Case Study: Using Machine Learning for Portfolio Management

7-day price predictions from the Nomics Bitcoin asset page.

[Edit 7/20/2020: Each week we will update this article to include the link to the next week’s blog post.]

In a recent blog post, Nomics announced the release of its 7-day crypto price predictions. Their predictions use a long short-term memory (LSTM) machine learning model. Although the 7-day predictions are still in beta, we were excited to see the development of new strategies for price analysis.

This excitement got us questioning how an ML-based portfolio strategy would perform over the course of a few months. To answer that question, we are putting together a study that will benchmark the performance of an ML-based strategy against other strategies like market-cap indexes, holding Bitcoin, and score-based allocations.

Nomics has been clear in their message: the price predictions are not investment advice. This study is for educational purposes only. Trading cryptocurrency is risky. There is no strategy in crypto that guarantees profit. Machine learning is no different.

Study Timeline

The study will begin on Monday, May 11 at 5 pm PST. There will not be any hard ending date for the study. We would like to continue the study for as long as people remain interested in the result. That could be 2 months, 4 months, or even a year.

Strategies

In this study, we will use a variety of different strategies to compare portfolio performance. Each week, we will publish an update on the performance we saw from the previous week. The updates will include comparisons between the different strategies, highlight different decisions that were made, and draw conclusions about how individual trades have been impacting the performance of the portfolio.

Each strategy will begin with a portfolio value of $1,000. Although most of the discussion will revolve around performance, it will be exciting to follow a tangible dollar value for the results over the next few months.

Nomics ML Strategy

This image depicts the top assets by market cap as calculated by Nomics.

The Nomics ML strategy uses a long short-term memory (LSTM) machine learning model to predict the 7-day price movement of each asset. LSTM is used in the field of deep learning to process, classify, and make predictions based on time series data.

Learn more about long short-term memory.

Methodology

Our team would like to keep the methodology for how we test the Nomics ML predictions as easily as possible. That way anyone who follows along with our study can reproduce the results.

At 5 pm Pacific Time each Monday, our team will collect the latest data from the Nomics ML predictions. Based on the predictions for the week, we will sort the assets in descending order based on the highest to lowest predicted percent price increase. The asset that has the highest predicted percent increase will be listed first, the one with the lowest predicted percent increase will be listed last.

The top ten assets with the highest predicted increases will be included in the portfolio for that week. Each asset will be given 10% of the total value of the portfolio.

Restrictions:

Only assets in the top 100 by market cap will be considered.

Only assets listed on Binance will be considered.

Only assets with a market spread less than 10% will be considered.

Stablecoins will not be considered unless there are assets in the top 10 that have negative percent predictions. In this case, 10% of the portfolio value will be granted to USDT for each asset in the top 10 that has a predicted percent change of less than 0%.

Once the target allocations for the portfolio have been selected, a single rebalance will be executed to allocate the desired portfolio and return all assets to a 10% target allocation.

