10 Reasons KuCoin Will Be The New Binance In 2020

The competition between exchanges has been heated. Especially throughout the last two years of decreasing investor sentiment towards cryptocurrencies. Exchanges are clawing their way to every inch of market share. Fighting for each and every trader.

Binance has largely dominated the exchange market since January 2018. While few other exchanges have been able to wiggle market share away from this giant, the tide may be starting to shift.

The winds of change are coming. 2020 is going to bring a storm that will throw some exchanges off their game while providing others with the force that can fill their sails and propel them further.

One of the exchanges that we foresee catching some wind in their sails is KuCoin. KuCoin has been a key Binance competitor since the very beginning in 2017. 2020 might finally be the year that KuCoin becomes the new Binance and dominates the market.

We’ve compiled a list of 10 reasons we believe KuCoin can beat Binance in 2020. Although the odds are stacked against them, we see this as the underdog story of the decade to watch in the crypto market.

1. Accessibility

Binance was once hailed as the most open cryptocurrency exchange in the market. The signup process was quick and easy, completely changing the way US investors got into the altcoin market. However, those days are gone. Binance broke with the US customer base to form the new Binance.US exchange. This new exchange is comparable in ways to Coinbase and Kraken, when it comes to KYC, verification, and regulatory compliance.

The cumbersome process of signing up for a new exchange, verifying your account, and being excluded if you live in one of 13 states is inconvenient, to say the least.

In terms of accessibility, KuCoin is already the new Binance. There is no exchange easier to get started using than KuCoin. It only takes a few minutes to sign up and start executing your first trades. The quick process is appealing to many crypto users.

Although KuCoin will eventually be forced to abide by the same strict rules to play in the US, KuCoin will have an advantage as long as they postpone adapting to the US regulations.

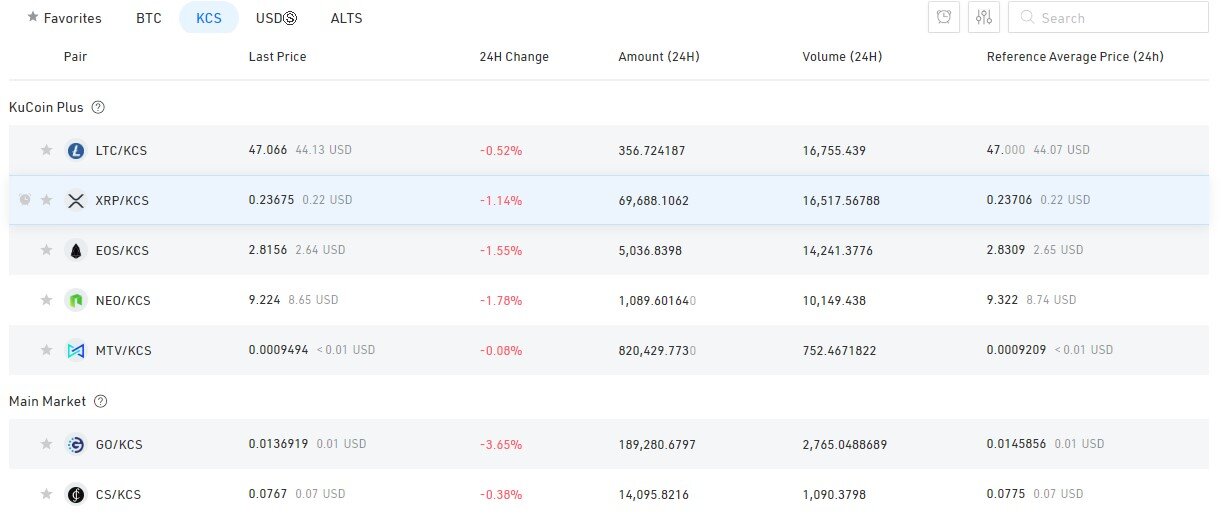

2. Diverse Asset Selection

Both KuCoin and Binance have a great selection of assets. While KuCoin has taken chances on some of the smaller assets in the market, Binance hasn’t shied away from making bold bets on specific cryptocurrencies they believe will bring value to their community.

After the split between Binance and Binance US, the tone has shifted in regards to asset listings. With Binance US being forced to abide by US regulations, it can be expected that fewer assets will be listed on the exchange, making it more difficult to compete with the diverse selection on KuCoin.

If KuCoin continues to experiment with asset listings on their exchange, it may continue to provide them a clear differentiation when it comes down to crypto users deciding where they want to trade.

