Cryptocurrency Index Funds (Updated 2020)

As blockchain technology and cryptocurrency markets continue to grow and mature, there will be a steady increase of capital coming into crypto markets. As such, there will also be a need to provide investment products and services dedicated to cryptocurrencies. While many of these products may be new, they will inevitably reflect traditional asset management in many ways. One of these ways is the emergence of cryptocurrency index funds in the market.

Before we dive deep into cryptocurrecy index funds, let’s start from beginning - What are index funds and how do they work?

What are Index Funds?

In traditional financial markets, an index is comprised of a portfolio of assets which represents the statistical change of the measured market. An index can be derived from a number of parameters such as price, market cap, and past performance. Examples of well-know stock indexes include Standard & Poor's 500 Index (S&P 500) , Dow Jones Industrial Average (DJIA), and the NASDAQ Composite.

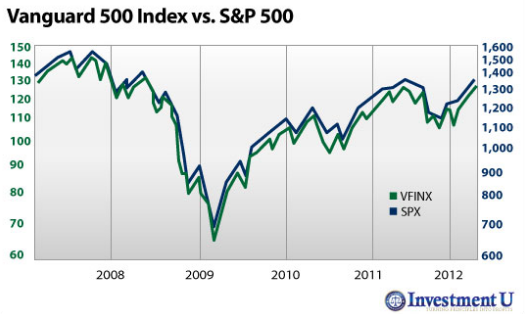

An index fund consists of assets allocated in the same ratio as the targeted stock index, with the goal of mimicking the stock index performance. For instance, the largest index fund in the world, Vanguard 500 (VFIAX), is constructed to track the performance of the S&P 500, and replicates its portfolio and asset ratios based on the stocks that make up the S&P 500.

According to Investopedia, the goal of an index fund is “to provide broad market exposure, low operating expenses and low portfolio turnover. These funds adhere to specific rules or standards (e.g. efficient tax management or reducing tracking errors) that stay in place no matter the state of the markets.”

Comparative Index performance between Vanguard 500 and its benchmark index, the S&P 500

Benefits of using Index Funds

Are there benefits of using an index fund? How do the results compare with a similar portfolio actively managed by a professional?

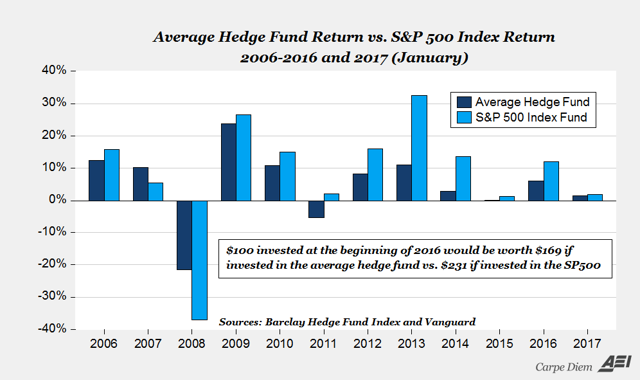

Index funds have shown to be an effective long-term strategy. According to NerdWallet, since 2000, index funds have generally outperformed actively-managed mutual funds due to the significantly higher expense ratio (management fees) from actively managed funds. Even Warren Buffet, one of the most successful investors of our time, said that “a very low-cost index is going to beat a majority of the amateur-managed money or professionally-managed money”.

A performance comparison between the S&P500 Index and actively-managed hedge funds.

Generally speaking, index funds tend to have better results compared to an actively managed portfolio when management fees and expenses have been accounted for. Index funds also help reduce company-specific risk by diversifying a portfolio into similar alternatives, thereby lessening the impact of a single volatile asset within the index.

Cryptocurrency Index Funds

Although cryptocurrencies and digital assets are relatively new asset classes, the industry acknowledges the need for crypto portfolio management products and solutions. Within just the past few years, there has been rapid growth of crypto index fund offerings.

Crypto index funds provide exposure to an extremely new and volatile asset class while also spreading that risk across a portfolio of different cryptocurrencies. This becomes particularly attractive to traditional investors, who are generally put off and discouraged from the comparatively risky crypto markets. As a result, we’re seeing a huge influx of crypto index products being created. Some popular crypto indices include:

