How To Use Trading Bots On Binance US

What kind of dog can keep a secret? … Hush Puppies

Trading bots have become a staple among cryptocurrency investors. They provide a simple way to automate a strategy that can execute at any time of the day. This allows traders to set up a strategy once and then let the trading bot precisely execute the trades based on the parameters of the bot.

Binance US is one of the quickest growing exchanges in the US market. Within hours of their initial launch, cryptocurrency traders were already integrating the new exchange into trading bots and programs to automate trades. The exchange has become a playground for trading bots, rapidly expanding the trading volume on Binance US. At any given time, there are thousands of different bots executing trades on the exchange. With such a significant influence makes it difficult for individuals to still have an advantage over these bots that can execute on a millisecond time scale.

Individuals no longer need to trade at a disadvantage. There are alternatives that are specifically designed for simplicity. Trading bots are being developed for the automation of portfolios.

The first thing you might imagine from a trading bot is a complex application that requires fine-tuning, an abundance of dials or levers, and maybe even programming.

Thankfully, not all trading bots are like that. There are some trading bots that are designed to automate the simple things that help with portfolio management. These things include rebalancing, dollar-cost averaging, or segmenting funds.

Binance US Asset Management

Managing your funds on an exchange can be complicated. Exchanges typically don’t offer a wide range of asset management options, but rather focus on trading. Binance US is no different. Although they are partnered with the largest cryptocurrency exchange in the world, Binance US still doesn’t offer any major asset management features.

Essentially, traders deposit funds to the exchange and then personally manage the execution of trades between assets, calculate performance, and allocate their desired portfolio. This has become a tedious process that consumes an excessive amount of time.

As a result, the asset management process has become cumbersome. Rather than focusing on research or enjoying the process of constructing a portfolio strategy, traders have become bogged down with process.

Many traders have begun turning to 3rd party applications because of this issue. The crypto community has begun building options for ways you can simplify your asset management. Rather than manually executing every individual trade, calculating performance, and monitoring progress, there are trading bots and services that can do this for you.

Throughout the next section, we will discuss the different types of services that are available in the market and how they can help you begin automating the way you manage your portfolio.

Before we get into those details, we will need to discuss API keys and how these are used to allow 3rd party applications to connect to your exchange account.

Binance US API Access

Most traders probably know that the top exchanges all provide API access to your account. This allows you to connect 3rd party applications to your exchange account. The application then uses the APIs to collect data on your funds, execute trades, and access market data.

Binance US is no different. Traders can create API keys for their account. Once the API keys have been created, they should be safely stored and only input into trusted 3rd party applications.

Some common applications that may take API keys include trading bots, terminals, tracking apps, and portfolio management services. Each of these applications may use the API keys in different ways, for example, some may only collect data and not execute trades, but the concept remains the same.

