KuCoin vs. HitBTC - What exchange is better in 2020?

This article is part of a series that compares aspects of different exchanges. Join our Telegram to stay up to date with the discussion and learn more about the top exchanges in the crypto industry.

Over the last 2 years, the cryptocurrency market has gone from a frenzy of altcoin hunting to a graveyard of abandoned projects. Although this isn’t reassuring for the moment, the day may come again where we see the resurgence of altcoins. When this day comes, we want to be prepared by having access to a diverse selection of assets through trusted exchanges.

During the last crypto craze, there were 2 exchanges that were widely known for their large selection of altcoins. These exchanges were KuCoin and HitBTC. Both of these exchanges have made a name for themselves by boldly listing assets the community wants.

Without a doubt, if you’re hunting for the latest and greatest altcoins, you should become familiar with these two titans. They will provide you access to hundreds of assets that range from the blue-chip cryptocurrencies like Bitcoin to those you might have never known like “Lympo”, the health and wellness token.

Cryptocurrencies are diverse. This diversity can become overwhelming when it’s difficult to find ways to access the assets you want to purchase. If a cryptocurrency is only available on a single exchange, the accessibility can become the bottleneck for adding the asset to your portfolio.

Throughout this article, we will compare and contrast KuCoin and HitBTC to determine which exchange should be crowned the king of altcoin hunting.

Before you begin, don’t forget to join our active community of traders to learn more about every major cryptocurrency exchange and discuss strategies for portfolio management.

KuCoin Review - Is it Safe for Cryptocurrency Trading

HitBTC Review - Is It the Best Exchange for Crypto Trading APIs

Available Cryptocurrencies

First and foremost, people who are hunting for altcoins will be looking for exchanges that support the most desirable altcoins. That makes the asset availability one of the highest priorities for selecting an exchange in this instance.

KuCoin

KuCoin currently has approximately 200 unique assets and 455 trading pairs listed on the exchange. This provides a wide selection of cryptocurrencies that have been vetted by the KuCoin team and made available for their expansive community.

When it comes to listing altcoins, KuCoin has a stellar track record of working with their customers to ensure they are always supporting the cryptocurrencies that are highly sought after.

HitBTC

HitBTC currently has 350 unique assets and 887 trading pairs listed on the exchange. Although the number of supported assets on HitBTC far exceeds KuCoin, a variety of these assets feel like zombies that were never delisted. The large list of assets may be due to HitBTC’s interest in providing the largest number of assets, regardless of the quality of these cryptocurrencies.

Unfortunately, this has resulted in a significant number of these assets being low market cap assets that are dying or seemingly already dead.

Which exchange has better crypto listings?

This is a difficult call. HitBTC clearly has a much wider selection of assets, however, many of these niche altcoins have extremely low liquidity. This presents a major problem when trading these low cap coins.

In comparison, KuCoin has a solid selection of up and coming altcoins. Factoring in the liquidity of the KuCoin order books presents promising opportunities for the exchange.

At the end of the day, HitBTC has the best selection of altcoins for crypto traders who are looking for those rare gems.

Order Types

In this section, we will explore the different order types supported by both KuCoin and HitBTC. Although many order types can be generated through a custom combination of limit orders, it’s often advantageous for exchanges to have a variety of built-in order types that can provide a guarantee on the execution based on the input parameters.

KuCoin

KuCoin has implemented one of the most complete selections of order types. Unlike other exchanges that only support limit and market orders, they have implemented a slew of more advanced order types that include stop, cancel after, post only, hidden, and iceberg orders.

The KuCoin suite of order types provides a complete array of options for institutions and individual traders who are looking to build more advanced trading strategies.

Those users who are looking for margin trading will also feel right at home. KuCoin offers a complete margin trading experience that rivals other major exchanges like Binance and Bitfinex.

Lastly, the KuCoin OTC trading desk is a great way for institutions to purchase high volume orders without going through the spot markets on the exchange.

