What Cryptocurrencies Should You Buy? How to Pick the Best Portfolio

The “Cryptocurrency 101” series will focus on the foundational topics for constructing your first crypto portfolio, getting involved with crypto trading, and learning the quirks of the industry. The following article will touch on tips for selecting the digital assets to place in your portfolio. In the future, we will provide additional discussions on how to construct a long-term strategy and in-depth content on how to perform research.

The foundation for any portfolio is deciding which assets should be purchased for your portfolio. Above all else, the selection of assets is the largest determining factor for how well a portfolio will perform over the long-term. Although there are strategies that can help reduce risk and boost performance, the assets we select for our portfolio will take priority.

Notice that this discussion is regarding portfolio management and not day trading or other higher frequency trading strategies. This article will not cover in-depth topics for how to analyze charts, how to day trade, or other short-term strategies.

To get more information on the best research tools in the market for crypto traders, check out our next article!

Crypto Trading 101: Research Tools

Outline

1. Project Vision / Purpose

2. Addressable Market

3. Product-Market Fit

4. Code Analysis

5. Community Reach

6. Marketing & Strategy

7. Team

8. Funding Sources

9. Price, Volume, and Supply Analysis

10. Project Integrations

When your leader trades, you trade. Shrimpy will automatically update your portfolio to always match your leader’s. Browse through hundreds of cryptocurrency traders to copy.

1. Project Vision / Purpose

Before digging into the weeds, it’s generally a good idea to start by trying to understand the purpose of a cryptocurrency. Some questions that can help get you started on this path are questions like:

What does this cryptocurrency do?

Who needs this cryptocurrency?

Why would someone use this cryptocurrency?

Starting with the project vision and purpose is a simple way to ease into investigating an asset. Before getting into the technical details of how it works, the purpose will provide us with a mental framework for understanding how every technical element, marketing strategy, and development will help accomplish the project’s vision.

The questions we ask ourselves during this stage will help us understand why this cryptocurrency needs to exist. If we resolve by the end of our internal questioning that the asset is unnecessary or has no practical use, we may want to save our time by not digging into the project any further.

At this point, a significant amount of our determination to continue investigating this asset will be based on our interest. If we don’t find the project vision interesting, it’s okay to stop investigating. There are thousands of cryptocurrencies in the world and there isn’t enough time to fully understand every single one. It’s easier to spend time researching a project when you are interested in the vision or purpose. Take your time to understand the cryptocurrencies that mean the most to you.

Resources

Some resources that can provide more information on project vision and purpose include the following:

Company Website

Project Whitepaper Summary / Intro

Company Social Media Posts / Blog Posts

2. Addressable Market

CryptoKitties is a novel cryptocurrency that targets the collectibles market.

Once we have an understanding of the product vision. We can begin broadening our understanding of the crypto project by researching the target market for this cryptocurrency.

The size and growth trajectory of the target market can provide an understanding of how large of an opportunity is being addressed by this asset. Although the crypto market is rapidly growing, that doesn’t make every target market equal. A cryptocurrency targeting the sale of Pokemon cards would be a small market. A cryptocurrency that targeted the sale of any physical collectible item may be a medium-sized market. A cryptocurrency targeting the sale of any physical goods or services worldwide would be a large market. Cryptocurrencies that target larger markets have a higher potential for growth.

With startups, many investors have an understanding that a few key investments will determine the return of their entire fund. This idea is called the power law. Essentially, most investments won’t have a large impact on the performance of their fund. Instead, there will be a small number of crucial investments that will pay back everything that was lost from failed startups as well as determine the return for the fund.

Since cryptocurrency is such a volatile and risky asset class, it may be worth considering using this type of mindset. Many cryptocurrencies will end up going to $0 in the long term. However, there might be a few key cryptocurrencies that will take off incredibly and define the future of finance.

