Shrimpy has launched a completely overhauled backtest tab for the Shrimpy app! The new backtest tab features a slick, responsive user interface, a massive improvement to the overall speed of running backtests, the ability to backtest all currencies and exchanges on Shrimpy, and you can now save your backtests and view your history of tests at any time!

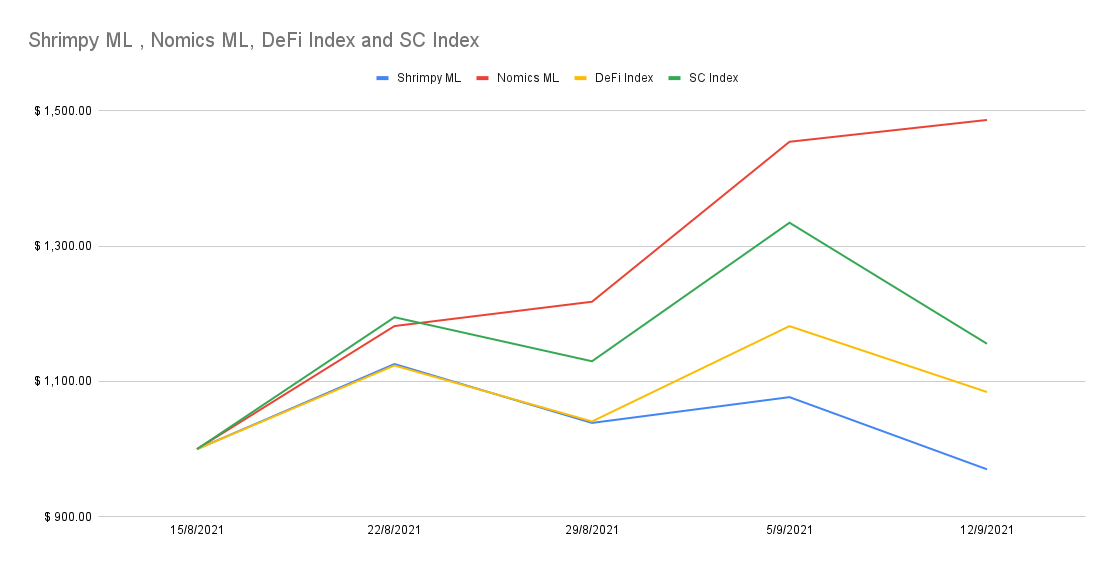

Read MoreThis was the fifth week of our case study that will evaluate the application of machine learning for portfolio management. Each week, we will publish an update to highlight interesting events that took place over the last week.

Read MoreThis was the fourth week of our case study that will evaluate the application of machine learning for portfolio management. Each week, we will publish an update to highlight interesting events that took place over the last week.

Read MoreThis was the third week of our case study that will evaluate the application of machine learning for portfolio management. Each week, we will publish an update to highlight interesting events that took place over the last week.

Read MoreThis was the second week of our case study that will evaluate the application of machine learning for portfolio management. The methodology for this study was first outlined in our previous article.

Read MoreThis week kicked off the start of our case study that will evaluate the application of machine learning for portfolio management. The methodology for this study was first outlined in our previous article.

Read MoreExplore using machine learning for cryptocurrency trading by viewing the results we received from Shrimpy’s native ML model.

Read MoreOver the last 8 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreWe will be focusing on a single primary strategy; rebalancing. Rebalancing has been used by institutions for decades and has stood the test of time. Although it appears simple on the surface, rebalancing has complexities that present unique opportunities.

Read MoreOver the last 7 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 7 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 6 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read MoreOver the last 5 months, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Read More