Binance vs. Coinbase - Which Exchange Is Bigger in 2020?

This article is part of a series that compares aspects of different exchanges. Join our Telegram to stay up to date with the discussion and learn more about the top exchanges in the crypto industry.

Out of all the companies operating in the cryptocurrency market, none have grown as significantly as the leading crypto exchanges.

These behemoths have painted a new industry faster than Morris Katz. Some have reported that Binance is even the fastest profitable startup in history to reach unicorn ($1B+ valuation) status. It only took the exchange about 6 months.

However, Binance is not the only cryptocurrency company that experienced explosive growth over the last few years. Coinbase saw similar growth when the exchange went from having a $483M valuation to an $8B valuation over the course of about a year.

As the crypto market continues to grow, we may see more examples of companies experiencing explosive growth. In fact, it may become seemingly commonplace as we reach global adoption.

Regardless, this article will focus on the two most popular exchanges - Binance and Coinbase. Our goal is to compare these two exchanges to determine which exchange is the most popular cryptocurrency exchange in the world.

Trading Volume

One metric that is important for active traders is the volume an exchange is executing. Trading volume gives insights into the popularity of an exchange for trading purposes.

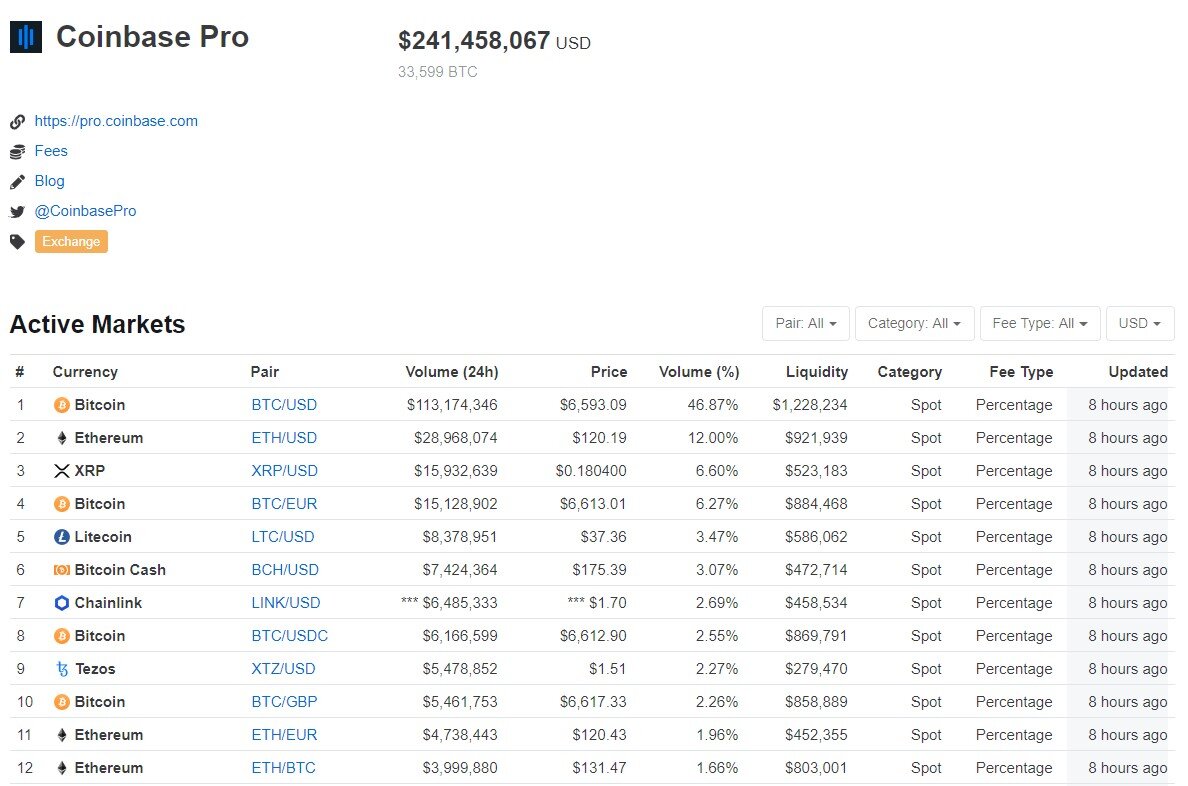

Coinbase

On December 18th, the 24-hour trading volume was approximately $241,458,067 across all trading pairs on the Coinbase Pro exchange.