Resources

Similar to the project vision, many of the resources to evaluate the target market will be provided directly from the crypto team. Some of these resources include:

Company Website

Whitepaper Summary / Business Purpose

Social Media Posts / Blog Posts

3. Product-Market Fit

In simple terms, product-market fit is the validation that there is a large demand for a product. When it comes to cryptocurrency products, we can measure product-market fit by the number of active users over time.

Some people quantify product-market fit by website metrics such as views, page visits, and bounce rate. It has become apparent these metrics may not be as relevant for the crypto market. Unlike other types of products, the cryptocurrency market has a driving force of profit. Cryptocurrencies have been known to use the promise of profit as a way to generate hype. As a result, the project’s website may appear to have impressive website metrics, but the substance behind the project can still be lacking.

Active Users

Since we want assets that produce long-term value, monitoring active users is a stronger representation of how the cryptocurrency will perform in the long-term.

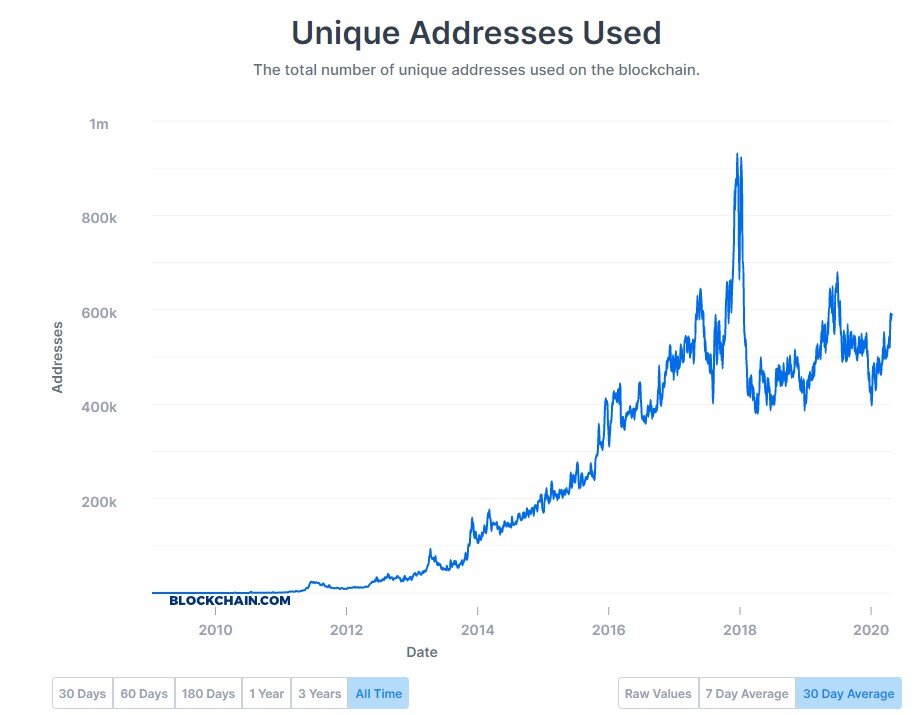

This chart shows the number of active Bitcoin addresses on a daily basis. Based on the continual growth of the number of active users, we can safely conclude that Bitcoin has reached product-market fit. (Source: blockchain.com)

When evaluating if a crypto project has reached product-market fit, spend some time evaluating the growth of the user base. A cryptocurrency that is continuously growing their number of active users could indicate product-market fit.

Blockchain Transactions

This chart shows the number of confirmed Bitcoin transactions per day. The continual growth of the transactions per day shows it is safe to assume Bitcoin has reached product-market fit. (Source: blockchain.com)

Besides active users, we can also gather useful metrics by evaluating the size and frequency of transactions on the blockchain network. It’s possible for a blockchain to have fewer active customers, but a drastically higher transaction frequency. This situation could demonstrate that fewer people use the blockchain, but those that do use the network are extremely satisfied with the project. That means the customers are getting a lot of value out of the network.

