Machine Learning for Crypto Portfolio Management Case Study: Week 2

It’s moon time.

It’s been a wild week for the crypto market. Bitcoin dominance has been rising like a rocket since the Bitcoin halving. That’s not to say other assets are performing poorly, but Bitcoin would surely make you think so.

The aggressive growth of Bitcoin has cast a shadow over the rest of the market and this shines clearly in the first week of our study. Bitcoin dominated the performance metrics dragging portfolios that included Bitcoin to the top of our charts.

Let’s not get ahead of ourselves though, let’s dig into the details of this week to see what’s what and where our study will take us next week!

Reminder: The methodology for this study was first outlined in our previous article.

Follow the progress of this study on Shrimpy.

Week 1 Results

The study has only been running for a week so far, but the results are already getting exciting. The first week produced clear results - portfolios with Bitcoin performed the best. The more Bitcoin in the portfolio, the better.

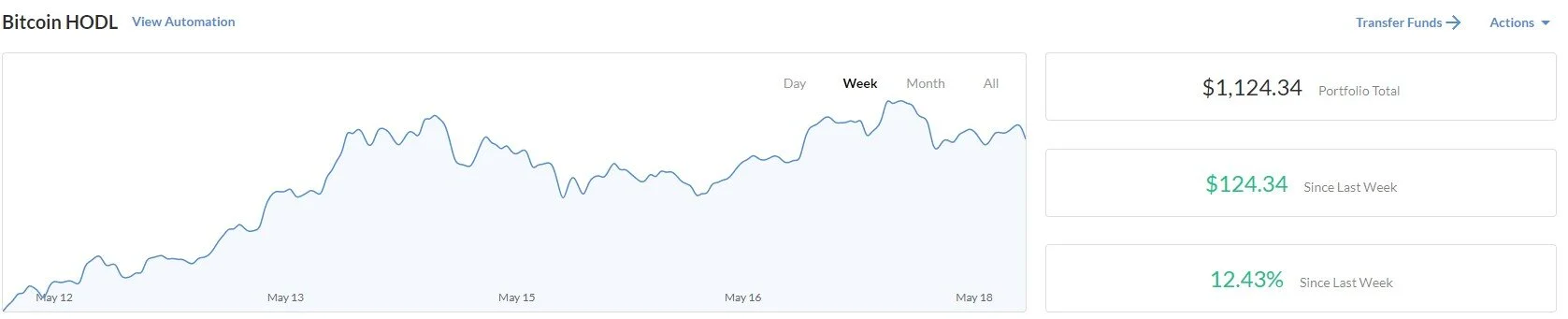

#1 Bitcoin

Bitcoin was booming this week. By the 3rd day, Bitcoin had already shot up to a +14% performance gain for the HODL portfolio. Few other assets were able to keep up with the meteoric rise of Bitcoin.

Remember that the Bitcoin halving took place on the same day this study began. Although this may not be the reason for the rise in value, the market may be inflating the price of Bitcoin in the short-term due to the excitement surrounding this event.