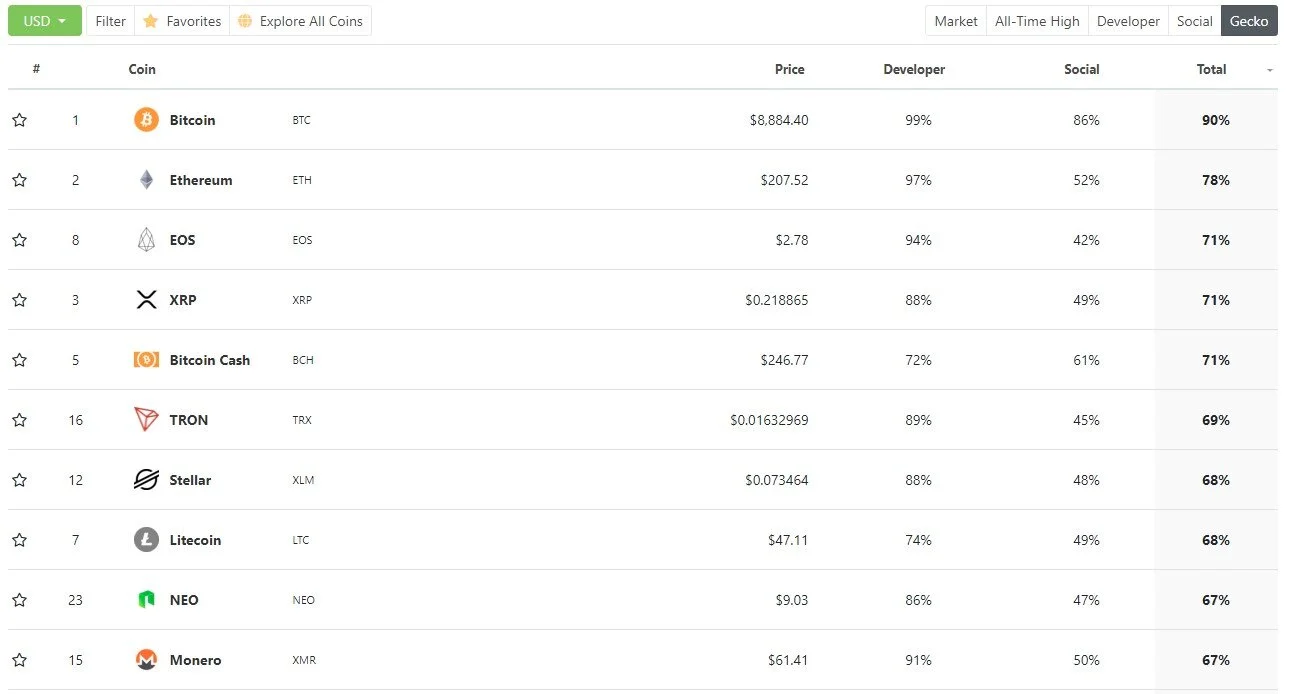

Coin Gecko Score

This image depicts the top assets by “Gecko Score” as calculated by Coin Gecko.

Coin Gecko is a service that provides unique social and developer insights into the market. Ideally, these insights would help predict the long-term value that is being generated by a cryptocurrency. The more robust the developer and investor community, presumably, the more robust the long-term projections.

This strategy will involve the “Gecko” total score. Each week at the same time, we will visit the Gecko ranking page here. By sorting the assets by “Total”, we will have a list of the top assets ranked by the Gecko score.

Methodology

The methodology for the portfolio constructed based on the Coin Gecko score will mirror that of the Nomics ML portfolio methodology.

At 5 pm Pacific Time each Monday, our team will collect the latest data from the Coin Gecko evaluations. Based on the highest rated coins each week, we will sort the assets in descending order. The asset that has the highest percentage score will be listed first, the one with the lowest percent score will be listed last.

The top ten assets with the highest percent scores will be included in the portfolio for that week. Each asset in the portfolio will be given 10% of the total value of the portfolio.

Restrictions:

Only assets listed on Binance will be considered.

Only assets with a market spread less than 10% will be considered.

Stablecoins will not be considered.

Once the target allocations for the portfolio have been selected, a single rebalance will be executed to allocate the desired portfolio and return all assets to a 10% target allocation.