In this case, we can evaluate the number of transactions executed per user. We could see how frequently each user on the blockchain makes a transaction and determine the size of each transaction. The higher the usage, the stronger the indicator that the network has reached product-market fit.

Note: Some projects will make claims like “We had 100,000 people sign up for our newsletter, so this is proof we have product-market fit”. In a market driven by profits, 100,000 people signing up for a newsletter may not be sufficient to indicate product-market fit. It’s possible to pay companies that will inflate these numbers, many of these people won’t become users, and some people might just be curious.

Having 100,000 people transact on your blockchain is vastly more difficult to accomplish than having 100,000 people on a newsletter. Looking at active users will provide a more trustworthy source for determining product-market fit than fluff metrics that could be inflated any number of ways.

Resources

To better understand if a project has reached product-market fit, you can leverage a number of different resources to gather information. Some of these resources include:

Blockchain transactions (Ex: https://www.blockchain.com/charts)

Active users (Ex: https://www.stateofthedapps.com/stats)

SimilarWeb (Ex: https://www.similarweb.com/website/bitcoin.org)

Alexa rankings (Ex: https://www.alexa.com/siteinfo/bitcoin.org)

4. Code Analysis

Now that we have a general understanding of the product, it’s time to start digging deeper into the technical side of the project development.

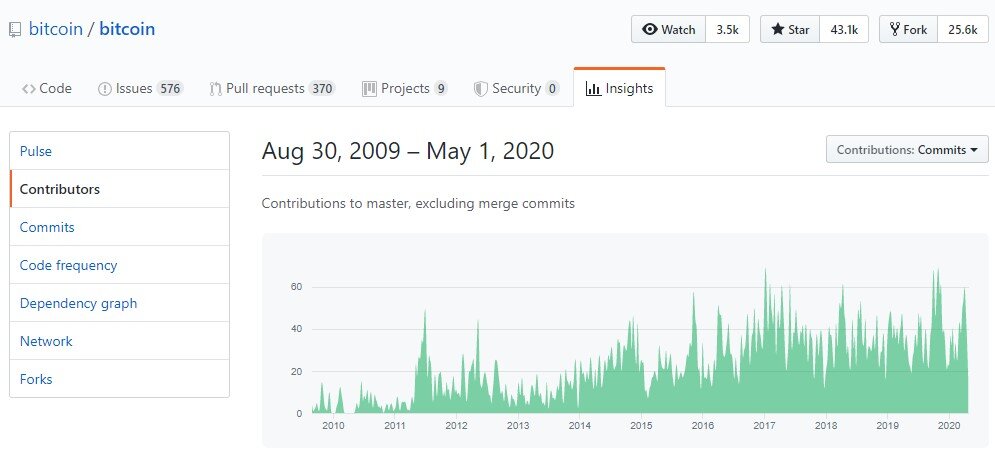

To start, we can begin by getting a high-level overview of the team’s development habits and metrics. There are a few places these metrics are available, but the key resource will be the team’s Git repository.

Some of the metrics we should evaluate include the number of times the repository has been forked, the number of watchers, how many developers have contributed to the project, and how many commits have been made over the last few weeks.

Each of these metrics tells us how well the community has been progressing with the development of the project.

Besides the high-level metrics, we can also evaluate portions of the codebase. Critical elements, like the consensus algorithm, should be evaluated to understand how the core functionality has been implemented. We should make sure the code is clean, easy to understand, and has comments that make logical sense.

Once we’ve completed our analysis of the code repository, we also want to get an understanding of where the project will go in the future from a technical perspective. We can get this information from public technical documents like a yellow paper or technical white paper. A business plan would not be an acceptable replacement for technical documents.

Since white papers can be filled with fluff and unproven theory, it’s important to take these documents with a grain of salt. At the end of the day, if the idea isn’t implemented in functional code, the concepts are still just a theory.