HitBTC

Compared to KuCoin, HitBTC has a limited selection of trading options. With only limit, market, and stop-limit orders available, traders will have a slightly more difficult time executing advanced strategies as they require custom logic.

Like KuCoin, HitBTC also provides institutions with access to an OTC desk. The HitBTC OTC desk is open for traders who are looking to purchase $100,000+ orders.

Which exchange has better order types?

KuCoin definitely has far more order types that can be leveraged to build advanced trading strategies.

Although HitBTC has a small selection of order types, these are essentially standard across every exchange. The bare minimum is not enough when comparing to the inspiring variety that is available on KuCoin.

KuCoin definitely takes the cake when it comes to order types. If order types is your highest priority, look no further than KuCoin.

Trading Fees

Both KuCoin and HitBTC have low trading fees when compared to the industry standard.

KuCoin

KuCoin has implemented an interesting trading fee tier list that echos Binance. Starting at 0.1% for both maker and taker, the trading fees decrease with higher trading volume and larger balances of KCS.

At Tier 10, taker orders will have a 0.03% fee while maker orders will execute with a 0.0125% fee.

HitBTC

HitBTC provides a trading fee tier list that aggressively competes with KuCoin. When trading with an upgraded account, traders will have access to a beginning trading fee of 0.07%. This is one of the lowest fees available in the market.

With increased volume, these trading fees continue to decrease until reaching a staggering -0.01% for maker orders and a 0.02% fee for takers. The -0.01% maker fee means HitBTC will pay you for these orders.

Which exchange has better trading fees?

When trading with a HitBTC upgraded account, the trading fees on HitBTC are better. Incentivizing institutions and high net worth individuals to execute higher trading volume by paying out money for the highest tiers is also a genius strategy for adding liquidity to the exchange without paying market makers.

UI Experience

It may not be a priority for everyone, but many individuals enjoy using products that are easy to use, pleasant to look at, and simple to understand. Fiddling with an exchange to try to figure out how to perform basic tasks can become overwhelming.

We believe a well-designed exchange should land you a few extra points, so let’s discuss the UI for both of these exchanges.

KuCoin

KuCoin has aggressively improved their UI over the last year. Everything from the trading view, onboarding steps, and process for depositing funds is pleasant. There are no major hiccups.

The most cumbersome part of using KuCoin is the sheer number of times you will be asked to enter your 2FA code, trading password, or verify emails. While we understand this is intended to ensure the complete security of your account, it does mean you will always need to have your phone and email handy when trading.

Overall, KuCoin has an exceptional UI. There is no doubt it took significant effort to get to this stage, and their hard work is shining through their work. We commend them for each update being better than the last.

