9 Features You Didn't Know Were In Shrimpy

Over the course of the last 3 years, Shrimpy has become packed with features. Some of these features might not be obvious at first glance. Our mission is to make portfolio management easy for every cryptocurrency investor. That sometimes means hiding some of the more advanced features so they don’t clutter the interface for new investors.

In this article, we will share the 10 advanced features you might not have known were available in Shrimpy. Start maximizing your portfolio management with these 10 advanced crypto trading features.

1. Maker’s Rebalancing

Maker’s Rebalancing is available for all Shrimpy customers by using the Fee optimization with maker trades setting. This is located on the Automation tab under Show more settings on the left-hand side.

When enabled, Shrimpy will automatically start executing maker trades instead of taker trades when rebalancing your portfolio.

There are a few advantages to executing maker trades instead of taker trades:

Open orders will be placed at a rate that is more favorable to you. Instead of just taking the best open order on the exchange at that time, we will place an open order at a better price than the current best order on the exchange.

Some exchanges offer fee discounts on maker trades. Although not all exchanges offer these discounts, the exchanges that do offer the discounts can sometimes reduce your fees by as much as 50%.

The placement of maker orders also works in parallel with the Shrimpy “Smart Order Routing” system. This system will be discussed in more detail later in this article.

Although enabling this setting can reduce the costs of rebalancing a portfolio, there are a few disadvantages to using this setting. Those include:

Maker’s rebalances take longer to execute trades because it relies on other market participants to execute your order. The result is rebalances can take anywhere from 30 minutes to 1 hour depending on the number of assets in your portfolio.

Slow-moving markets can result in unfilled open orders for prolonged periods of time. There is a certain point at which Shrimpy will give up and complete some trades with taker orders.

If the market moves in the opposite direction of the orders that are placed by Shrimpy, it’s possible to receive a worse rate. However, averaged across rebalances over the long-term, the maker’s rebalances should perform better.

Fee Optimization

Our team has developed an intelligent way to rebalance a cryptocurrency portfolio through a combination of maker and taker trades. We are calling this new feature “Fee Optimization With Maker Trades”.

2. Dollar-Cost Averaging

Dollar-cost averaging (DCA) is another advanced feature that is available to all Shrimpy users. DCA can be enabled under the same Show more settings expansion as the Fee optimization with maker trades setting.

Enabling DCA for a portfolio strategy means Shrimpy will automatically distribute deposited funds into the portfolio when new funds are detected.

The best part about this feature is that no existing funds are impacted. That way, a full rebalance is not executed, only the new funds that are deposited into the portfolio will be traded.

A DCA will strategically allocate the deposited funds to attempt to reach the target allocations of each of the assets in the portfolio. That way at the end of the DCA, each asset will be as close as possible to their desired allocations.

Advantages of using a DCA strategy include

Reduced fees as a result of less frequent rebalances.

Fewer taxable trade events.

Portfolio reaches target allocations with the least effort possible.

Funds can be periodically deposited into an exchange account or portfolio without manually trading the funds into the portfolio.

Notice: DCA also triggers when funds are transferred into a portfolio. A transfer is seen as a deposit event, so these funds will be picked up and distributed into the portfolio.

DCA for Crypto

Dollar-cost averaging (DCA) is a strategy used by investors to reduce downside risk of placing large sums of money into the market at one time.

3. Manage Multiple Exchanges

Many crypto traders are constantly looking for ways to reduce risk and increase their exposure to more cryptocurrencies. By creating accounts with multiple exchanges, traders are able to manage funds on multiple exchange accounts at the same time.

Without Shrimpy, managing multiple exchange accounts is a nightmare. It’s a complex process to log in to each account, execute trades manually to allocate portfolios, and continuously monitor each exchange account.

With Shrimpy, you can connect an unlimited number of exchange accounts. There is no limit.

Whether you have funds on 12 different exchanges or 31 Binance accounts, each and every one of them can be connected to a single Shrimpy account.