Resources

Some resources that can provide technical documents and access to code repositories include the following:

White Paper (Found on the project website)

Git repository (Ex: https://github.com/bitcoin/bitcoin/pulse)

Technical Conference Presentations

CoinMarketCap (Can provide links to the team’s source code)

5. Community Reach

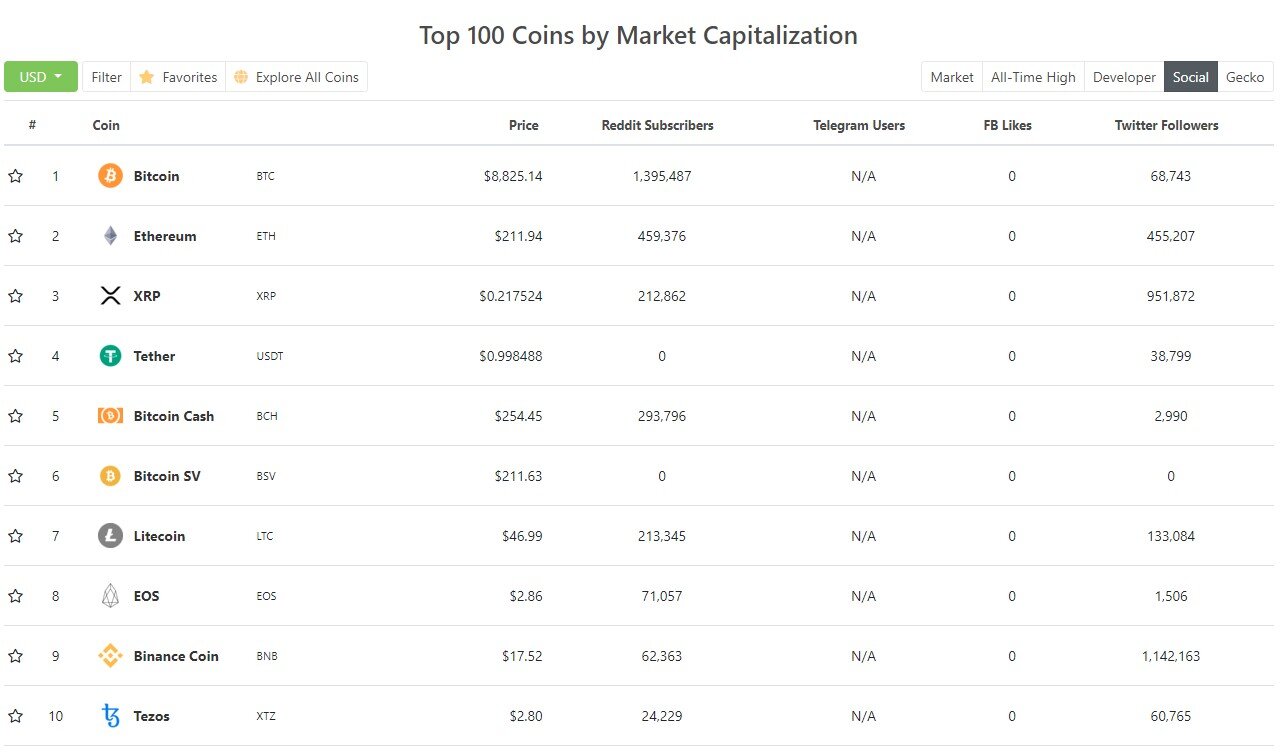

This screenshot taken from Coin Gecko shows the social stats for the top 10 cryptocurrencies.

In the previous section about product-market fit, we discussed how the number of subscribers or website visits is not a substitute for active users when determining product-market fit.

Although the size of the community can’t directly indicate product-market fit, it does provide insights into other aspects of the business. For example, it can show us how the project’s team thinks about business development and community building.

Even if the team starts by heavily investing in business development and community building, it’s possible they can catch up on the technical side in the future. Although the product may not have reached product-market fit early, that doesn’t rule out the possibility that it might eventually.