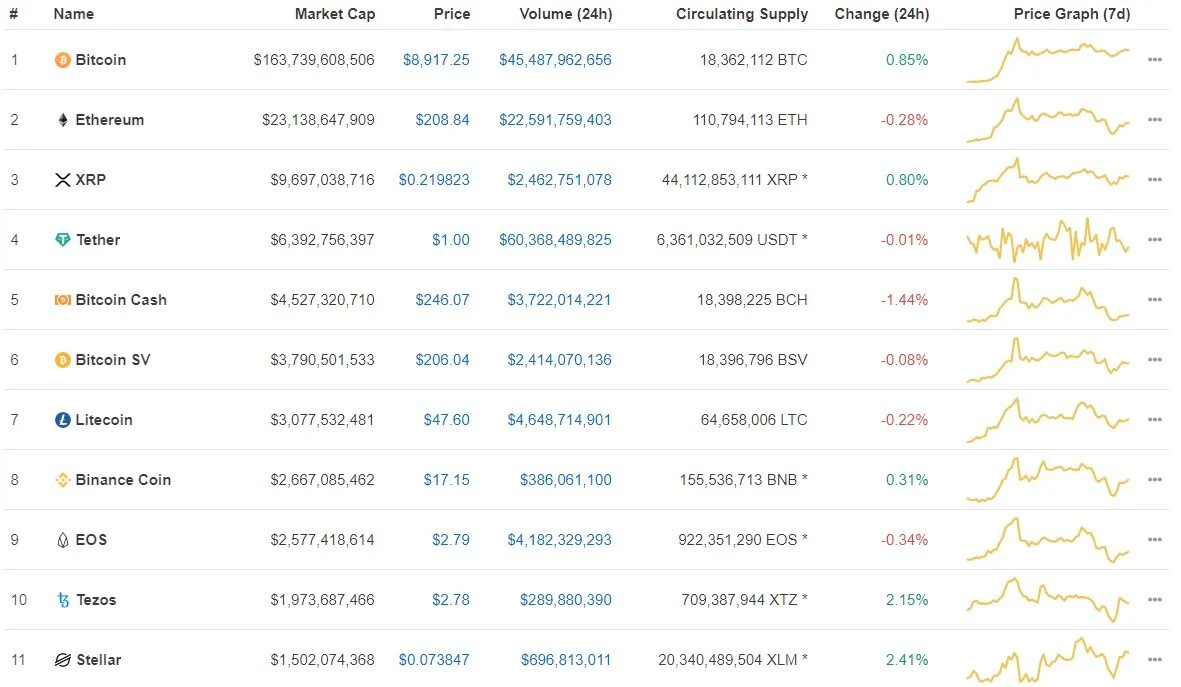

Market Cap Index

This image depicts the top assets by market cap as calculated by CoinMarketCap.

CoinMarketCap provides a robust service for accessing the market caps of nearly every cryptocurrency in the market. To benchmark the Nomics ML strategy against the market, we will use a simple top 10 market cap index. The index will exclude any stablecoins and leverage a standard weekly rebalance. That way the rebalances also coincide with the Nomics ML strategy rebalances.

Each week at the same time, the CoinMarketCap top ten index will be updated based on the latest market cap data. At that time, any assets that have been added or removed from the top ten will also be swapped in or out of the index.

Learn how to build your own index.

Methodology

The methodology for the portfolio constructed based on the market cap will mirror that of the Nomics ML portfolio and the Coin Gecko portfolio methodologies.

At 5 pm Pacific Time each Monday, our team will collect the latest data from CoinMarketCap. Based on the highest market cap assets each week, we will sort the assets in descending order. The asset that has the highest market cap will be listed first, the one with the lowest market cap will be listed last.

The top ten assets with the highest market caps will be included in the portfolio for that week. Each asset will be weighted proportionally to their market cap contribution. Similar to a market-cap weighted index fund.

Restrictions:

Only assets listed on Binance will be considered.

Only assets with a market spread less than 10% will be considered.

Stablecoins will not be considered.

Once the target allocations for the portfolio have been selected, a single rebalance will be executed to allocate the desired portfolio and return all assets to a 10% target allocation.

Bitcoin Hold

This image depicts the price of Bitcoin as collected and displayed by Shrimpy.

The final benchmark for this study will be Bitcoin. Since Bitcoin is the largest market cap crypto asset and, in many ways, considered the gold standard, investors will want to see a comparison to Bitcoin performance.

If the strategies can outperform a simple Bitcoin hold, then that presents exciting prospects for the strategies.

Unlike the other strategies that are being examined in this study, there will be no rebalancing or trading strategy implemented for the Bitcoin HODL. Bitcoin will simply sit untouched in a portfolio throughout the entirety of the study.

Follow Along

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Thanks for stopping by!

The Shrimpy Team

Disclaimer

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Shrimpy or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Shrimpy, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.