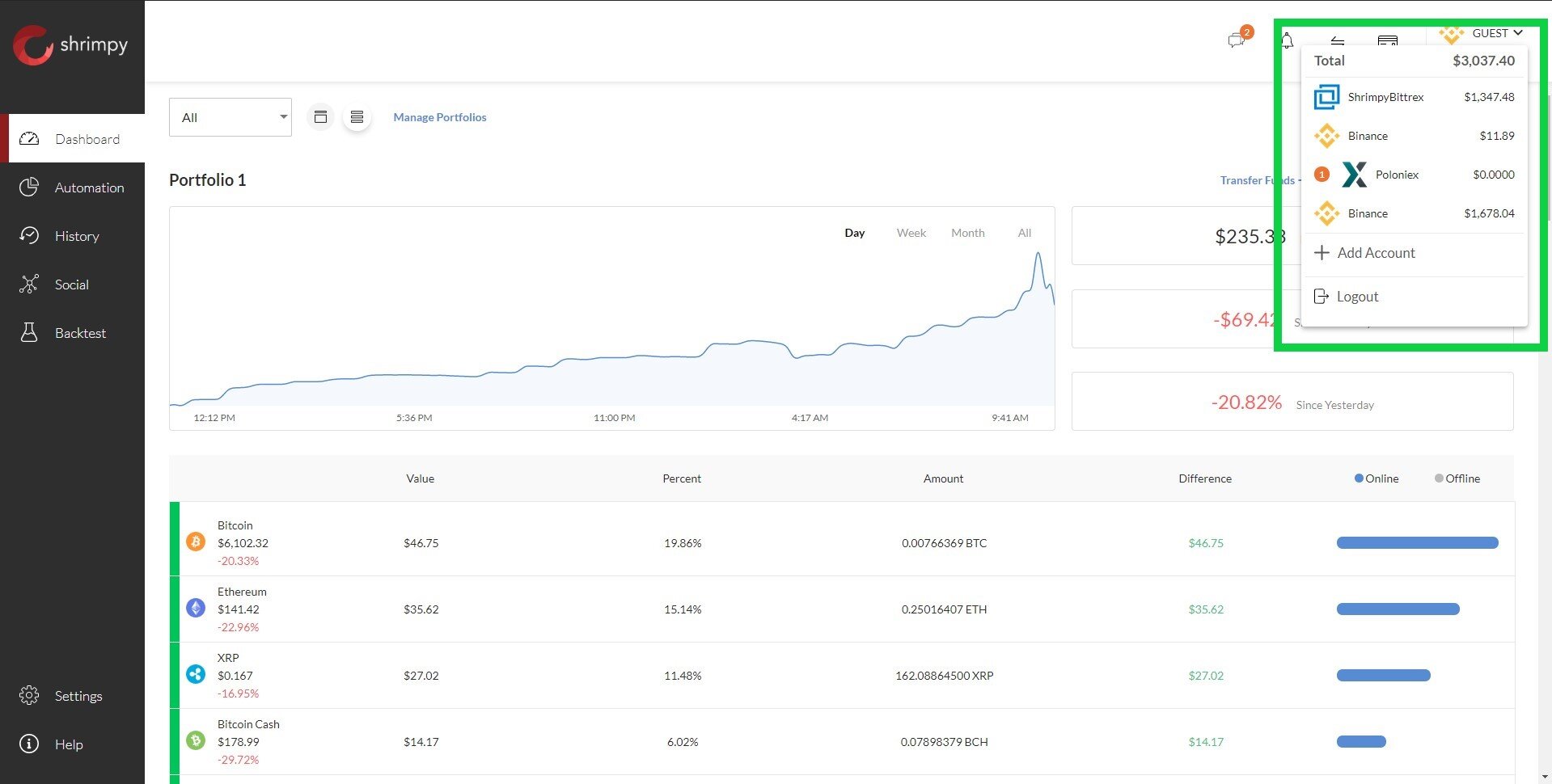

Every exchange account you connect can be viewable from the top-right drop-down. This drop-down allows you to select an account to view. Once selected, the dashboard, automations, history, and backtesting tabs will all be specific to that exchange account.

That means you can create custom automations for each of your exchange accounts. Each automation can be independently automated at the same time on each exchange.

Notice: The settings tab is the only tab that is not specific to any exchange account. It controls the settings for your entire Shrimpy account. However, the other tabs are specific to each individual exchange account.

Multi-Exchange

Whether you want to link 1 Bittrex account or 25, it's possible with Shrimpy. Each exchange account that you link will show up in the box that I have highlighted with the pink outline.

4. Automate Multiple Portfolios

Similar to the way each Shrimpy user can connect multiple exchange accounts to a single Shrimpy account, each exchange account can have multiple portfolios.

On each exchange account, Shrimpy provides a unique advanced feature where investors can allocate multiple portfolios. These portfolios are virtually maintained by Shrimpy. That means your exchange won’t know anything about these portfolios.