As a result, it’s still important to consider how the team has been building their community. A strong technical project with no community is a problem. It either means the project isn’t as useful as people think (a disconnect between cool technology and functionality) or it could mean the development team doesn't have the business sense to bring the cryptocurrency to mainstream adoption.

Take care to evaluate the project’s social media presence with a critical eye. It has become popular among communities to hire firms that will help the team acquire fake followers, fake engagement, and metrics that don’t match reality.

If the team has high engagement on a single platform, but low engagement on others, it could be a red flag that the team is artificially pumping their metrics on specific platforms. However, as with all things, there are exceptions. Some teams focus far more effort on growing their communities in specific channels since they see the most engagement through those channels.

Resources

There are a lot of ways cryptocurrency startups build communities. These communities can exist on any number of platforms, so take the time to evaluate each of the options to see where the community is the most active.

Twitter

Linkedin

Facebook

Telegram

Discord

Reddit

Company Forums

CoinGecko (Social Stats)

6. Marketing & Strategy

At the end of the day, even if the crypto project is exceptional, it doesn’t matter if nobody uses it. The marketing and distribution strategies that are leveraged by the team will demonstrate their ability to onboard a critical mass of users into the network.

Without this vital step, cryptocurrencies can lose out on growth opportunities that will shift a project from a niche market to a global platform.

To evaluate a team’s marketing strategy we should look at the way they attract new customers. If they are a platform blockchain, we can also look at the tools they provide for developers to build on the network. The further the team is able to reach into the market, the more complete the network effects will become for the cryptocurrency.

Without an expansive reach, the project may slowly fizzle out. Especially in the crypto market where developers are constantly expanding on ideas to develop new platforms, innovate, and leverage existing ideas.

Resources

There are a number of ways to evaluate the marketing strategies of a cryptocurrency project.

Set Google Alerts for the name of the project.

Podcast / conference / news appearances.

Social media campaigns.

Keyword search in Ubersuggest.

7. Team

It has often been said that a terrible team can ruin even the best ideas and an excellent team can build a business around even the worst ideas.

Since a team can make or break a project, spend time to carefully evaluate the qualifications of the team. Understand how they work together, think, and grow over time. These factors can play an important factor in the longevity of a project.

Everyone seems to have a different way of evaluating people, so there is generally no one accepted set of criteria for determining the quality of a team. We recommend finding the values that resonate with yourself and investigating ways you can evaluate teams based on those values. This will allow you to better align yourself with the team and their standards.

Building a company takes time. In fact, most decent companies can take upwards of 10 years before they find their footing in a market place. With this amount of time, it’s important to trust that the team is ready for the level of commitment required to build a successful company.

For most cryptocurrency projects, there should be a balance between engineering, marketing, and business development. Each of these roles play an important role in growing a successful business. If the team is heavily invested in only one area, for example marketing, this could be a red flag that their team is not properly equipped to accomplish their vision.

When evaluating a team, some questions you may want to ask yourself include:

Is this team in it for the long haul?

Does the team have the skills required to execute their vision?

Where did the team attend university?

Where did the teamwork before starting this project?

What specialties do the team members have?

Can you trust the team?

What is the ratio of developers to business, marketing, and other personnel?

Resources

To evaluate the leadership team, spend time working through their social media accounts and personal websites that can give a better idea of their character.

Twitter

Facebook

LinkedIn

Personal blogs

8. Funding Sources

Crunchbase can be a great resource for finding the funding history of a cryptocurrency. In this example, we can see the investors that are backing Polkadot.

There has been a significant amount of money getting thrown around in the crypto market. This has made it exceptionally difficult to determine the validity of the funding sources.

When evaluating a crypto project, look at the funding sources. Validate that the funding sources are accurate and reputable. Although having the backing of the public is great for crypto projects, having the name recognition of a major investor or company can catapult the reputation of a project to a new level.