This trading volume has significantly grown since January 2018. The growth could potentially be contributed to Coinbase aggressively listing new assets to diversify the cryptocurrencies that are available for trading through the platform.

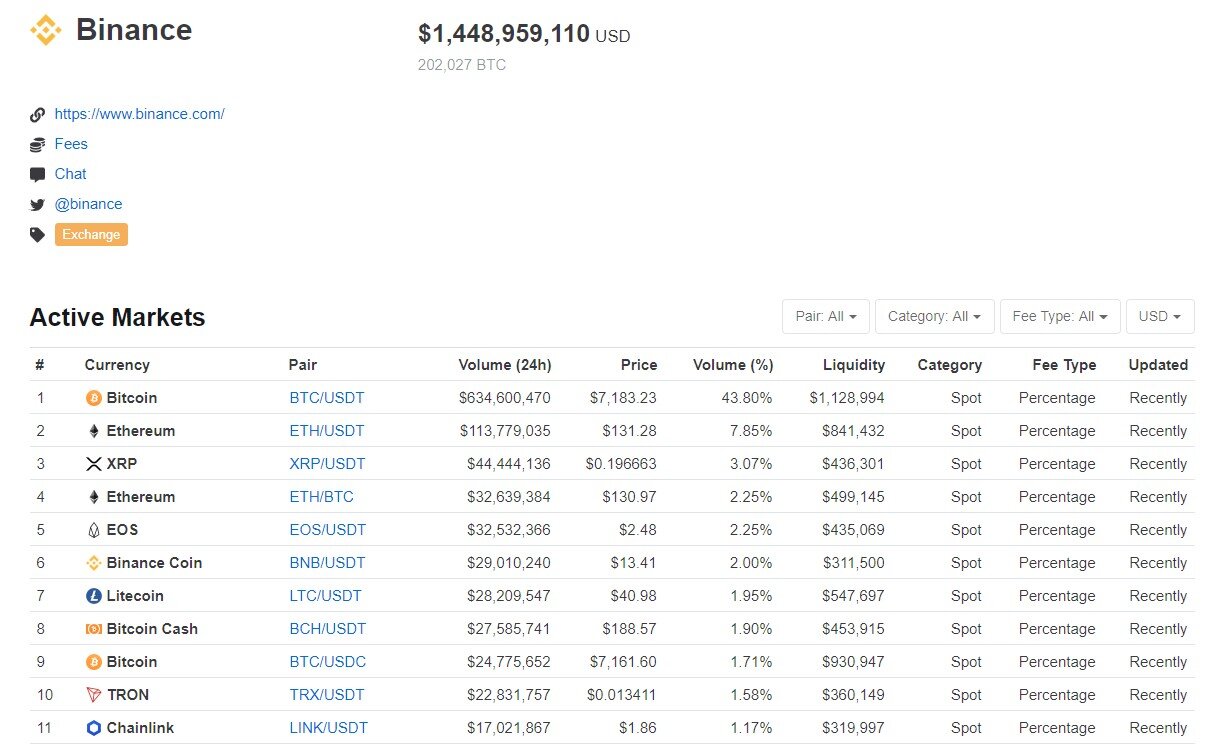

Binance

On December 18th, the 24-hour trading volume was approximately $1,448,959,110 for the Binance spot trading markets.

It can be noted that Binance also supports Futures markets that also experienced approximately $2B in trading volume over the same 24-hour period.

Conclusion

When it comes to trading volume, there is no exchange that can compete with Binance. Binance has completely dominated the market when it comes to trading volume.

Users

Both Coinbase and Binance support users of all kinds. Anyone from novice traders to global institutions are welcome to participate on these exchanges.

