What is Trade History? How to See Recent Trades on Crypto Exchanges

In our “Cryptocurrency Trading 101” series, we are exploring the basic principles of cryptocurrency trading. Some recent topics we covered include the following.

Anyone looking to access historical crypto trade data should use the Shrimpy Developer APIs. Also, don’t forget to join our Telegram community to stay up to date with all our latest content.

The exchange trade history is a way for traders to read the latest buy and sell trades that have been executed on an exchange. When a customer using an exchange makes a trade on a trading pair, the completed trade will be broadcast to the other traders on the exchange. Some of the more popular exchanges include Binance, Coinbase Pro, Bittrex, and Kraken.

Open orders are not broadcast through the trade history feed. These orders are displayed on the exchange’s order book. Learn more about order books in our article here.

Once an open order has been filled or partially filled, other traders will be notified through live updates to the trade history. This data is typically streamed through a real-time websocket as each individual trade takes place. That way traders can process the changes live.

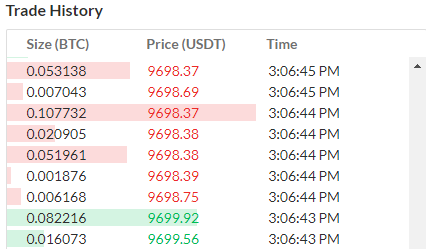

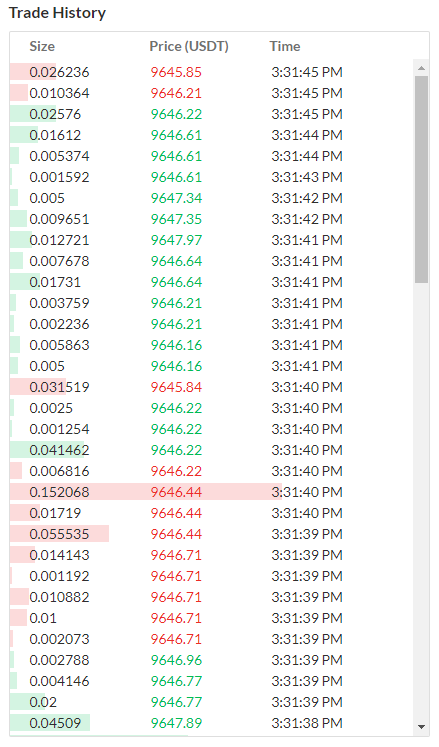

We can find an example of an exchange’s trade history for the BTC/USDT trading pair to the right.

In this instance, BTC would be the base currency and USDT would be the quote currency.

When someone executes a trade on the exchange for the BTC/USDT trading pair, the new trade will instantly be added to this feed and sent to everyone who is waiting to receive the latest trades.

The 3 pieces of data we see here include:

The size of the trade is in terms of the base currency. In this case, the size is in terms of Bitcoin.

The price of the trade is in terms of the quote currency. In this example, the price is in terms of USDT.

The time that the trade took place.

A trade where the taker is buying Bitcoin is marked as green while a trade where the taker is selling Bitcoin back to USDT is denoted with red text.

Taker refers to the person in the trade that crossed the market spread and took another open order on the exchange’s order book. The taker therefore removes liquidity from the exchange and executes the trade.

Besides the color-coding of the price text, we can also see that there are faint bars behind each trade row. These bars represent the magnitude of the trade size. The larger the trade size, the longer the bar.

Each bar is scaled relative to the size of the largest bar that is currently being shown in the list. The largest trade in the list will be denoted with a bar that consumes the entire length of the row.

Interpreting

Now that we have a general understanding of the information provided in the exchange’s trade history, we can move on to understanding how this information can be used when trading.

Since the cryptocurrency markets are volatile, the conditions can shift at a moment’s notice. As a result, many traders keep their eyes glued to live data streams, waiting to catch the next big move.

The trade history can help us determine the direction of the market at a given moment in time.

If the trading history is being filled with green rows of orders, this suggests there are a lot of buyers currently taking orders on the exchange. With enough buying power, the price of the asset could increase.

The opposite is true as well. When the trading history becomes filled with red rows, that could indicate a sudden surge in people selling an asset. We could expect the price of the asset to go down as a result.

These quick observations can provide us a glimpse into the direction and momentum currently present in the market.

Additional Good Reads

Case Study: Using Machine Learning for Portfolio Management

Cryptocurrency Trading Bots - The Complete Guide

Threshold Rebalancing for Crypto Portfolio Management

Get Historical Trade Data

Throughout this article, we will provide several examples of how to use the Shrimpy Developer APIs to access the complete archive of historical trade data…

About Us

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Thanks for stopping by!

The Shrimpy Team