Bitwise 10 Large Cap Crypto Index

Bitwise 20 Mid Cap Crypto Index

Bitwise 70 Small Cap Crypto Index

Bitwise 100 Total Market Crypto Index

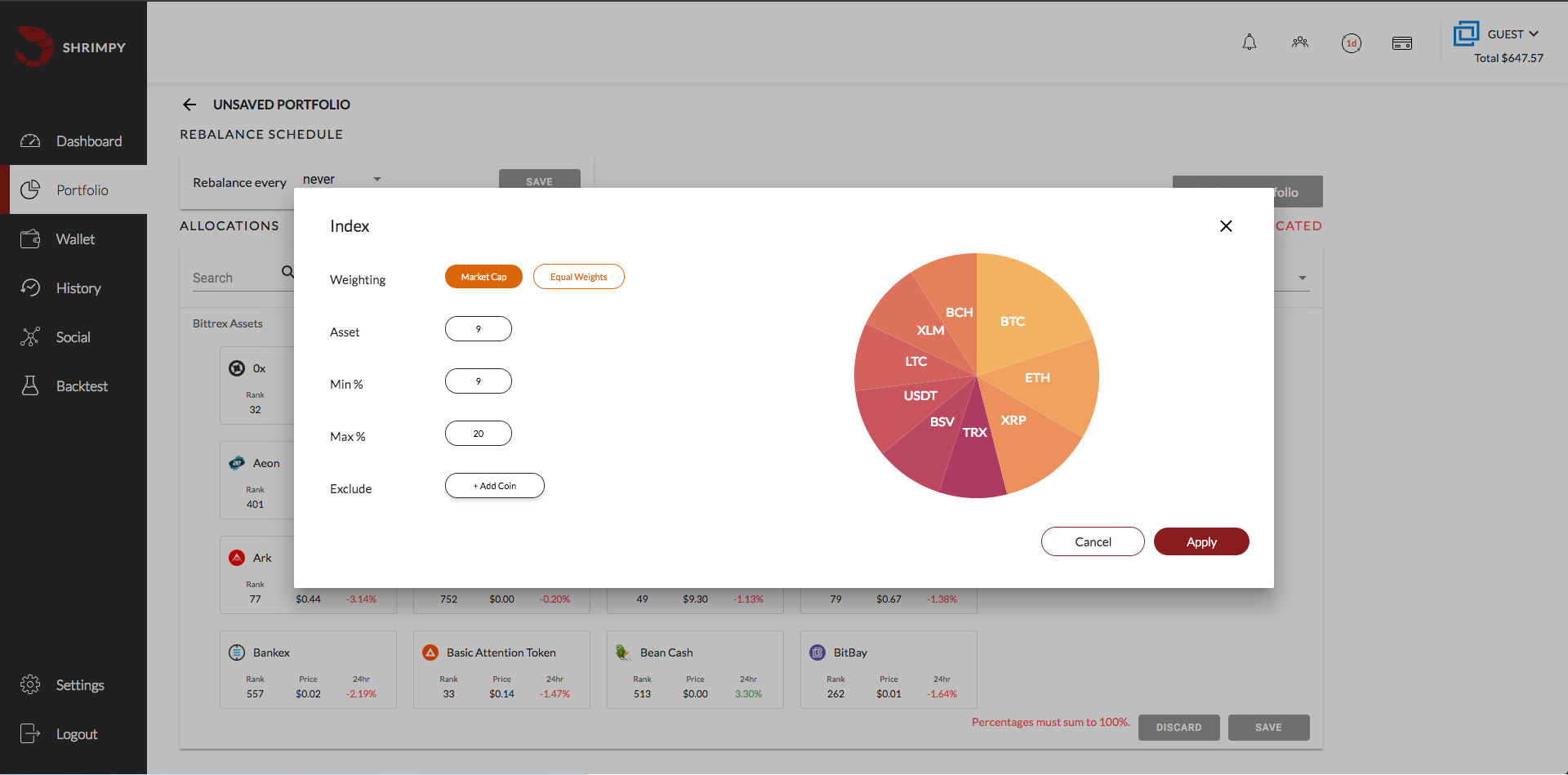

Create your Own Cryptocurrency Index

Interested in creating and managing your own automated cryptocurrency index portfolio? With Shrimpy, you can create an automated cryptocurrency index fund in just a matter of minutes! Our unique rebalancing features will automatically conduct trades based on your desired portfolio strategy so you don’t have to! Here’s how to get started:

Step 1: Join Shrimpy

Shrimpy is easy to use - Sign up here.

Step 2: Link your exchange to shrimpy VIA API Key

Connecting an exchange account to Shrimpy will allow you to automate your index, view portfolio analytics, backtest strategies, and share your strategy in the social program. Shrimpy supports 16+ of the top cryptocurrency exchanges. Some of these include Coinbase Pro, Binance, Bittrex, KuCoin, Poloniex, Kraken, and more.