Each portfolio that is allocated in Shrimpy is treated completely separately. Portfolios can be automated at the same time as each other or not at all. You could have 1 portfolio follow a leader while the other is automated by a custom strategy. You could have 3 different portfolios follow 3 different leaders. The options are endless!

Notice: Each exchange account can have up to 5 different portfolios.

Multi-Portfolio

With the recent release of the multiple-portfolio feature in the Shrimpy application, many users will be wondering how they can leverage multiple portfolios to build a robust portfolio management strategy.

5. “Amount” over time graph

One of the more hidden features on Shrimpy is the ability to click on an asset on the dashboard. After clicking on an asset, Shrimpy will display additional data about that specific cryptocurrency.

There are a number of different pieces of data that are displayed on the sidebar. One of the most interesting for many investors is the graph that shows the amount of an asset that you owned over time.

This graph can show how you are accumulating an asset over time.

6. Popular assets

In the same sidebar as the “Amount” graph, we can also find some other fun information. This includes asset popularity and asset dominance metrics.

The asset popularity tells us what percent of people on Shrimpy hold this specific asset in their portfolios.

The asset dominance describes what percent of the asset is allocated in the average Shrimpy user’s portfolio.

Learn more about asset popularity.

7. Smart Order Routing

The Shrimpy team has worked tirelessly to make Shrimpy the easiest platform for managing a diverse crypto portfolio. As a result of this mission, there are countless features that are buried deep inside the technical implementation of Shrimpy.

One of these technical features that is unique to Shrimpy is the built-in smart order routing. Every rebalance on Shrimpy is executed using our advanced smart order routing engine.

Every trade opportunity is carefully evaluated in real-time. We calculate each possible trading route in real-time to determine the most optimal routes when trading one asset for another.

The algorithm for these trades gets complicated when thinking about how this is accomplished for a diverse portfolio. After all, that would mean that every possible asset in your portfolio can potentially trade to any other asset. This could potentially result in hundreds of different trading pairs that need to be evaluated in real-time to make the smartest decisions possible.

That’s not all. We’ve made this functionality available through our Developer APIs as well. That way no other developers will ever need to go through the complex work of putting together a robust SOR strategy.

SOR APIs

Smart Order Routing is the process of automatically taking advantage of the best price available across multiple market pairs to optimize the outcome of an order.

8. Portfolio Management APIs

Speaking of APIs, all Shrimpy users have the option to manage their portfolio through the "Portfolio Management APIs”. Notice that there are two different APIs offered by Shrimpy. The Portfolio Management APIs are designed for individuals who are managing their portfolios through Shrimpy. The Developer APIs have more features and are intended for developers who are building complete cryptocurrency trading applications.

With the Portfolio Management APIs, investors can automate their portfolio strategy by accessing information about their portfolio in real-time, executing rebalances, and changing allocations.

Trading Bots API

The following sections will discuss how developers can integrate every major exchange without ever worrying about maintaining and scaling the complex infrastructure that is required for exchanges.

9. IP whitelist

The last advanced feature we will mention is IP whitelisting.

IP whitelisting is a way for Shrimpy customers to tell the cryptocurrency exchange what IPs they want to access their accounts. Our team placed this feature at the bottom of this list because it is the most nuanced.

In order to have the feature work, you must place all 4 IPs from Shrimpy into the exchange. These 4 IPs are provided in the Settings tab under General.

When creating a new API key on an exchange, these 4 IPs can be entered into the exchange as further protection for accessing your exchange account with the created API keys.

Shrimpy will then only send requests to your exchange account from those specific IPs.

Notice that the provided IPs are owned by Shrimpy. They are not IPs that are owned by the investor (you). If the investor puts their own IPs into the exchange when creating API keys, Shrimpy will not be able to access the investors account since we don’t own the IPs that were input into the exchange.

IP Whitelist

IP Whitelisting is a feature which exchanges use to restrict access to your cryptocurrency exchange account.

Conclusions

Shrimpy is constantly adding features, so some features might get lost in the mix. Hopefully, this article will help present some of the more advanced features that you might not have seen previously in Shrimpy.

As we continue developing new features, we will continue adding to the list so everyone has a reference to some of the more advanced features.

Additional Good Reads

Cryptocurrency Trading Bots - The Complete Guide

Threshold Rebalancing for Crypto Portfolio Management

Crypto Users who Diversify Perform Better