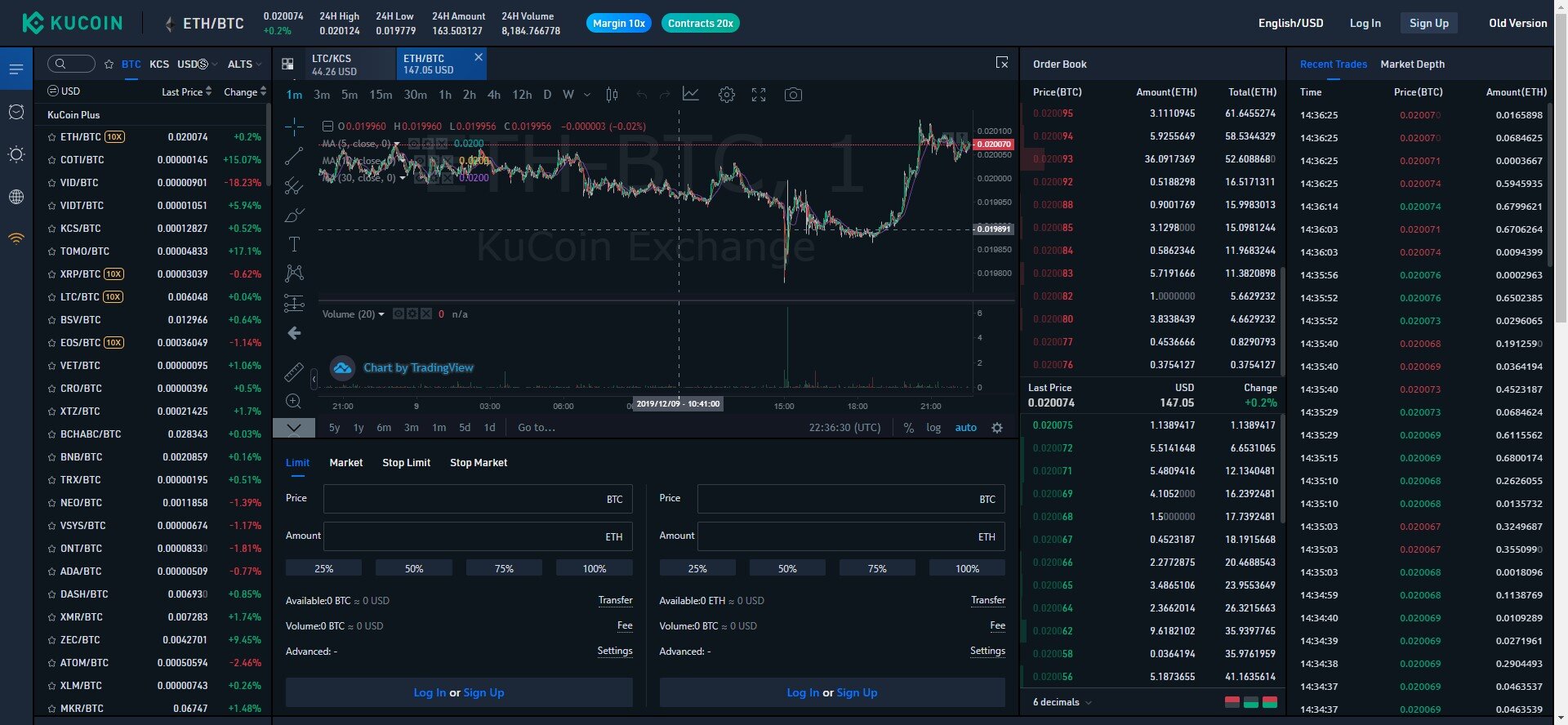

3. Impressive Trading Infrastructure

Binance claims they can process 1.4 million trades a second. That’s impressive and certainly something to be excited about. There are few exchanges that would be able to support the volume of users and trading activity that Binance currently manages on a daily basis, let alone during peak activity.

KuCoin may not have comparable infrastructure to Binance yet, but they have been working night and day to get there. In the last year, KuCoin has consistently upgraded their trading infrastructure. Each iteration is better than the last.

If this effort continues, we expect to see KuCoin reaching comparable order execution and processing power to Binance in the coming year. This will provide KuCoin with enough speed to compete with Binance head-to-head.

With faster order execution, less down time, and fewer errors, KuCoin will continue to grow their user base.

4. Trading Fees

When Binance launched their innovative trading fee tiers that leveraged the BNB token to reduce fees and drive interest, it felt like a new business strategy was born. Soon after, KuCoin announced interesting trading fee mechanisms of their own. Traders can get discounted trading fees when holding balances of KCS.

While Binance has traditionally supported some of the lowest trading fees in the market, KuCoin isn’t far off. Both of these exchanges have unique ideas on how to provide incentives for users through their exchange tokens. As KuCoin grows, we expect KCS will gain traction among crypto traders, driving higher adoption and more usage on the exchange.

5. The Underdog

Everyone loves a good underdog story. The feeling of succeeding against all odds makes us feel like we also have a shot at making it big one day.

