Crypto Exchange Trading Fees Compared

Cryptocurrency exchanges work hard to attract new customers. With so many different options for trading available in the market, each exchange must find unique ways to stand out. One way some exchanges differentiate themselves in this competitive market is by offering compelling trading fees.

Throughout the remainder of this article, we will cover the trading fees that are currently being charged by many of the top exchanges.

Once we’ve evaluated each exchange, we will discuss which trading fees are the best for novice traders and which would be ideal for professional traders.

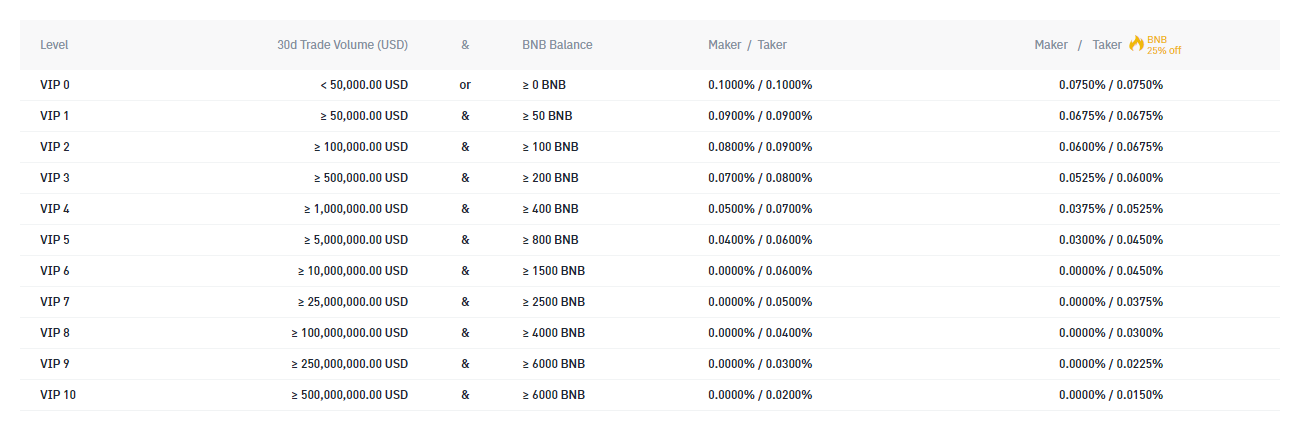

Binance Fee Schedule

Fee Range: 0.015 - 0.1%

Binance was one of the pioneers when it came to innovative fee structures. When the exchange originally launched and offered discounts for holding BNB, many traders immediately saw the potential for trading on Binance. Today, Binance has grown into the world’s largest exchange. At least part of the reason is due to the exceptional fee schedule developed by the exchange.

Binance US Fee Schedule

Fee Range: 0 - 0.1%

Taking a lesson from the launch of the original Binance exchange, Binance US continues the tradition of excellence by offering some of the lowest fees offered in the United States by any exchange. Although the exchange is still small, the low fees are a compelling reason for many to migrate to Binance US.

Bittrex Global Fee Schedule

Fee Range: 0 - 0.25%

Bittrex (Global) offers competitive trading fees when compared to other exchanges in the United States. However, when put head-to-head with other global exchanges, the trading fees come up short. The base trading fee of 0.2% is nearly double many other global competitors.

However, that doesn’t rule out the exchange as a competitor. When it comes to US exchanges, Bittrex is on point. The reasonable fees offered by the exchange would be enticing for many US traders.

KuCoin Fee Schedule

Fee Range: -0.005 - 0.1%

KuCoin may not be as large as Binance, but they have managed to remain competitive when it comes to trading fees. KuCoin even offers negative fees once a trader reaching the LV 8 trading fee tier. A negative fee means the trader gets paid for executing trades.

Coinbase Pro Fee Schedule

Fee Range: 0 - 0.5%

Coinbase Pro might be one of the largest US exchanges, but you wouldn’t know it from the high fees that the exchange charges. Starting at a base fee of 0.5% for both maker and taker fees, Coinbase is easily the most expensive exchange in the United States. The only exchange that matches the exorbitant fees is Bitstamp.

Kraken Fee Schedule

Fee Range: 0 - 0.26%

Kraken, the king of institutional trading, offers a competitive fee schedule that’s suitable for both retail and institutional trading. At the base rate, Kraken offers a taker fee of 0.26% and a maker fee of 0.16%. This is an enticing rate for customers that are considering the switch from Coinbase Pro.

Poloniex Fee Schedule

Fee Range: 0 - 0.125%

Poloniex has had a wild and unpredictable history in the crypto space. Over the years, the exchange has supported a wide variety of trading fees. Today, Poloniex offers two different fee schedules. In addition to a normal fee schedule that begins with a 0.125% maker and taker fee, we can also see they offer a separate fee schedule for TRX trading pairs. This decision may have been driven by the close relationship Poloniex has with Justin Sun.

