Top Machine Learning Products for Cryptocurrency Price Predictions

After the launch of the Machine Learning Case Study, tens of thousands of crypto traders have taken the dive into learning more about cryptocurrency price predictions based on machine-learning models.

Simply put, the price prediction market is exploding. The increasing availability of crypto market data and recent advancements in machine learning provides new opportunities for people to develop innovative trading strategies.

Not all machine-learning price predictions are created equal, so it’s time to rank the top services that have caught our eye here at Shrimpy.

Don’t forget to join our Telegram to keep up to date with all of our latest articles!

1. Nomics

Nomics has been the focus of increasing attention since the launch of the Machine Learning Case Study. They have demonstrated that there are potentially viable strategies that can be constructed by allocating portfolios based on machine-learning models.

These portfolio strategies can be as simple as allocating a selection of assets once a week and rebalancing.

About the Predictions

The Nomics predictions use long short-term memory (LSTM) machine learning models with aggregated OHLCV candlestick data to make predictions. These 7-day predictions attempt to predict the price of the asset 7 days into the future.

Accuracy Concerns

There have been some concerns about the accuracy of the Nomics ML predictions. This concern arose after a number of traders noticed the predictions became more inaccurate since the time Nomics released the predictions. This behavior can be observed in the above image that shows the Bitcoin price predictions over time.

We can see in the above image that Nomics was historically strong when it came to predictions. However, once we reach April on the graph, there is an abrupt change in the accuracy of the predictions. This could be a result of over-fitting. If Nomics had used the complete history set to train the models before April, then it would be expected that the historical predictions are more accurate than the future predictions.

Regardless of these concerns around accuracy, we have seen that the predictions generally outperform the market when putting the predictions into a portfolio setting.

Real-World Results

As previously mentioned, the real-world results from running a study based on the Nomics ML predictions produced outstanding results. The predictions were able to outperform the market by 4-5x.

The Machine Learning Case Study would allocate a portfolio of the top 10 predictions on a weekly basis. On their own, the price predictions may not be entirely accurate, but when averaged across a portfolio of assets, they have historically performed well.

Note: Perfectly predicting the market is impossible. The reason we have placed Nomics in our #1 slot is because although the predictions may be off, they have been a useful indicator when including other factors. The real-world results from the case study have been exceptional so far and should not be ignored.

2. Into The Block

IntoTheBlock is a crypto market intelligence company that uses statistical modeling and machine learning to bring customers insights about assets.

Based on these insights, ITB is able to generate hourly price movement predictions along with troves of other visual data. This data spans exchange market behavior, sentiment analysis, and onchain signals.

About the Predictions

IntoTheBlock uses deep neural networks to uncover complex non-linear relationships between variables that may not be obvious. According to their analysis, deep learning models have shown a stronger ability to make generalized decisions about the market compared to many machine learning and time series forecasting strategies.

Although IntoTheBlock believes deep learning will be the key methodology for predicting asset prices, that doesn’t mean the system is without drawbacks. Unfortunately, deep neural networks are difficult to build, expensive to scale, and hard to interpret.

Learn more about their process of developing a Deep Learning model.

Real-World Results

The real-world results can be found inside the IntoTheBlock website. At a quick glance, we can see that the “prediction accuracy” gives us an idea of how frequently the predictions are correct.

Based on these accuracy metrics, we find that the average prediction accuracy seems to be around 47 - 60%. That means if they provided 100 predictions, generally we have found that a bit more than 50 would typically be correct.

While this doesn’t feel like a groundbreaking performance, we believe it would be possible to create a long-term trading strategy that leverages these signals to benefit over a long period of time.

3. The TIE

Diverging from other companies that are using raw market data to construct predictions, we have “The TIE”. They have developed a Sentiment Analysis based AI that attempts to predict the movements in the market.

The TIE considers themselves an alternative data provider for cryptocurrencies. Essentially, rather than providing or analyzing raw exchange market data or on-chain data, they analyze secondary data. This secondary data can be derived from primary data sources or even social sentiment. With this secondary data, The TIE is able to provide context around events that might not be obvious from looking at raw data sets.

Some of the secondary data provided by The TIE include Twitter social sentiment analysis, corporate actions feed, and statistical analysis.

Based on these data streams, The TIE leverages machine learning models to further evaluate assets. Particularly, The TIE has partnered with eToro to provide a social portfolio strategy that can be followed by retail investors.

About the Predictions

The TIE analyzes over 850 million tweets in real-time to understand the current social sentiment surrounding cryptocurrencies. With these deep analytics, they are able to construct a portfolio strategy that attempts to predict the fluctuations in the market.

Paired with the corporate actions feed, The TIE sets themselves apart from other predictive engines due to the close relationships their team has built with 3rd party data providers.

Real-World Results

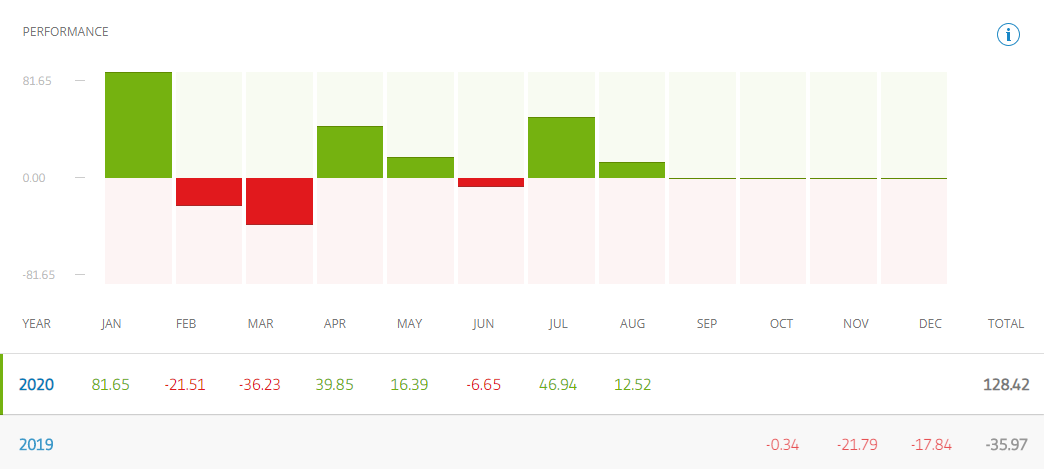

The TIE has accumulated an impressive following on eToro. They have become the best performing Copy Account on eToro US with over $50k in AUM.

In total, they have experienced a 128% performance increase since the start of the year. As the market becomes more volatile, it may only further launch the strategy. However, due to the limited selection of assets available on eToro, there will be limitations regarding what assets can be included in the portfolio.

Conclusions

Machine learning, deep learning, and advanced statistical analysis strategies will be a defining feature of the cryptocurrency space in the coming years. We believe our generation will see a shift from actively managed funds to passively managed AI funds.

These AI funds will be able to evaluate billions of data points in real-time to intelligently decide what assets to buy and sell. While the best machine learning system may become restricted to institutional players, we hope to see continued development in the retail market as well.

Additional Good Reads

Cryptocurrency Trading Bots - The Complete Guide

Threshold Rebalancing for Crypto Portfolio Management

Crypto Users who Diversify Perform Better

Python Scripts for Crypto Trading Bots

Script for Bitcoin Price Live Ticker (Using Websockets)

Our Social Trading Platform

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.