How Investors Can Automate Their Crypto Tax Reporting

Cryptocurrency gains and losses tax reporting is a sensitive topic amongst traders. With a large number of rumors flying around, I thought it would be helpful to explain exactly how cryptocurrency gains and losses are taxed and discuss how traders using automated trading tools like Shimpy can automate the tax reporting process through the use of crypto tax software and crypto tax calculators like CryptoTrader.Tax.

How Is Crypto Taxed?

The IRS treats cryptocurrencies as property for tax purposes, not as currency. Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting liability when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it for.

In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes.

For example, if you purchased 0.2 Bitcoin for $2,000 in April of 2018 and then sold it two months later for $4,000, you have a $2,000 capital gain. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. a long term gain.

Oppositely, if you sold your cryptocurrency for less than you acquired it for (you lost money), you can write off that capital loss to save money on your crypto taxes.

The Tax Reporting Challenge

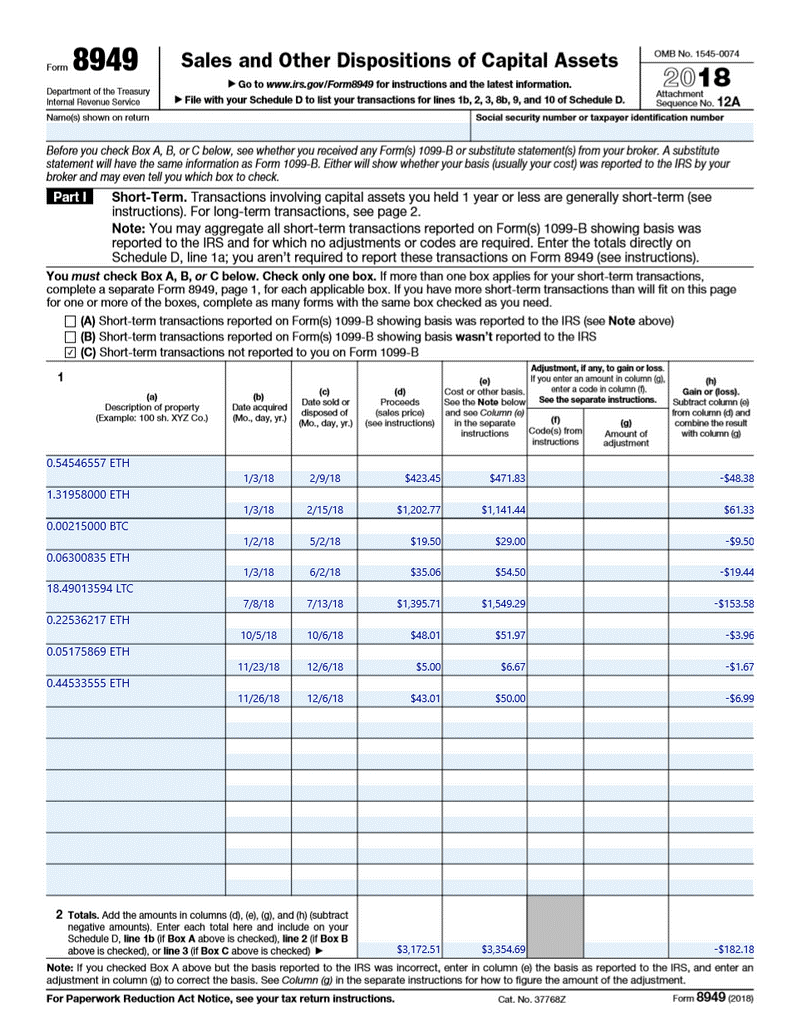

Unfortunately things get a bit more complex when it comes to filling out the required tax forms for your crypto gains and losses like IRS Form 8949. Form 8949 is the IRS tax form used to report capital gains and losses for all types of property, including cryptocurrency.

You can see an example 8949 generated from CryptoTrader.Tax below.

As you can see, you need to fill out an entry on 8949 each time that you make a crypto-crypto trade or otherwise incur a taxable event. A taxable event is simply a specific action that triggers a capital gain or loss. In the world of crypto, selling cryptocurrency, trading one crypto for another, and using crypto to buy a good or service triggers taxable events.

Let’s Walk Through An Example

Let’s say you buy 0.05 BTC for $100. One month later, you trade that 0.05 BTC for 0.25 ETH.

As mentioned previously, trading one cryptocurrency for another triggers a taxable event, so how do you calculate your gain from this trade?

The answer is that you use the USD fair market value of Ethereum at the time of the trade. In this example, let’s say 0.25 ETH was trading for $150. In this case, your capital gain is $50 (150 - 100).

To report this transaction on Form 8949, you’d enter

The description of the sale - 0.05 BTC

The date it was acquired and the date it was traded for ETH

The proceeds of the trade - $150 (value of 0.25 ETH at the time)

Your cost basis in the property - $100 (original cost of 0.05 BTC)

Your gain or loss - $50

Tax Reporting for Shrimpy Users

As you can see, this tax reporting process can become extremely tedious, and it’s no wonder that accountants and consumers typically turn to tax software to handle this process.

For Shrimpy users who leverage automated trading strategies that perform trades across a number of different cryptocurrency exchanges, tax reporting gets even more complex. Rather than doing the above calculations by hand for every single trade, I want to demonstrate how you can automate the entire tax reporting process by simply uploading your trading history into CryptoTrader.Tax.

1. Import Your Trade History

The first step for Shrimpy users is to import their trading history into the CryptoTrader.Tax platform. To do this, create an account and simply upload your trade history CSV file that you receive from your exchange or directly connect your exchange account with “Read Only” API access.

Either of these options work, and both will pull in all of your historical buys, sells, trades, and other transactions and automatically retrieve the historical US dollar price at the time of the transactions. Once you’ve imported your trade history from all of your exchanges that you use, you are ready to move on!

2. Add Any Forms Of Crypto Income

After you’ve imported your exchange data, you can add any forms of cryptocurrency income you had directly to the app. This includes cryptocurrency received from mining or staking. After your income is in, you are ready to generate your tax reports!

3. Generate Your Tax Reports With 1 Click

Once all of your trade history and cryptocurrency income are into the CryptoTrader.Tax platform, you can auto-generate your tax reports with one click. All that’s left now is to pay for and download your tax reports.

Because we’ve partnered up with the Shrimpy team, you can use the code Shrimpy2019 to get 20% off all of your CryptoTrader.Tax reports!

What Next?

Once you have your tax reports in hand, you can leverage CryptoTrader.Tax’s partnership with Intuit TurboTax to upload your tax reports directly into your TurboTax profile. You can also send them to your accountant or file them yourself.

In Conclusion

Reporting your cryptocurrency transactions on your taxes doesn’t have to be excruciating. Here at CryptoTrader.Tax, we’re excited to be partnering up with the Shrimpy team to bring easy tax reporting to users. Make sure you leverage the Shrimpy2019 discount code for 20% off your tax reports!

You can learn more about how cryptocurrency is taxed here. Also feel free to shoot myself or my team a message/ email with any questions you have about crypto tax reporting. We are always happy to help out!

David Kemmerer is the CEO and co-founder of CryptoTrader.Tax, cryptocurrency-focused tax software for automating your tax reporting.

Disclaimer: The views, opinions, and positions expressed within this guest post are those of the author alone and do not represent those of Shrimpy. The accuracy, completeness, and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions, or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.

The information provided on this website does not constitute investment advice, financial advice, or trading advice. Please conduct your own due diligence and consult your financial advisor before making any investment decisions. Shrimpy will not be held responsible for the investment decisions you make based on the information provided on the website.