Bibox Fee Schedule

Fee Range: 0.075- 0.15%

Out of all the trading fee structures we will discuss in this article, Bibox may have the most simple fee schedule. Rather than taking a tiered approach to reduce fees for higher volume traders, Bibox offers a simple flat fee of 0.075% for maker trades and 0.15% for taker trades.

Gemini Fee Schedule

Fee Range: 0 - 0.35%

In stark contrast to Bibox which has the most simple fee structure, Gemini easily takes the cake as the most complex system for fees. Not only does the exchange have a tiered fee structure, but the fees depend on how you execute a trade. Executing trades through the API does not result in the same fees as placing a trade on the website. Even more confusingly, placing a trade through the mobile app results in different fees than trading on the website or through the APIs.

Quite frankly, the fee structure for Gemini is a big deterrent to using the platform. Simplifying the fee structure would be a big improvement for most traders.

Huobi Global Fee Schedule

Fee Range: 0.097 - 0.2%

Compared to other international exchanges, Huobi Global charges higher fees than the standard rate that typically ranges between 0.1 - 0.15%. In addition to the slightly higher fees than the market rate, we can also see how they have decided to forgo fee reductions for maker orders. This can potentially lead to reduced liquidity on the exchange and thinner order books.

HitBTC Fee Schedule

Fee Range: -0.1 - 0.09%

HitBTC was one of the first innovators that introduced negative maker fees. The intention of providing these negative fees was to encourage market makers to join the platform and provide liquidity to the exchange.

Typically, exchanges employ market makers to add consistent liquidity to the exchange. However, by providing negative fees, anyone with enough capital can become a market maker and earn money for providing liquidity to HitBTC.

At the base rate, HitBTC also provides one of the lowest rates of 0.09% for both maker and taker fees.

BitMart Fee Schedule

Fee Range: 0.0563 - 0.25%

BitMart is one of the only exchanges that does not offer discounts for maker trades at any trading volume tier. When it comes to international exchanges, BitMart enforces fees that are nearly double the expected market rate.

At the second-highest VIP 7 tier, BitMart customers will still be charged fees at a higher rate than the base tier for some other exchanges on this list.

Bitstamp Fee Schedule

Fee Range: 0 - 0.5%

Bitstamp remains one of the most expensive exchanges when it comes to trading fees. The only comparable exchange is Coinbase Pro. With a base fee of 0.5%, trading on Bitstamp for retail investors is a hard sell. However, institutions that are trading significant volume might benefit from the exchanges reduced fee for higher volumes.

OKEx Fee Schedule

Fee Range: 0.03 - 0.15%

OKEx offers a competitive fee structure that rivals the other leading global exchanges. With a base taker fee of 0.15% and a base maker fee of 0.1%, the exchange is a great option for both retail and institutional traders.

Bitfinex Fee Schedule

Fee Range: 0 - 0.2%

Bitfinex offers a trading fee schedule that is competitive for maker trades, but a bit more pricey for taker trades when compared to the other global exchanges. However, with the addition of the taker discount for holding LEO, the taker fees on the exchange are comparable to other large exchanges like OKEx.

Conclusions

The cryptocurrency market presents a wide variety of fee schedules that allow exchanges to compete on different fronts. While most global exchanges offer fees that range from 0.1% to 0.15%, US and European exchanges often offer fees at a premium. These premium fees can go as high as 0.5%.

Notice that trading fees are not the entire picture. Executing a trade on an exchange with lower trading fees does not necessarily mean the trade was better than a similar trade on an exchange with a higher fee. We must also consider order book depth and market liquidity.

Trading on an exchange with higher trading fees may be worth it depending on the exchange’s liquidity and other features they provide. Before making a decision on which exchange to use for trading, we recommend investigating everything offered by each exchange.

Retail Investors

When it comes to trading for retail investors, there is no better place than Binance. Binance offers one of the lowest base trading fees. This is only amplified when you consider the ability for anyone to hold BNB and further reduce their trading fees.

Add the other benefits of using Binance, such as the high liquidity and diverse selection of assets, and it is no wonder how Binance was able to climb to the top. Retail investors are flocking to Binance for good reason.

On the other hand, retail investors should be cautious of trading on exchanges like Coinbase Pro and Bitstamp. The massive fees will quickly eat away at any profits for traders that are trading small volumes.

Institutional Investors

Institutional investors have found a home on Binance for many of the same reasons that the exchange is used by retail investors. The high liquidity and low trading fees create a perfect environment for trading large volumes.

In addition to Binance, many institutions have gravitated towards Kraken. Although the base fees are higher than Binance, the fees at higher volumes drastically decrease, reaching levels that aren’t even supported by Binance. This makes Kraken a compelling option for institutions that require the strict regulatory compliance that is offered by Kraken, but still desire competitive trading fees.

Additional Good Reads

The Easy Arbitrage Crypto Trading Strategies

Cryptocurrency Trading Bots - The Complete Guide

Threshold Rebalancing for Crypto Portfolio Management

How to Read Crypto Candlestick Price Charts

Dollar Cost Averaging for Crypto Portfolios

About Us

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!