’s owners, the latest regulatory approval is set to spark serious interest from institutional investors, considering that they have reached a higher level of compliance.

Argentinian tax authority requests orders exchanges to file monthly transaction reports

Argentina’s Federal Administration of Public Revenues has asked cryptocurrency exchanges operating in the country to file transaction data on their customers in monthly reports. Exchanges have to list several pieces of private information, including identities, income, expenses, and monthly account balances.

Economic hardships have led Argentinians to search for alternative methods of storing wealth. Ripio, one of the largest local crypto exchanges, reports having reached one million users by the end of 2020, doubling in size.

Coinbase decides to approve new cryptocurrencies more swiftly than usual

Leading cryptocurrency exchange Coinbase is historically known for being picky when deciding which digital assets to list. However, a new company policy will change that as the exchange is interested in improving the speed at which they add new cryptocurrencies.

CEO Brian Armstrong has likely made the decision in an effort to stay competitive and grab more liquidity from users. The latest policy update is important as the older listing model has previously forced them to stay on the sidelines.

Binance is reportedly under investigation by the DOJ and IRS

The industry’s largest exchange by volume is under a money-laundering investigation launched by U.S. authorities per a recent report from Bloomberg. The report states that Binance Holdings Ltd. faces federal investigations by both the U.S. Department of Justice and the Internal Revenue Service (IRS.)

CEO Changpeng Zhao openly stated on Twitter that the content of the report is not as bad as the title. However, he did not directly reveal whether the exchange is under investigation or not.

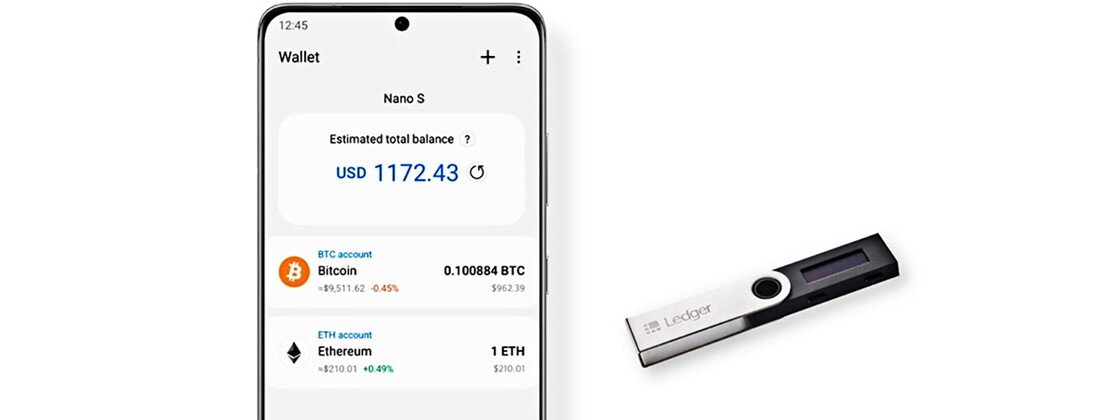

Samsung integrates Ledger wallet to smartphone crypto app

South Korean tech giant Samsung plans to integrate Ledger’s hardware wallets into their own smartphone crypto wallet. The Galaxy smartphone lineup, Samsung’s flagship series, features a blockchain wallet that will from now on support Ledger Nano devices.

As a reminder, Samsung originally launched a blockchain wallet in 2019 with the Galaxy S10, which supported Bitcoin, Ethereum, ERC-20 tokens, and TRON. After their recent integration with the U.S. crypto exchange Gemini, we can expect Samsung to support even more crypto assets.

Brave expands Web 3.0 capabilities by integrating .crypto domains

Web 3.0 browser Brave has partnered with Unstoppable Domains to add support for so-called ‘.crypto’ blockchain domains. Brave users will gain access to more than 30,000 decentralized sites and 700,000 blockchain domain names.

The 3rd-party’s domain system works by building domains on blockchains, where each domain is a non-fungible token (NFT) stored inside the owner’s wallet.

This week in crypto

1. Tether’s composition report reveals that 49% of tokens are backed by unspecified commercial paper. The stablecoin’s latest report is part of Tether’s initiative to stay compliant with U.S. laws by regularly showcasing their reserves.

Tether and Bitfinex were previously charged for covering up to $800 million in losses.

The new report notes that roughly half of USDT’s collateral is backed by unspecified commercial paper.

2. Reserve Bank of India asks lenders to cut ties with crypto exchanges. A report by Reuters states that the request has been made on an informal basis.

An anonymous senior bank executive noted that the RBI is uncomfortable with overseas funds coming into the country via cryptocurrency.

As a reminder, the Reserve Bank of India often pressures the government to ban cryptocurrencies.

3. IRS to seize crypto assets from citizens who do not pay their taxes. America’s tax agency treats crypto as property and will therefore seize it if crypto holders fail to pay their taxes.

The IRS did not specify how it plans to seize digital assets from users.

The IRS treats crypto as assets rather than currency since 2014.

Huobi Ventures invests $100M into DeFi

Huobi’s investment arm has decided to invest $100 million into DeFi, mergers, and acquisitions. All acquisitions made by the exchange will become integrated into Huobi’s ecosystem of decentralized applications and services. Moreover, they will also serve the purpose of improving the company’s capital.

Ethereum reaches $500B Market Cap

Ethereum briefly hit a market cap all-time high of $500 billion on Wednesday morning, surpassing both JPMorgan and Visa in the process. However, the victorious achievement did not last long enough as the cryptocurrency was rejected at this level and went back to the previous $475B market cap.

As Ethereum reaches price discovery, cryptocurrency markets became unstable all across the board. The coin in question fell to $3,600 after a dramatic onslaught by bears and is now attempting to reclaim the previous all-time high.

Quote of the week

The Good News

Ebay’s executives decided to allow the sale of non-fungible tokens on their platform.

A Bank of England official stated that the launch of a CBDC looks “probable”

Metrics from Cryptwerk indicate that merchants and retailers continue to adopt the Monero privacy coin.

The Bad News

South Korea’s Central Bank will monitor crypto transactions from September, marking a new era of regulatory scrutiny.

Former BitMEX Executives Arthur Hayes, Samuel Reed, and Benjamin Delo will face up to five years in prison if a trial planned for March 2022 does not end in their favor.

Crypto Twitter Highlights

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!