Regulatory Concerns Attack Crypto Again, Peter Thiel Calls Bitcoin a ‘Chinese Weapon’

Welcome to the sixth edition of Shrimpy’s weekly newsletter, a place for staying up to date on the latest trends, news, and events in the cryptocurrency industry.

Digital assets evolve and move faster compared to any other market. For those who do not have time to constantly scroll Crypto Twitter, we wrote a special weekly update covering everything major that happened this week.

Summary

PayPal called Bitcoin a Chinese weapon, calling it a threat for the U.S.

Robinhood’s crypto activity increased massively as 8 million new customers joined the platform

Japan’s central bank is interested in creating common rules for CBDCs

Ripple’s CTO shared his opinion about XRP’s regulatory state

Blockchain security firm CipherTrace added a new compliance tool for DeFi

Digital banking platform Revolut added support for 11 new crypto assets

Korea’s Kimchi Premium negatively influenced Bitcoin’s price action this week

Grayscale has added Chainlink to its crypto funds list

PayPal co-founder Peter Thiel calls Bitcoin a ‘Chinese weapon’

During a virtual roundtable joined by U.S. Secretary of State Mike Pompeo, PayPal co-founder Peter Thiel warned that Bitcoin could be a ‘Chinese financial weapon’ used to destabilize U.S. monetary stability. Thiel said that he is pro-crypto, but he is uncertain about whether Bitcoin poses a danger to the U.S., especially the dollar.

The statement was heavily criticized by industry leaders and the crypto community itself, which believes that the old narrative is a tool used to disrupt Bitcoin’s rise.

Robinhood: Customers trading crypto increased from 1.7M to 9.5M

Online brokerage platform Robinhood shared in a blog post that its crypto-trading customers increased drastically. In Q4 2020, only 1.7 million users have invested in cryptocurrencies. In Q1 2021, the figure increased to a total of 9.5 million.

The new blog post also notes that Robinhood’s team has tripled this year and that it plans to further grow its crypto division.

Bank of Japan seeks ‘common rules’ for CBDCs

The Bank of Japan (BOJ) revealed on Thursday that it seeks to lay out ‘common rules’ around the use of central bank digital currencies (CBDC). To do so, the financial entity will collaborate with seven other major central banks, including the U.S. Federal Reserve and the European Central Bank.

According to the bank’s representative, these common rules should result in more efficient cross-border payments. Moreover, the report states that the collaboration will be joined by countries with similar economic structures.

Ripple CTO attacks SEC’s position on crypto, believes that XRP and Bitcoin are similar

David Schwartz, the CTO of blockchain company Ripple, told CoinDesk in an interview that Bitcoin and XRP are similar, despite the Securities and Exchange Commission's (SEC) view that XRP is being sold illegally as a security.

The CTO claims that the market shares the same view and that the recent SEC action “came out of nowhere.” With rumors of Coinbase relisting the controversial asset, Schwartz believes that XRP will retrace to its former position in the cryptocurrency market.

CipherTrace launches compliance tool for DeFi exchanges

Blockchain analytics firm CipherTrace decided to add a sanction-friendly address tracker as a new tool for decentralized exchanges (DEXs), which can be used to monitor regulatory compliance and fight against malicious users.

The tool utilizes a decentralized oracle created by Chainlink that tracks wallet addresses that are connected to a government watchlist. DEXs and other DeFi platforms can therefore use the tool to prevent transactions interacting with sanctioned addresses.

Revolut adds 11 digital assets to its crypto offering

UK-based digital banking service Revolut announced the launch of 11 new cryptocurrencies on its platform. From now on, clients from the U.K. and European Union will be able to invest in Cardano, Uniswap, Synthetix, Yearn Finance, UMA, Bancor, Filecoin, Loopring, Numeraire, Graph, and Orchid.

Revolut serves more than 15 million customers all over the world and offers crypto trading services since July 2017. This year, the financial company plans to expand to the U.S. as well by applying for a banking license.

This week’s regulatory threats

1. JPMorgan CEO calls for cryptocurrency regulations. In a letter to his shareholders, JPMorgan CEO Jamie Dimon listed the legal and regulatory status of crypto assets as a “serious emerging issue that needs to be dealt with.”

Alongside crypto, Dimon also listed shadow banking, cybersecurity risks, and ethics regarding AI technology as other important issues.

Last week, JPMorgan released a report which sets a long-term price target for Bitcoin of $130,000.

2. Singapore Central Bank Warns retail investors against trading crypto. The Chairman of the Monetary Authority of Singapore (MAS) stated on Monday that cryptocurrencies are not suitable for retail investors in response to a parliamentary question.

The chairman noted that the crypto market is fairly small in comparison to Singapore’s bonds and stock market.

The same week, Singapore’s prime minister urged citizens to “remain vigilant when dealing with crypto platforms,” revealing that they will not be protected by regulatory laws when dealing with unregulated firms.

3. South African crypto exchange iCE3 goes into liquidation. iCE3, a prominent crypto exchange in South Africa, told its clients that it has gone into liquidation after discovering discrepancies in their balances.

The exchange will not operate again as it was advised to liquidate its assets as a result of the missing crypto balance

At the same time, iCE3 disabled all withdrawals and informed clients that they would receive further details in the near future.