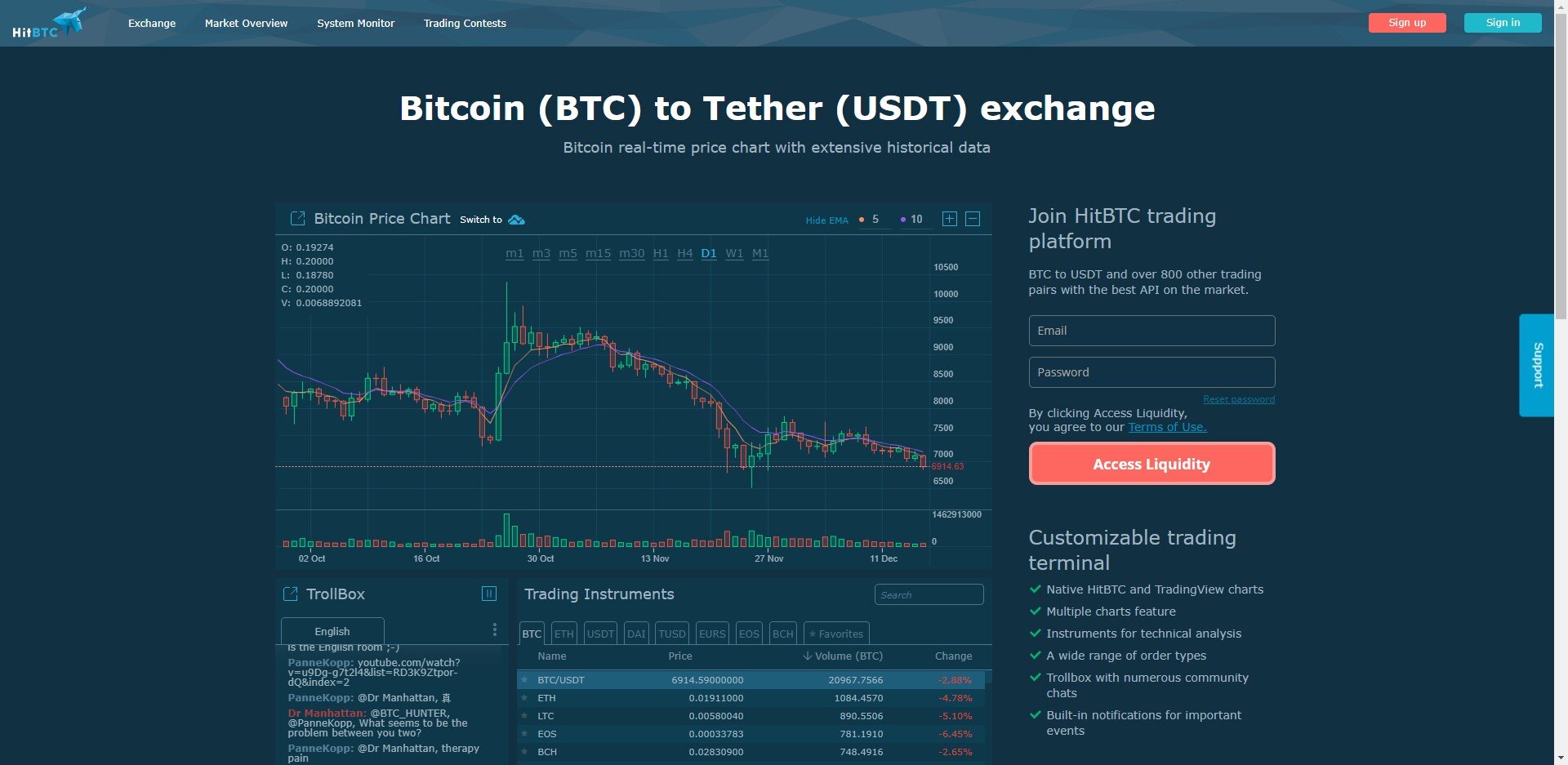

HitBTC

Compared to KuCoin, it feels as though HitBTC has not dedicated the same energy to improving their user experience.

Nearly everything in the HitBTC UI could use small tweaks or updates. The trading view feels outdated, the onboarding process doesn’t feel as secure, and there is less guidance on how to use the exchange than KuCoin.

All-in-all, HitBTC feels outdated. It’s closer to Poloniex than Coinbase Pro, when it comes to user experience.

Which exchange has a better UI?

KuCoin has a user experience that far exceeds HitBTC. KuCoin’s resilience in pushing their UI to become better with each update has secured KuCoin as one of the leading exchanges when it comes to user experience. There are few exchanges we would place in the same category as KuCoin in terms of UI.

Trading Liquidity

In order to buy and sell cryptocurrencies, we need liquid order books. This allows us to trade at the market prices and not introduce significant trading costs. Although many traders will immediately understand how trading fees can be costly, sometimes the bigger cost can come from crossing large bid-ask spreads or experiencing slippage during a large order.

In this section, we will compare the liquidity of KuCoin and HitBTC by evaluating the BTC/USDT trading pair on both of these exchanges. Since this is the most liquid trading pair on most exchanges, this should provide a general understanding of how liquid the largest books are on these two exchanges.

KuCoin

Previously, we mentioned KuCoin has 455 trading pairs listed on the exchange. Of these trading pairs, almost 200 have daily trading volume under $1,000. This can be a concern for traders who are focusing on trading small market cap altcoins.

