ETH 2.0 Deposit Contract Released — Should You Stake ETH?

Introduction

Vitalik Buterin, Ethereum's famous founder and chief scientist, made tsunami waves after unexpectedly releasing the Ethereum 2.0 staking deposit contract just last week.

Initially slated for much earlier in the year, the deposit contract's release ends months of anticipation amongst the Ethereum faithful.

However, it's not just Ethereum insiders who are happy about the giant leap towards staking. Everyone seems to be rubbing their hands together thinking about the sweet staking gains to be made on cryptocurrency's second-in-command asset.

Let's back up for a second. There's a lot going on here, and maybe you need a recap of Ethereum 2.0, why it matters, and what the ETH deposit contract is.

Getting a handle on this is essential before the rapidly approaching December 1, 2020 launch date for Ethereum 2.0's beacon chain event — so, scroll on!

Since staking is a relatively new concept, you may not know how it works. Jump into the article to find out.

Quick Recap of Ethereum 2.0

To understand the significance of the ETH deposit contract release, you need to know why Ethereum 2.0 matters.

For years, Ethereum developers have been signaling a major upgrade on the horizon slated to fundamentally transform the way Ethereum works. ETH 2.0 will do plenty of things different from the current Ethereum version, but most importantly, it introduces proof of stake.

Proof of stake

Currently, Ethereum uses a proof of work consensus algorithm — just like Bitcoin.

Mining at the scale needed for global networks like Ethereum is energy inefficient, costly, and creates a barrier to entry for smaller would-be network participants. If the point of blockchain is to spread decentralization, mining creates a hardcap that limits who and how many people can join up.

PoW doesn't only encourage the centralization of resources but also makes poor use of those resources, creating transaction bottlenecks that make network scaling nearly impossible.

Proof of stake answers these issues by lowering computing and energy resource requirements along with introducing faster transaction validation.

Scaling

Scaling is blockchain's golden ticket for not just surviving into the future, but becoming the preferred network of tomorrow's tech infrastructure.

Poor scaling performance means longer wait times for transactions to confirm, higher gas fees, and less overall usability as traffic increases. All of these negatives describe the experience of using Ethereum when a popular DApp, such as Uniswap, is in full swing usage.

To combat poor scaling performance, Ethereum 2.0 will introduce a scaling solution called sharding. In a nutshell, sharding allows for transactions to be processed in parallel on different threads (shards).

In time, Ethereum 2.0 hopes to surpass the Visa transaction throughput standard.

Rewards

Let's face it — everyone wants rewards. That might also be the biggest takeaway from this year's DeFi craze. The mantra going forward is crypto should earn more crypto — and Ethereum 2.0 is going to adhere to that.

At its outset, ETH 2.0's beacon chain implementation will reward users staking ETH in the deposit contract anywhere up to 20% yield, or perhaps even more. Considering that the minimum stake is 32 ETH, at current prices (~$450), that's nearly $3K a year in earnings for doing nothing but holding ETH.

Why the ETH 2.0 Deposit Contract Matters

Ethereum's deposit contract release is significant for a few reasons.

It signifies Ethereum 2.0 is here. It's not years down the road, nor is it an unknown. No, developers are confident enough in testnet results to give the green light for the phase 0 beacon chain launch.

Stakers are required to lock up a minimum of 32 ETH in the deposit contract. For ETH holders, regardless of whether you stake or not, this significant lockup of circulating ETH supply means less sell pressure, greater locked value, and the likelihood of strong currency value going forward.

As the second-largest blockchain network in the world, Ethereum's shift to proof of stake proves that mining just may be an antiquated consensus type. From here on out, the likelihood that upcoming blockchain networks choose PoW is low, even if Bitcoin embraces it.

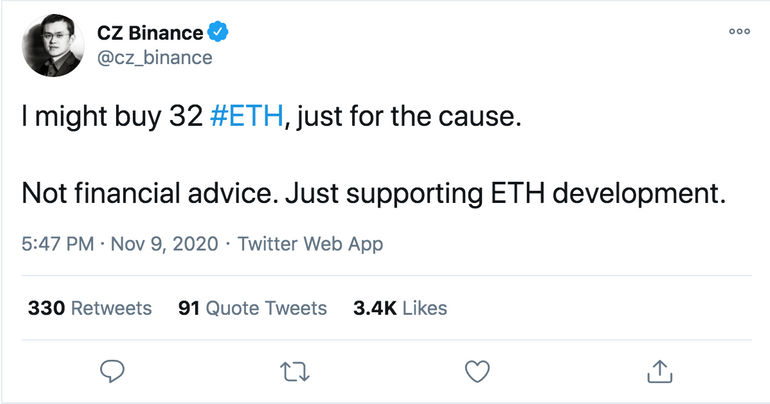

Now that the deposit contract is live, stakers are free to begin depositing amounts equal to or greater than 32 ETH. In a show of confidence, Buterin himself deposited 3,200 ETH. CZ, a popular crypto figure and Binance founder, also signaled support for staking ETH in a recent tweet.

After a week, the ETH contract address had taken in well over $20 million in deposits, showing strong community support for the four-part Ethereum upgrade.

Should you stake ETH 2.0?

If you're interested in staking ETH for the 2.0 upgrade, you should know your options. There are two main scenarios we'll cover below.

However, first, you should know one significant detail. When you deposit ETH into the contract address, that ETH is locked, meaning you can not retrieve it until the contract unlocks.

Wondering when that will be? So is the rest of the world.

At present, nobody knows when the deposit contract will release your ETH, because releasing is contingent on the next phase of ETH 2.0 implementation. Some developers estimate that might take an additional 1-2 years.

If you're going to stake ETH now, you're getting in at the ground floor of the ETH 2.0 project — but be prepared to wait. While a wait with no end date isn't the most appealing proposition, the very decent yield somewhere between 8%-20% should dull the pain.

You have at least 32 ETH you're willing to stake

In this scenario, nothing is stopping you from depositing at least 32 ETH into the contract address. Check the official ETH2 update here to get the latest, including the real contract address for deposits.

You have less than 32 ETH you're willing to stake

There are plenty of people like yourself who want to participate but either don't have the 32 ETH minimum or don't want to stake such a large amount of their ETH stash.

Worry not — you can pool your resources with others to come up with the necessary amount! Staking pools are popping up like wildfire, allowing you to stake just fractions of an ETH in pools with others.

Amongst the best ETH staking pools is Rocketpool, with others, like Staked, providing additional options.

Resources for staking ETH 2.0

Whether you're suspicious, curious, or flat out ready to stake ETH 2.0, it's best to tackle some additional reading and research first.

https://twitter.com/VitalikButerin — Vitalik Buterin's Twitter account is an endless wellspring of information

https://blog.ethereum.org — The official Ethereum blog is as close to the horse's mouth as one can get

https://docs.ethhub.io/ethereum-roadmap/ethereum-2.0/eth-2.0-economics — A deep dive into the economics of Ethereum 2.0

Liquidity Mining

What is liquidity mining? How does it work and how do users earn money by providing liquidity to decentralized exchanges?

About Us

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!