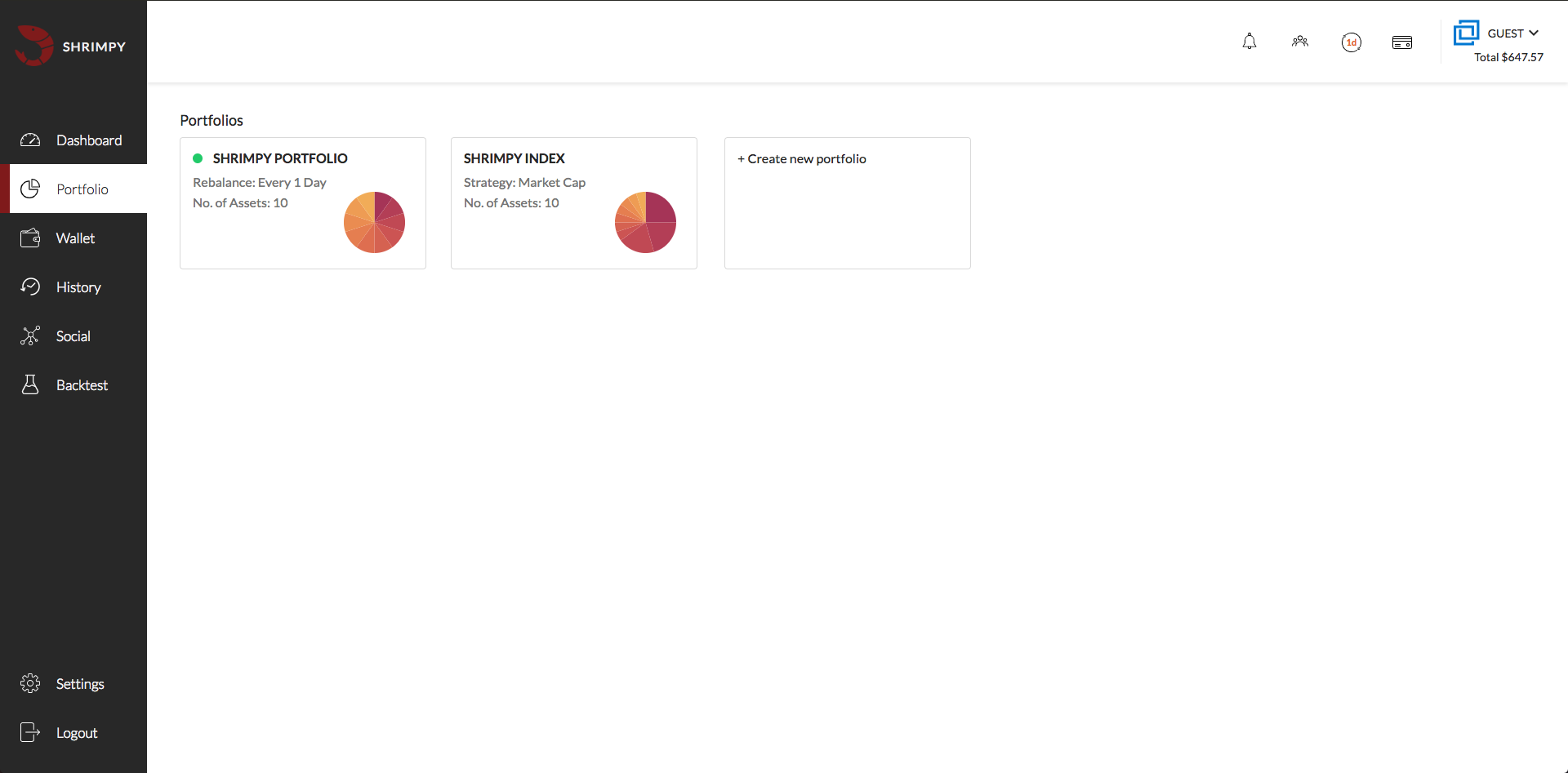

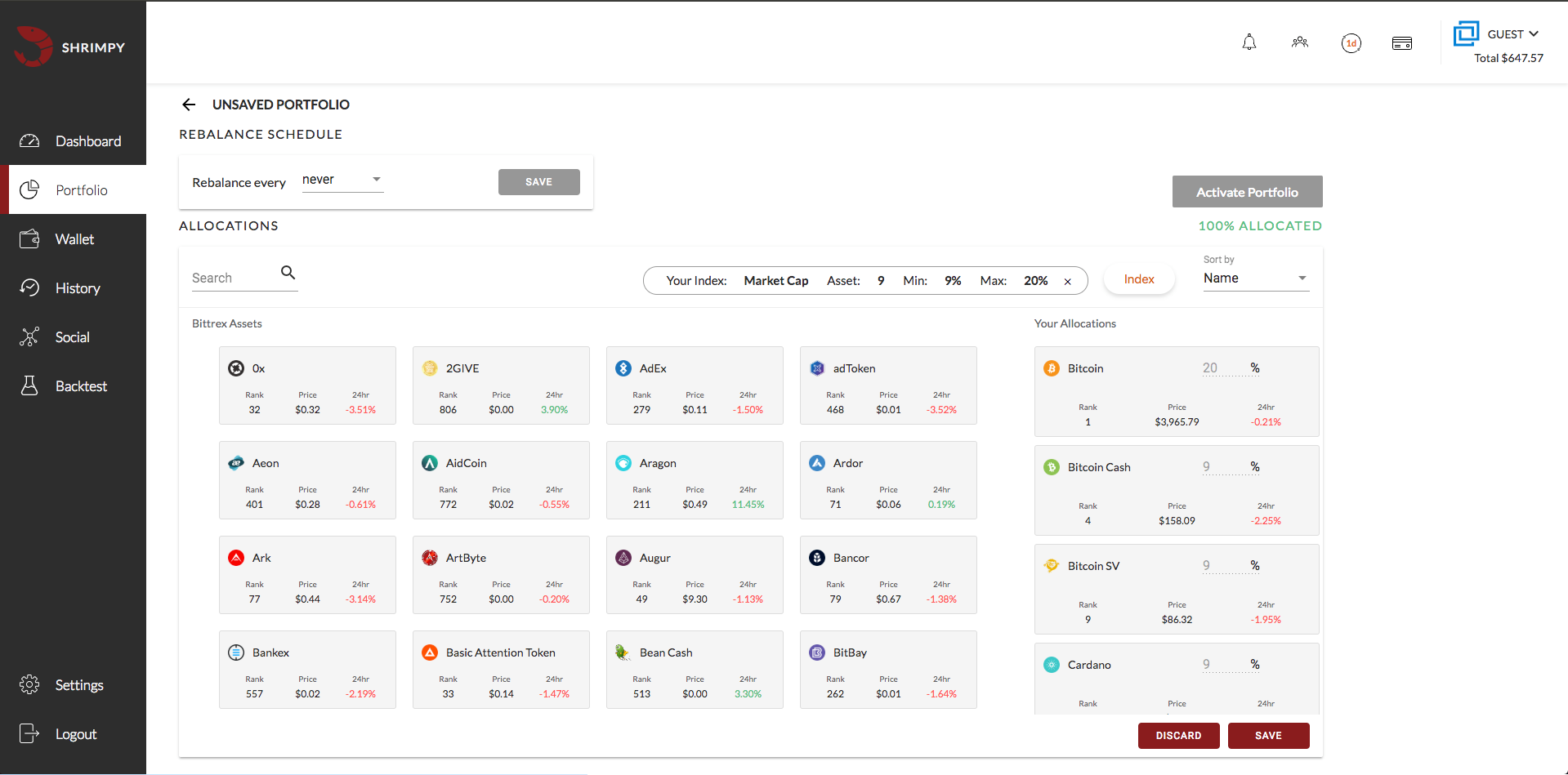

Step 3: Create your Custom Crypto Portfolio

Once you’ve connected your exchange to Shrimpy, you’ll be able to create your custom crypto index in the Portfolio tab. You can read a detailed guide on how to build your own crypto index here.

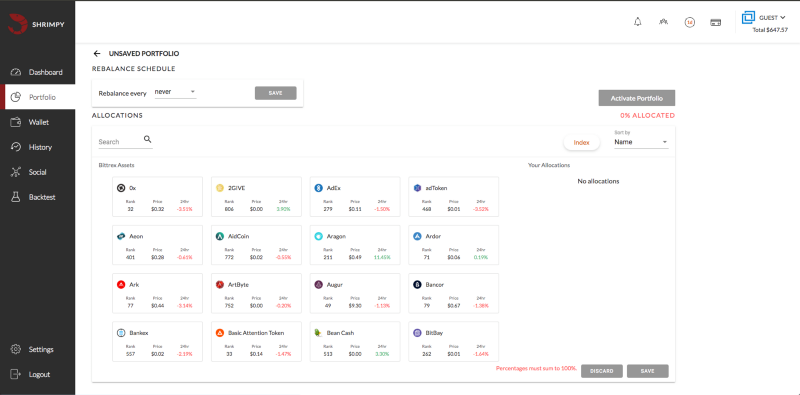

Step 4: Set your Trading (Rebalance) Frequency

Once your index or portfolio has been created, you’ll need to set your rebalance frequency, or how often you would like Shrimpy to perform trades to maintain your desired asset ratios. You can rebalance as often as every hour or once a month. It’s completely up to you. In recent updates, we’ve also integrated the option to take advantage of advanced threshold rebalancing. That way you can set a deviation threshold which will trigger a rebalance when the portfolio becomes misaligned with your target allocations.

Learn more about rebalancing strategies here.

You’re All Set! Let Shrimpy Take Care of the Dirty Work for you!

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!