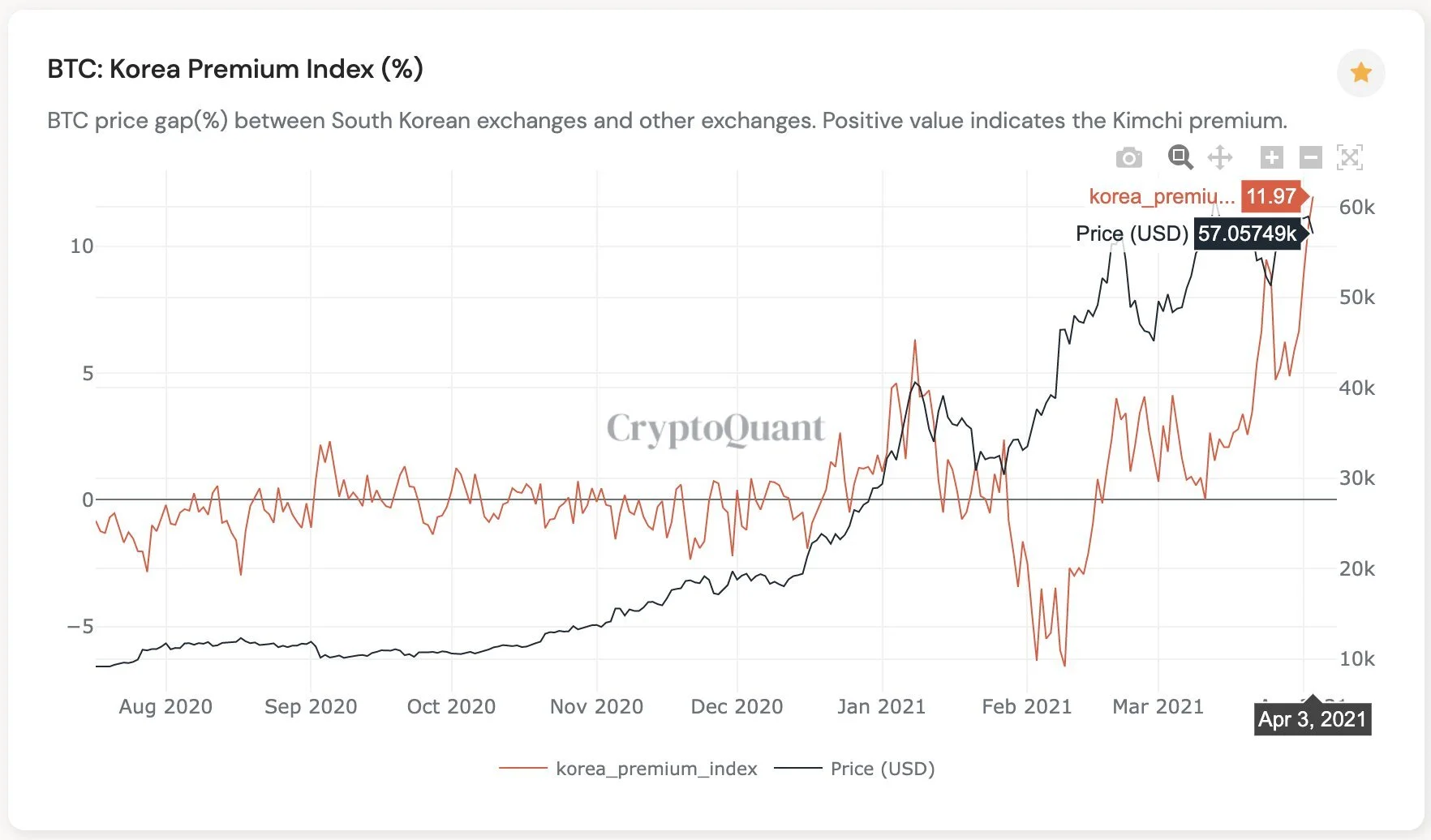

Bitcoin drops after Korean ‘Kimchi Premium’s’ decline

The Kimchi Premium, a price discrepancy occurring on crypto exchanges in South Korea, began massively rising in value in the last few weeks. Believing that the premium is a sign of revitalized interest, Bitcoin whales have overleveraged and entered a shopping spree.

In the meantime, arbitrageurs have decided to profit by buying Bitcoin on western exchanges and selling coins on South Korean exchanges. The chain of events has caused the premium to fall apart, which made Bitcoin lose 6% of its value on all other trading platforms.

Chainlink join Grayscale’s crypto funds list

Institutional-grade digital asset manager Grayscale Investments has decided to add Chainlink to its Digital Large Cap Fund. The decision was most likely made in order to replace the emptiness left by XRP’s removal a few months ago.

Chainlink, a decentralized oracle network based on Ethereum, is now available to Grayscale’s institutional investors. Considering that the project’s use case is mild, we doubt that regulatory uncertainty will haunt another cryptocurrency fund held by Grayscale.

Quote of the week

The Good News

Bloomberg’s analysts predict that the ongoing crypto rally will catapult Bitcoin to $400,000 this year.

The Bitcoin Lightning Network, a layer 2 scalability solution that focuses on improving transaction speed, has reached 10,000 active nodes and $69 million in locked value.

The Bank of Russia plans to present a new prototype for the digital rouble CBDC in December.

The Bad News

Experts believe that Fei Protocol’s controversial debut will push new investors away from the DeFi market.

Former BitMEX CEO Arthur Hayes has surrendered to the U.S. after landing in Hawaii as part of an agreement set between Hayes and the government.

Cryptocurrency custody firm Anchorage has decided to add support to TRIBE, a governance token related to the FEI stablecoin, which fuels the ‘VC dump’ narrative.

Crypto Twitter Highlights

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!