BTC/USDT Analysis:

We examined 116,690 trades using the BTC/USDT trading pair that happened between 12/1/19 and 12/3/19 on KuCoin. With these trades, we were able to calculate the following stats.

1,551.7291 BTC Trading Volume on the BTC/USDT pair.

58,078 orders were placed over the time period.

Max order size was 15.7119 BTC.

Max slippage was 0.1665%.

5,697 orders experienced slippage of more than 0.01%.

9.81% of orders slipped more than 0.01%.

36 orders saw slippage more than 0.1%.

0.062% of orders slipped more than 0.1%.

HitBTC

Similar to KuCoin, a large percentage of assets listed on HitBTC consistently maintain trading volumes lower than $1,000. In fact, 600 of the 887 trading pairs available on the exchange have daily trading volumes under $1,000. This is truly unprecedented, especially when comparing HitBTC to exchanges like Binance. Binance currently supports less than 20 trading pairs out of 587 that has a trading volume of less than $1,000.

BTC/USDT Analysis:

We examined 85,810 trades using the BTC/USDT trading pair that happened between 12/1/19 and 12/3/19 on HitBTC. With these trades, we were able to calculate the following stats.

93,831.7456 BTC Trading Volume on the BTC/USDT pair.

42,787 orders were placed over the time period.

Max order size was 120.7243 BTC.

Max slippage was 0.1454%.

4,693 orders experienced slippage of more than 0.01%.

10.97% of orders slipped more than 0.01%.

6 orders saw slippage more than 0.1%.

0.014% of orders slipped more than 0.1%.

Which exchange has better liquidity?

Many of the metrics we evaluated in this quick liquidity study were similar across HitBTC and KuCoin. Both exchanges experienced similar slippage profiles throughout the examined period.

Considering all of these different liquidity factors, we find that these two exchanges possess relatively strong liquidity for their largest trading pair BTC / USDT. Neither exchange experienced significant slippage, and the frequency of even minor slippage events was quite low.

Although we find the BTC/USDT trading pair on both of these exchanges present acceptable liquidity, there are a significant number of assets that don’t provide this same liquidity. Personally, we think both of these exchanges should be cleaning house of the assets that don’t meet minimum trading volume requirements.

Final Words

At the end of the day, both of these exchanges provide unique value to cryptocurrency traders. In this study, we’ve teetered back and forth between KuCoin and HitBTC while trying to determine which exchange is the ultimate platform for altcoin hunters. That’s because these are both exceptional exchanges.

However, we’re running out of things to discuss, so it’s time to crown the king of altcoin hunting exchanges.

… and the award goes to…

Both!

Let me explain.

If you are only looking for a diverse selection of assets, there is no better place than HitBTC. HitBTC has the largest selection of altcoins in the market, hands down. Many of these assets cannot be found easily on other exchanges.

On the other hand, if you’re making your first voyage as an altcoin hunter in the cryptocurrency market, KuCoin may be a better choice for beginners. Although they have fewer assets, many traders may find the user experience a bit more comfortable.

While HitBTC has the authority of a world-class exchange, KuCoin has the feeling of a grassroots movement that centers around the customer.

After everything is said and done, you won’t regret using either one of these exchanges. We encourage you to experiment with both options to find the exchange that works the best for you.

Additional Reading

Coinbase vs Kraken - Which Exchange Is The Best For Buying Bitcoin?

Bittrex - Is It The Best US Crypto Exchange?

Shrimpy is a trading bot that simplifies crypto portfolio management. Linking your exchange account to Shrimpy unlocks convenient trading features that can help you automate your crypto strategy. Try it out today!

Shrimpy’s Universal Crypto Exchange APIs are the only unified APIs for crypto exchanges that are specifically designed for application developers. Collect real-time trade or order book data, manage user exchange accounts, execute trading strategies, and simplify the way you connect to each exchange.

Follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.