The number of users can give us an idea of the popularity of the exchange among retail investors. Since this metric is heavily skewed by the number of signups from regular people, we can get a sense of how well the exchange targets retail customers.

Coinbase

We don’t have the exact number of users on Coinbase, but based on a Coinbase “About” page, they had over 30M users the last time the page was updated.

For reference, this is more users than registered on Charles Schwab.

Binance

Similar to Coinbase, we don’t have precise numbers for how many users are on Binance. However, based on an interview given by CZ, he suggests they support about 15 million users.

Comments

Unfortunately, the market is more nuanced than simple user numbers. There are a few things we should consider when evaluating which exchange is larger.

Binance has far more lax restrictions on registering accounts. They don’t require KYC, so many users have registered more than one account.

Coinbase was founded in 2012 while Binance was founded in 2017.

Coinbase may include users across all of their products - Coinbase, Coinbase Pro, Coinbase Wallet, and Coinbase Earn. This can lead to an inflation of user numbers.

Conclusion

With everything said, we believe Coinbase has a larger user base. Their iron hold on the US retail market has driven nearly every US crypto user to register with Coinbase.

Revenue

The revenue growth from both of these exchanges has been awe-inspiring. Few companies have ever been able to grow revue at a comparable rate to these two companies.

Coinbase

Coinbase Revenue

Coinbase posted $520 million in revenue in 2018. In 2017, Coinbase reported about $1 Billion in revenue. Although this means the exchange experienced a slump after the last crypto bull market, it outlines the potential for similar or higher revenue during future bull markets.

Binance

Binance Profit

Binance brought in $78 million in profit in Q1 2019. This was calculated from the quarterly burn that was executed by Binance for BNB.

In Q3 of 2019 alone, the exchange made a profit of $183.5 million. The most impressive aspect of this rapid growth in profit observed over the last few quarters is that the market is still relatively stagnant since the previous bull run.

Conclusion

It is difficult to discern the exact situation given the difference (or rather lack) in reporting from these exchanges. While we can gather some information about Binance’s profits each quarter due to the BNB burn, we don’t have more detailed reports. This also doesn’t directly correlate to their revenue each month.

Based on the profits from the last quarter, we would bet that Binance is currently bringing in more revenue than Coinbase. However, Coinbase may have been bringing in more revenue even as recently as 6-9 months ago. That suggests Binance may have recently overtaken Coinbase in revenue.

Employees

At the end of the day, it’s the employees that make a company great. Although Binance and Coinbase likely have different cultures, they both feel like great places to work. That’s why hundreds of world-class engineers, business people, and executives have flocked to these companies.

Coinbase

Through a number of different sources, some have estimated the current employees at Coinbase to be around 1,300.

In 2016, the exchange had 117 employees according to an article published by Laura Shin. That suggests a 10x growth over the course of 2017 - 2019.

Binance

In the 2 short years since the launch of Binance, the exchange has already grown to around 1,800 employees.

Binance now consists of teams spread across 12 different locations including California, Paris, Singapore, London, New Delhi, Malta, and more.

Final Thoughts

Binance and Coinbase are both massive exchanges. While Coinbase appears to have a much larger appeal for retail investors, Binance has dominated the global institutional trading market.

Projecting forward, Binance is on a path to overtaking Coinbase in a big way. While Coinbase has a clear hold on the US market, this will become an exciting battle zone for these two exchanges as Binance.US competes with the established US exchanges.

The final verdict is these exchanges are currently neck and neck. If Binance continues their trajectory, they will overtake Coinbase to become the most popular crypto exchange in the world by the end of 2020.

Additional Reading

Coinbase vs Kraken - Which Exchange Is The Best For Buying Bitcoin?

KuCoin vs. HitBTC - What exchange is the best for altcoin hunting in 2020?

How to Make a Crypto Trading Bot Using Python

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Shrimpy’s Universal Crypto Exchange APIs are the only unified APIs for crypto exchanges that are specifically designed for application developers. Collect real-time trade or order book data, manage user exchange accounts, execute trading strategies, and simplify the way you connect to each exchange.

Follow us on Twitter for updates!