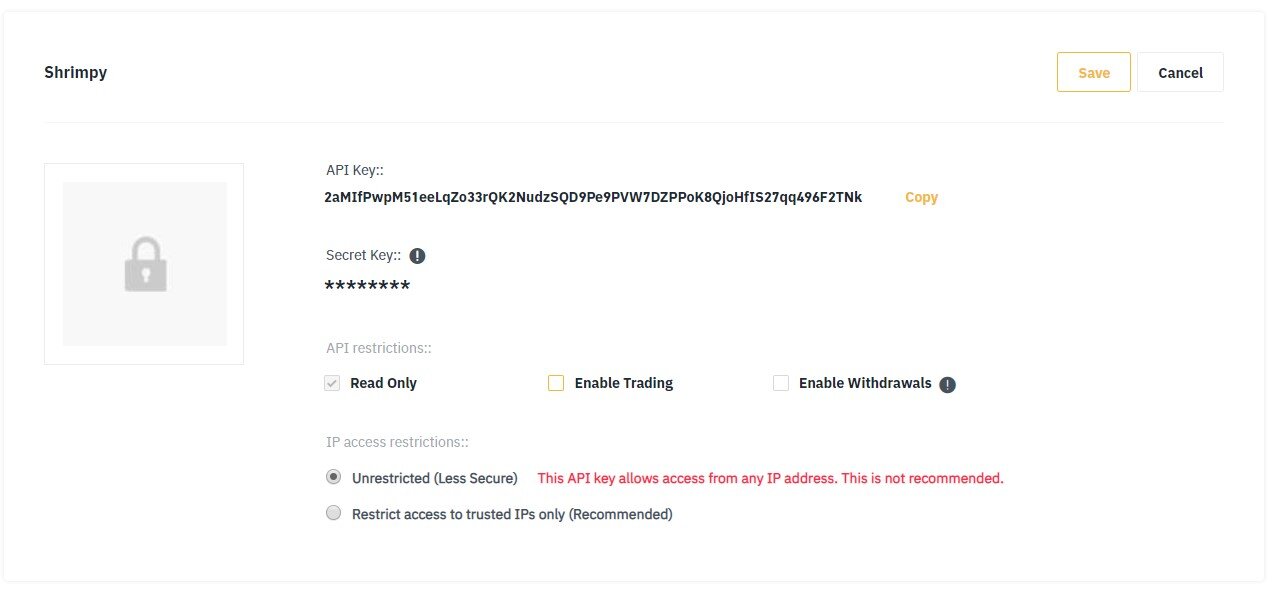

Understanding the permissions that are required for different applications is important for protecting yourself and your funds. There are 3 main permissions that most exchanges allow for API keys. These are Data, Trading, and Withdrawal permissions.

Data Permissions

On Binance US, data permissions are called “Read Only” permissions. This permission will allow the APIs to access data about your account in a read only fashion.

The most common permission that is required by all applications that accept API keys is the “data permissions”. These permissions allow the application to access information that is relevant to your account. For example, your asset balances, your trading history, and your current trading fee tier.

When using tracking applications, this is usually the only permission that must be enabled on your API keys.

Trading Permissions

In Binance US, you can enable trading through APIs by using the “Enable Trading” permission. This will allow applications to post trades to your account by using the API keys.

Trading permissions allow the application that is connecting through your API keys to execute trades on your behalf. Essentially, this grants the application full control over how your funds are managed, traded, and allocated on the exchange account.

Permissions for trading are generally required for any application that needs to trade. These include trading bots, terminals, and portfolio management applications. We recommend only enable these permissions if the application needs to trade on your account, otherwise, leave the trading permissions disabled on your API key.

Withdrawal Permissions

Withdrawal permissions are enabled by turning on “Enable Withdrawals” for the API key. Notice that Binance US requires extra steps to enable this feature since it carries a heavy risk.

Withdrawal permissions allow the application to withdraw funds from your exchange account. The permissions to withdraw your funds should NEVER be enabled. You may have a good reason to enable withdrawal permissions, but we would still recommend not taking the chance, even if you are highly aware of what you’re doing.

Enabling withdrawal permissions on your API keys will give the application complete control to completely remove the funds from your account. If the application developers want, they can freely take your funds and deposit them into their own wallets.

Withdrawal permissions are never necessary. If an application recommends enabling withdrawal permissions, you should seriously rethink using that service at all. It’s simply too risky to trust applications with withdrawal access that we recommend NEVER enabling this setting on your API keys.

None of the types of services we discuss will need withdrawal permissions.

Note: We understand there may be rare situations where withdrawal permissions may be useful, but for the sake of this article and public argument, the line is so thin that it’s far easier to not take the risk.

Services that Use API Keys

Once we have an understanding of how API keys work, we can take a look at the different types of applications that can accept API keys.

Each of these applications support different features that can help us monitor, manage, and construct our portfolio in different ways. Experiment with each type of application to find what works best for you.

Tracking Apps

Tracking applications are ideal for active traders who want to live their lives and not be tied down to a computer. Many of the most popular tracking applications have options for broadcasting signals, alerts, and other notifications to let you know when the market is changing.

Popular tracking applications include Blockfolio, CoinStats, and Delta.

Each of these tracking applications can plug directly into Binance US to pull your balance history, monitor your portfolio, and notify you when things are getting exciting.

By plugging your API key into a tracking application with only data permissions, the app will be able to collect information from your account to construct a history of your trading activity. This is ideal for monitoring your portfolio and keeping up with performance.

Generally, tracking applications have limited or no trading features. As a result, most traders turn to additional trading services to support their trading requirements.

