Cryptocurrency Index Funds - Personal Asset Management

The cryptocurrency market is complex. For most people, managing a crypto portfolio is the first time they’ve ever had to actually manage their own finances. I mean really manage. Not “manage” by letting a large company like Fidelity hold the funds and automatically invest in a diversified portfolio. I’m not talking about “manage” by putting them in a bank, to be accessed at any time by just swiping a credit card. Where if something goes wrong, people can just call customer support and request a charge back, close the account, or resolve issues that arise.

Managing cryptocurrency means it’s all up to you. Buying and selling assets is done directly on exchanges. It’s not as simple as clicking a few buttons and letting someone else take care of building your portfolio. The complexity of the cryptocurrency market leads to users struggling to manage their assets across exchanges, hardware wallets, and cold storage solutions.

Until Automated Crypto Index Funds Came Along

Automatic portfolio management tools that automate your personal cryptocurrency index fund like an expert have taken the market by storm. Instead of executing trades manually on each exchange, these tools execute the trades for you. Selecting a dynamic index is as easy as selecting a number of assets to include in your portfolio and letting these applications manage the allocation and continuous rebalancing of your portfolio.

Revolutionize your cryptocurrency portfolio by leveraging the most powerful tools in the market. Don’t wait around and let this opportunity pass you by.

If you’re new to cryptocurrency index funds, get an introduction to this topic from our previous article here:

Cryptocurrencies & Index Funds

Dynamic Portfolio Indexing

Indexing the market can be configured with a number of different advanced features. Learning each of these settings might take a few minutes to understand, but once understood they unlock powerful ways to implement your indexing strategy. The following guide will walk you through important features for any cryptocurrency index fund.

Don’t forget to join our telegram group which is dedicated to cryptocurrency index funds. We’re always happy to answer questions you have about constructing your very own index!

Weighting

There are three primary weighting options when constructing a dynamic index. These three options are weighting by market, square root, and equal. To better understand each of these options, let’s break down how these different options work.

Market Cap

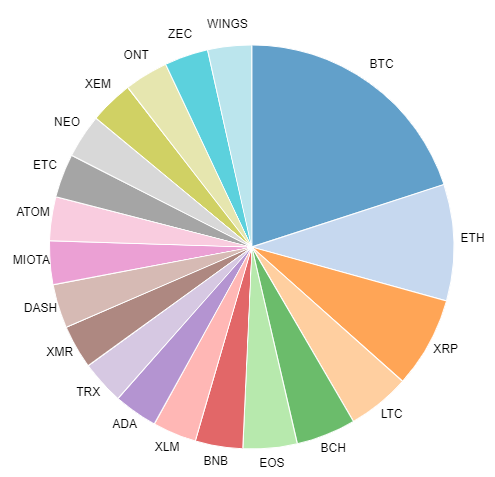

Market cap weighting is one which tracks the market caps of each asset in the dynamic index. The allocation assigned to each asset will be proportional to their market cap weighting compared to the other assets in the index. That means the assets with a larger market cap will consumer more of the portfolio than those which have a smaller market cap. This allows your portfolio to closely match the current state of the market, resulting in a performance which will be as close as possible to the market performance of all cryptocurrencies.

For example, if you have an index of two assets and the first asset is BTC and the second asset is ETH.

BTC Market Cap: $137,008,021,275

ETH Market Cap: $26,081,172,184

Calculating the weightings in the portfolio.

BTC weighting: 137,008,021,275 / (137,008,021,275 + 26,081,172,184) = 84%

ETH weighting: 26,081,172,184 / (137,008,021,275 + 26,081,172,184) = 16%

Therefore, the allocations in this example portfolio would be 84% BTC and 16% ETH.

Square Root Market Cap

A square root market cap distribution will take the square root of each of the market caps to dampen the affect an individual asset has on the portfolio. As we saw in the last example, Bitcoin held 84% of the value in the portfolio. Some people may consider this risky since most of the portfolio value is held in a single asset. To more evenly distribute the funds in the index, we can use a square root market cap.

Let’s examine how this will change the resulting allocations.

BTC weighting: 137,008,021,275^(1/2) / (137,008,021,275^(1/2) + 26,081,172,184^(1/2)) = 69.62%

ETH weighting: 26,081,172,184^(1/2) / (137,008,021,275^(1/2) + 26,081,172,184^(1/2)) = 30.38%

We see the result of taking the square root of the market cap is a distribution that is more evenly dispersed among the available assets.

Equal Weights

An equally weighted index is one which allocates an even percent across all assets. If there are 5 assets in the portfolio, that means each will receive 20% of the value for the portfolio. If there are 10 assets, each will receive 10% of the total value of the portfolio.

Asset Selection Range

Select assets based on the customizable range which you desire for your dynamic index. Whether you want to index the top ten assets by market cap, index 20 mid cap assets, or 30 low cap assets, this selection range allows you to do so.

A couple examples of ranges you can select would be rank 1 - 10. This will include the top 10 assets into the portfolio by market cap and maintain them as they swap in and out of that range. Another option would be to select assets from position 50 to 70. This means the index will take the assets which market cap range from 50-70 and add them to the index. As assets move in and out of this range, they will be added or removed from the index to maintain the desired allocation range.