Final Bitcoin portfolio value: $1,124.34

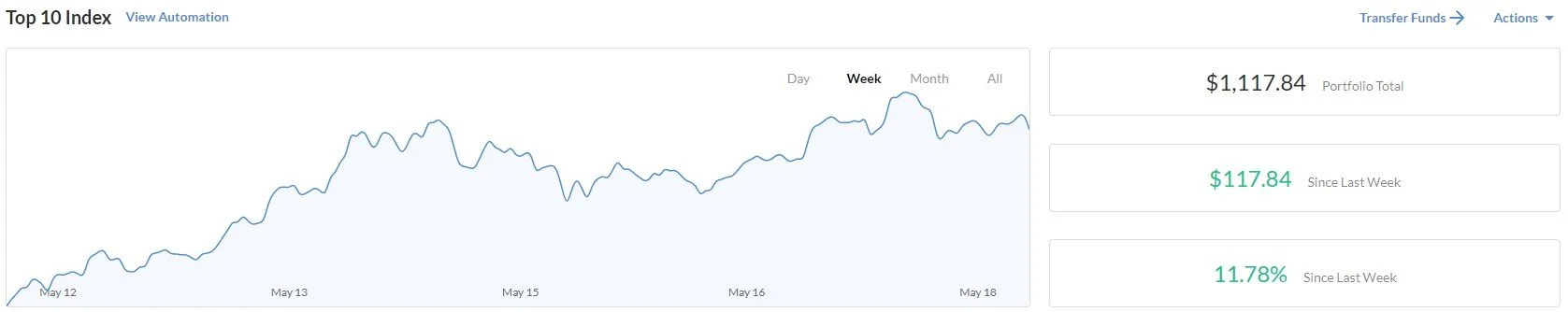

#2 Top 10 Index

Due to the rise of Bitcoin, it was expected that the Top 10 Market Index would perform similarly in the short-term. In this index, Bitcoin held a 77.38% weight in the portfolio for the first week which provides a significant sway in how well the portfolio performs.

As the portfolio continues to rebalance, we will be able to better understand how the portfolio will deviate from the simple Bitcoin HODL portfolio.

Final Top 10 Index portfolio value: $1,117.84

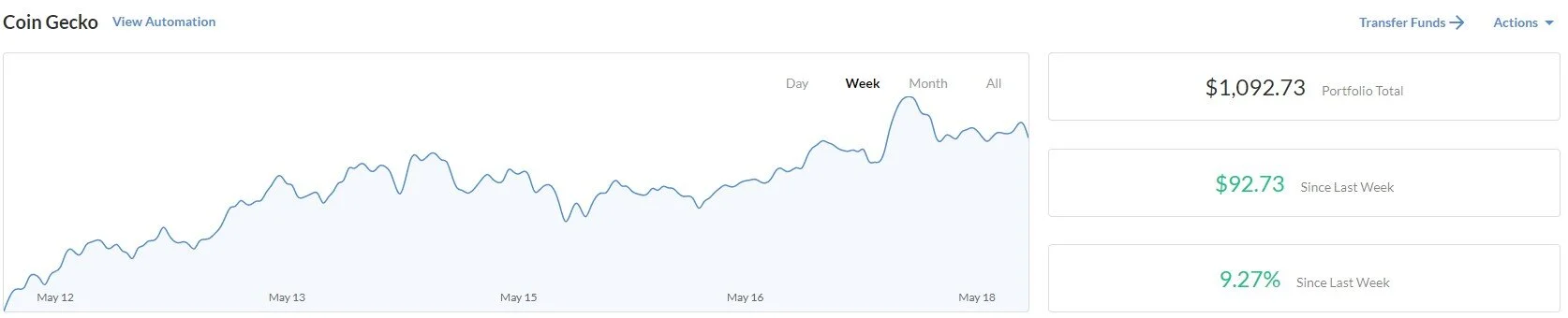

#3 Coin Gecko

The Coin Gecko portfolio demonstrated steady growth throughout the first week. Although this portfolio does hold Bitcoin, 90% of the portfolio value was allocated to assets other than Bitcoin. The results for the first week could suggest that not only did Bitcoin perform well, but assets with a strong developer and investor community performed strongly.

Interestingly, none of the assets selected by the Coin Gecko strategy produced negative returns over the course of the last week.

The biggest winners selected by the Coin Gecko strategy:

Ethereum (ETH): +13.66% Last 7 days

Bitcoin (BTC): +11.78% Last 7 days

Monero (XMR): +11.01% Last 7 days

Final Coin Gecko portfolio value: $1,092.73

#4 Nomics ML

The Nomics Machine Learning strategy underperformed the other portfolios throughout the first week. The projected profit from last week was +45.64% across all of the selected assets. With a final portfolio performance of +0.28%, the portfolio failed to hit the targets in the studies first week.

The biggest losers selected by the Nomics ML strategy include:

Tierion (TNT): -44.07% Last 7 days

Status (SNT): -17.97% Last 7 days

Ripio Credit Network (RCN): -13.84% Last 7 days

ETHLend (LEND): -12.72% Last 7 days

The biggest winners selected by the Nomics ML strategy include:

Zilliqa (ZIL): +42.33% Last 7 days

Ren (REN): +23.02% Last 7 days

Basic Attention Token (BAT): +12.48% Last 7 days

The poor performers drastically damaged the performance of the Nomics ML portfolio.