Terminals

The most basic trading applications are simple terminals. Terminals can help you manage your orders across exchanges, monitor the market, and execute trades. However, the majority of the functionality of a trading terminal is manual. That means only minor automations are typically integrated into terminals. Full automation is usually reserved for trading bots.

Some common features supported by trading terminals include the calculation of trading stats, directing your attention towards opportunities, and automating the execution of individual orders.

Popular trading terminals include Coinigy and 3Commas.

Terminals are ideal for traders that only want to trade when they are physically at their computer. Trading terminals are not designed to help you execute trades while you’re out and about. If you have a strategy that requires monitoring the market 24/7, we recommend trading bots to manage these strategies.

Trading Bots

Trading bots allow traders to automate day trading strategies that they would otherwise need to manually execute on the exchange. Trading bots can run 24/7 to monitor the market and precisely execute trades to match the strategy you defined.

That means you don’t need to rely on yourself to execute every piece of the strategy. Once the strategy is set, no matter how complex, it will automatically execute over time through the use of these trading bots.

The Complete Guide to Cryptocurrency Trading Bots

In the crypto market, the most popular crypto trading bots include services like CryptoHopper and HaasBot.

The difficulty that comes with trading bots is usually the complexity of the strategies that are implemented. Understanding the market isn’t easy, so people have spent countless years devising intricate indicators, systems, and signals to identify opportunities. Without a deep understanding of these statistics, it can become overwhelming when you try to set up a successful strategy.

That is where our final type of application comes into the story. That is the portfolio management application.

Portfolio Management

Portfolio management applications are a combination of each of these previous categories. Not only do they provide portfolio and market tracking, but they supply terminals and trading bots to help simplify the way we manage our portfolio.

The end goal of most portfolio management services is to make your life easier. Instead of spending every day preoccupied with the market, portfolio management tools allow traders to set up a long-term portfolio management strategy and then step away. Then, rather than engaging with the market constantly, the bots can take over for the trading aspect, while you can focus on monitoring the portfolio.

Portfolio management applications bring a holistic approach to constructing a strategy that can stand the test of time. These applications make it easy to build a diverse portfolio, reduce risk by implementing rebalancing strategies, and continue to dollar-cost average into the market over time.

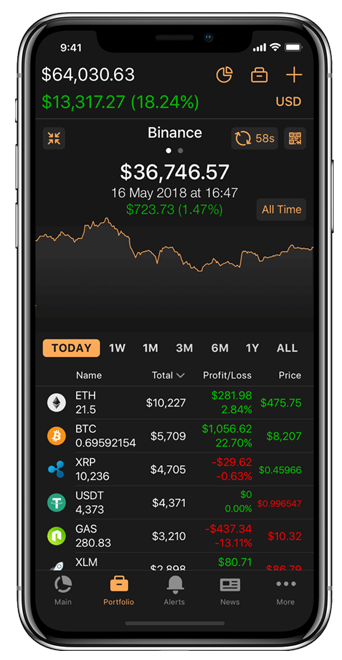

The most popular portfolio management service in the market is Shrimpy. Shrimpy automates portfolio strategies like dollar-cost averaging, rebalancing, and smart order routing, so traders can spend more time on their research and less time on managing their diverse portfolio of assets.

Build Your Own Application

At the end of the day, none of these resources may cover what you’re looking to do. You might want a specialized alert, a custom trading bot, or a portfolio management service that implements a portfolio strategy that you personally developed.

It’s possible to develop your own applications using Universal Developer APIs that connect to different exchanges. These APIs allow you to collect data across every major exchange, execute trades, manage users, and much more.

Get started by diving into this article about how to build your own crypto trading bot. After getting started, you will quickly find there are countless opportunities in the crypto space. With the Shrimpy Developer APIs, you can build the future of crypto trading, tracking, and portfolio management.

About Shrimpy

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Thanks for stopping by!

The Shrimpy Team

Additional Good Reads

The Ultimate Guide To Building A Crypto Index Fund

Crypto Trading Automation for Portfolio Management

A Comparison Of Rebalancing Strategies for Cryptocurrency Portfolios

Script for Bitcoin Price Live Ticker (Using Websockets)

Threshold Rebalancing - The Evolution of Cryptocurrency Portfolio Management