People are standing in KuCoin’s corner because they see the passion and potential for greatness. We have no doubts that they will continue taking their shot at becoming the leading exchange, even when the chips are stacked against them.

KuCoin has all the makings of an underdog. The rivalry runs thick, making KuCoin scrappy and determined. They are often finding creative new ways to compete since they need to do more work with less resources.

Traders in the KuCoin community can smell the desire from KuCoin. They are ready to do whatever it takes to win. KuCoin is willing to make bigger plays to become the leading exchange.

Since Binance has made it big, we may see them become more cautious and calculating when they make changes to the way they operate. kuCoin, on the other hand, can afford to take risks and shoot big.

6. Powerful Community

KuCoin has the feeling of a grassroots movement that resonates with many crypto users. Word of mouth has been one of the most powerful marketing tools employed by KuCoin. The personal branding they have built has excited traders because they finally feel heard.

The KuCoin community is unlike anything we’ve ever seen. Their community is more than a bunch of traders. Each person really believes in the KuCoin mission. Although the slogan “People’s exchange” may have been a branding play, they were spot on with this one. The exchange really has turned into the exchange of the people. This has grown into an international movement for KuCoin.

By continuing to grow organically through word of mouth, KuCoin is setting themselves up to have the most powerful customer base when the market starts to turn bullish. A personal referral can quickly influence someone new in the crypto market to sign up for the exchange, without exploring the competition.

7. Liquidity

The recent trading infrastructure updates not only provided faster order execution and more reliable trading, but it also brought in liquidity. The KuCoin order books continue to become more liquid as larger institutions and traders find their way to the exchange.

After Binance’s recent split from their international exchange, into a US and non-US exchange, we expect to see a dip in the liquidity provided across these two exchanges. The splintered Binance volume and reduced liquidity might end up driving customers to seek out new exchanges like KuCoin. This great migration will add more liquidity to the exchange and further strengthen the trading experience.

As the market turns bullish, we will see the liquidity across every major exchange climb. Since KuCoin provides global liquidity on their exchange, rather than splitting their liquidity across multiple regional exchanges, international institutions will become more comfortable with the idea of using KuCoin.

8. Support for Trading Services

One of the major signs of success for a cryptocurrency exchange is the number of integrations with third-party tools, trading bots, and analytical software. Although nearly every major service supports exchanges like Binance, KuCoin is gaining ground when it comes to the number of integrations.

Over the next year, we expect every major service will be rushing to integrate KuCoin. This will further cement KuCoin as an integral part of the cryptocurrency ecosystem. Becoming a major exchange for traders who execute arbitrage strategies, high-frequency trading algorithms, and portfolio management solutions.

9. Robust Security

As far as we know, KuCoin has never been hacked. While that doesn’t mean the exchange will never be hacked, or that you should keep your assets on the exchange, it’s still impressive.

Binance, on the other hand, has been hacked several times. The most publicized hacks over the last two years include the following 3 events.

These consistent hacks should be concerning for most cryptocurrency traders. Although Binance claims to have one of the most sophisticated security systems, their track record suggests otherwise.

KuCoin’s squeaky clean record is reassuring. As the market becomes volatile again, new cryptocurrency users will be attracted to exchanges that haven’t had run-ins with hackers in the past.

10. A Changing Landscape

2020 may be the year cryptocurrency revives stronger than ever. This presents a new opportunity for exchanges to rise and fall from public grace. KuCoin will have their shot at pushing forward, powering a movement, and taking their place on the global stage.

The future has not been set. Mid-sized exchanges like KuCoin will be well-positioned to scale if they take measured risks, experiment with new strategies, and subvert creative attempts to hack their exchange.

With the right strategy, we can see 2020 being the rise of KuCoin.

Conclusions

The cryptocurrency market will continue to expand in the coming years. This expansion will present new opportunities for exchanges to find their place in the market. KuCoin has built a unique brand and culture that isn’t matched by any other exchange. While Binance has been a dominant force, we believe KuCoin will soon have their shot at becoming a formidable opponent to Binance. The groundwork has been laid, so it’s just a matter of patience and timing.

We look forward to another exciting year of supporting KuCoin, Binance, and every other major exchange in Shrimpy.

Additional Reading

Binance Review - Best for Crypto Trading?

KuCoin Review 2019 - Is it Safe for Cryptocurrency Trading?

Shrimpy is a trading bot that simplifies crypto portfolio management. Linking your exchange account to Shrimpy unlocks convenient trading features that can help you automate your crypto strategy. Try it out today!

Shrimpy’s Universal Crypto Exchange APIs are the only unified APIs for crypto exchanges that are specifically designed for application developers. Collect real-time trade or order book data, manage user exchange accounts, execute trading strategies, and simplify the way you connect to each exchange.

Follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.