Final Top 10 Index portfolio value: $1,002.82

Conclusions

Generally, it seems that the portfolios with more Bitcoin performed the best this week. Interestingly, the Nomics ML strategy picked both the highest gainers and the highest losers over the course of the last 7 days.

Note: The purpose of this study is to evaluate each of these strategies over the long-term. We cannot yet draw any conclusions for the long-term potential of these strategies after only a single week. As a result, we should take these results with a grain of salt. Non-the-less, it was an interesting first week!

Week 2 Strategy Changes

Now that we have covered the results from the last week, it’s time to break down how we will change each of these portfolios for the coming week.

Nomics ML Strategy

The Nomics ML Strategy leverages the 7-day price predictions generated by the Nomics ML engine. These price predictions are then used to determine which assets should be placed into our portfolio for this week. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The following assets were allocated exactly 10% of the portfolio value for the second week of this study.

1. OmiseGo (OMG)

Projected 7-day profit: +42.73%

2. Zilliqa (ZIL)

Projected 7-day profit: +37.48%

3. Theta Token (THETA)

Projected 7-day profit: +28.02%

4. Chiliz (CHZ)

Projected 7-day profit: +27.88%

5. Matic Network (MATIC)

Projected 7-day profit: +22.93%

6. Blockstack (STX)

Projected 7-day profit: +17.89%

7. Nano (NANO)

Projected 7-day profit: +10.29%

8. Ren (REN)

Projected 7-day profit: +9.04%

9. NEM (XEM)

Projected 7-day profit: +8.01%

10. Enjin Coin (ENJ)

Projected 7-day profit: +7.66%

Reminder: We are only including the assets that are available on Binance in this portfolio.

The average performance estimate is 21.19% for the next 7 days for this portfolio.

Coin Gecko Score Strategy

The Coin Gecko Score Strategy uses the “Gecko” score that is calculated by the popular data site “CoinGecko”. These asset scores are used to determine the most promising long-term assets that should be included in a portfolio. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The following assets were allocated exactly 10% of the portfolio value for the first week of this study.

1. Bitcoin (BTC) - Score: 88%

2. Ethereum (ETH) - Score: 79%

3. Bitcoin Cash (BCH) - Score: 71%

4. XRP (XRP) - Score: 71%

5. EOS (EOS) - Score: 69%

6. TRON (TRX) - Score: 69%

7. Monero (XMR) - Score: 68%

8. Stellar (XLM) - Score: 68%

9. Litecoin (LTC) - Score: 68%

10. NEO (NEO) - Score: 67%

Note: There were no changes to the portfolio from last week. That means we will leave the allocations at 10% for each of the above assets and simply rebalance the portfolio one time.

Coin Market Cap Index Strategy

The Coin Market Cap Index Strategy uses the asset market caps that are calculated by “CoinMarketCap” to determine which assets should be included in the portfolio. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The allocations for the Top 10 Index portfolio strategy will be the following in the second week.

1. Bitcoin (BTC): 77.81% Allocation

2. Ethereum (ETH): 10.34% Allocation

3. XRP (XRP): 4.29% Allocation

4. Bitcoin Cash (BCH): 1.99% Allocation

5. Litecoin (LTC): 1.28% Allocation

6. Binance Coin (BNB): 1.13% Allocation

7. EOS (EOS): 1.07% Allocation

8. Tezos (XTZ): 0.85% Allocation

9. Stellar (XLM): 0.62% Allocation

10. Cardano (ADA): 0.62% Allocation

Note: The assets included in the index will remain the same, however, the allocations for each asset has changed from last week. We will adjust the allocations to match the new percentages and execute a single rebalance operation.

Bitcoin Hold Strategy

The most simple of the strategies we will be exploring is a simple Bitcoin HODL. The Bitcoin HODL strategy will allow us to benchmark these other strategies against the price performance of Bitcoin. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

100% Bitcoin

Note: There will be no changes or rebalances for the Bitcoin HODL portfolio.

Follow Along with Shrimpy

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Disclaimer

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Shrimpy or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Shrimpy, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.