Not all money is created equal. The more reputable the source, the more value that can be generated with that capital. That’s because the advice, expertise, and network of an investor comes with each dollar they invest. The more reputable the source, the greater the value of those funds.

Understand that a crypto project with the backing of a big name is not a golden ticket. This does not secure their place in the history books. Companies are difficult to build. They are complex and new markets like cryptocurrency take exploration and chance. Even the most prestigious investors make mistakes.

Some questions you should ask yourself when evaluating the funding sources:

How did the team get funding?

Do they have enough funding to bring their ideas to life?

What brands or investors are backing this project?

How quickly is the team using the funds?

Resources

Investor Websites

Project Websites (Validate the claims with 3rd party sources)

9. Price, Volume, and Supply Analysis

Nomics is a rapidly growing market data provider. In this image, you can see an example of their landing page which shows the top assets by market cap.

Before we can get comfortable with the idea of adding an asset to our portfolio, we should gather a general sense of the asset’s core metrics. For many investors, the core metrics will be things like the market cap, price, volume, circulation supply, and price history.

Each of these metrics will provide insight into the health of the network, the outlook in the near future, and a more high-level understanding of the external factors that are at play for the cryptocurrency.

Resources

We can gather this information from a number of different sources. Some of these resources include:

Exchanges that have listed the asset

10. Project Integrations

The final aspect of a project we will investigate will be the integrations. To fully penetrate a market, a cryptocurrency will need the help and support of other products that build upon the network.

Let’s look at Bitcoin as an example. Bitcoin is supported by nearly every cryptocurrency exchange as the primary quote currency. Almost every vendor that supports cryptocurrency payment options supports Bitcoin first and foremost.

There are thousands of applications and services that have built their product centered around the Bitcoin blockchain. Everything from hardware wallets to blockchain explorers to data analytics companies.

Tens of thousands of businesses have placed their confidence in Bitcoin as the leading cryptocurrency. Bitcoin holds 64% of the market cap at this time and has penetrated the market significantly deeper than any other asset. No cryptocurrency compares to the vast reach of Bitcoin when it comes to integrations and community support.

We can take other cryptocurrencies in the market and benchmark their integrations in a similar way. For platform assets like ETH, we can evaluate the number of dApps that are built on Ethereum versus other platform assets like EOS. In addition, we can check the number of active users these dApps maintain. This can help show how deeply the blockchain is integrated into the development community.

Exchange Listings

These are only 20 of the listed pairs for Bitcoin. Bitcoin has been listed on nearly every major exchange with thousands of supported markets when combined across all of these exchanges. Bitcoin has more trading pairs than any other cryptocurrency. (Source: CoinMarketCap.com)

The final way we can effectively evaluate an asset’s integrations is by evaluating the number of exchanges that support the asset. The higher the number of exchanges that support the cryptocurrency, the more likely other companies will pick up the cryptocurrency for integrations.

Essentially, when an exchange lists an asset, they are validating the utility of the cryptocurrency. The more exchanges that support an asset, the stronger the indication that the cryptocurrency will have infrastructure built around its utility.

Resources

Generally, we can find lists of integrations in the following places:

CoinMarketCap (Asset Pages. Ex: https://coinmarketcap.com/currencies/bitcoin/markets/)

Block Explorers (Ex: https://www.blockchain.com/explorer)

Conclusions

The crypto market is exciting due to the rapid growth and development. Although this provides a significant number of new opportunities to participate in an evolving financial system, it also means we must refine the way we evaluate opportunities.

It is up to us to properly research each project. With the personal responsibility that comes with the crypto market, so does the responsibility to develop our skills in determining promising opportunities.

These tips will break down different aspects of cryptocurrencies and digital assets which should be considered when determining if a certain coin is a promising addition to your portfolio.

Our Social Trading Platform

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Disclaimer

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Shrimpy or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Shrimpy, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.