Minimum Asset Allocation

The minimum asset allocation sets a minimum limit to the percent of a portfolio that can be allocated to a single asset. This prevents conditions where using a market cap weighted index results in a significant number of low weighted assets. For example, allocating the top ten assets on Bittrex by market cap at the time this article was being written would result in the following distribution:

BTC - 66.76%

ETH - 12.69%

XRP - 8.2%

BCH - 3.42%

LTC - 3.09%

BSV - 1.86%

XLM - 1.14%

TRX - 1.1%

ADA - 1.04%

XMR - 0.7%

We can see that the majority of the assets in the index are allocated less than 5% of the total value for the portfolio. This might be undesirable, so we can set a minimum percent. For example, if we set a 5% minimum allocation, the resulting portfolio would look like the following:

BTC - 49.51%

ETH - 9.41%

XRP - 6.08%

BCH - 5%

LTC - 5%

BSV - 5%

XLM - 5%

TRX - 5%

ADA - 5%

XMR - 5%

We can see the weightings from the larger assets are decreased in order to increase the weightings for each of the assets that are below the 5% threshold. The outcome is no asset holds less than 5% of the total value of the portfolio.

Maximum Asset Allocation

The maximum asset allocation is similar to that of the minimum asset allocation. This prevents conditions where using a market cap weighted index results in a single asset holding too much of the weighting in the portfolio. Continuing from the last example, we can see that BTC is still holding almost 50% of the value in the portfolio. If we wanted to reduce this amount to 20% for example, the resulting portfolio would look as follows:

BTC - 20%

ETH - 20%

XRP - 19.51%

BCH - 8.14%

LTC - 7.35%

BSV - 5%

XLM - 5%

TRX - 5%

ADA - 5%

XMR - 5%

We see that placing a maximum asset allocation on our index has reduced our BTC weighting to 20%. In doing so, we redistributed some of the weighting to other assets in the index. ETH for example increased in weighting enough to also exceed the maximum asset allocation, resulting in it also capping at 20%. The remaining amounts left over are distributed to the remaining assets based on market cap.

Amun is an example of an index fund which uses a minimum and maximum allocation percentage. You can read more about their methodology on their site here:

Asset Buffer Zone

The buffer zone for a dynamic index is the allowable buffer before assets are swapped in or out of the portfolio. Since constantly adding and removing assets from a diverse portfolio can lead to excessive trading fees, the buffer places limits on when these swaps can occur.

As an example, when a buffer of 5% is set for an index, this means an incoming asset must acquire enough market cap to become 5% more than the next largest asset in the index.

Say we have an index of 2, using the example above with BTC and ETH.

BTC Market Cap: $137,008,021,275

ETH Market Cap: $26,081,172,184

Since ETH currently has a market cap of $26,081,172,184, that means the only way for ETH to be removed from this index is for a different asset to reach a market cap of 27,385,230,794 or greater. Notice although the market cap of ETH is only $26,081,172,184, an incoming asset would need to acquire an extra 5% in order to be able to cause the swap. This prevents constant swapping of assets in and out of the index.

Bitwise Investments is an example of an index fund provider which uses a 5% buffer zone for their funds. You can find more information by visiting their methodology documentation here:

Exclude Assets

Excluding assets ensures the asset which has been excluded will not become allocated in the index. If the excluded asset falls within the index range such that it would have been allocated if it had not been excluded, the asset will be replaced with the asset of the next highest ranking.

Imagine we have an index of the top 10 assets. The current portfolio would look as follows:

Rank 1

Rank 2

Rank 3

Rank 4

Rank 5

Rank 6

Rank 7

Rank 8

Rank 9

Rank 10

Now, let’s say we want to exclude the asset which is currently rank 5. The resulting index for our portfolio would be the following:

Rank 1

Rank 2

Rank 3

Rank 4

Rank 6

Rank 7

Rank 8

Rank 9

Rank 10

Rank 11

Notice how Rank 5 is no longer in the index, however “Rank 11” has now been included. This allows us to keep 10 assets in our portfolio, even when an asset has been excluded.

Include Assets

In contrast to excluding assets, there are times when you will want to include an asset. This allows for the selection of a range of assets, but also include assets in the index which may be of specific interest to you. They may be inside or outside the range of the index. Including an asset means no matter where this asset’s ranking lies, whether it drifts inside or outside the index range, and regardless of price changes, it will be included in the index.

An example of this feature in action would be if you wanted to create an index of the top 5, but you also wanted to include DOGE because it holds a special place in your heart. The index would look like the following:

Rank 1

Rank 2

Rank 3

Rank 4

Rank 5

DOGE

Notice: Rank 1 - 5 are included in the portfolio as well as DOGE. That means there are 6 total assets which will be added to the portfolio during portfolio allocation.

Now that we have explored the core features which are required to construct a powerful cryptocurrency portfolio index fund, it’s time to implement this strategy for your portfolio. Implement your dynamic cryptocurrency index fund strategy with Shrimpy by signing up today! It’s easy to get started, so what are you waiting for - sign up here.

Additional Good Reads

How to Rebalance your Cryptocurrency Portfolio

Threshold Rebalancing - The Evolution of Cryptocurrency Portfolio Management

Crypto Users who Diversify Perform Better

Developing Trading Applications with Shrimpy’s Crypto Exchange API

Shrimpy is a cryptocurrency portfolio management application which supports every major crypto exchange including Coinbase Pro, Binance, Bittrex, Kraken, Poloniex, and more. Linking your exchange account to Shrimpy unlocks convenient trading features which can help you automate your trading strategy. Try it out today!

Follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.