Machine Learning for Crypto Portfolio Management Case Study: Week 9

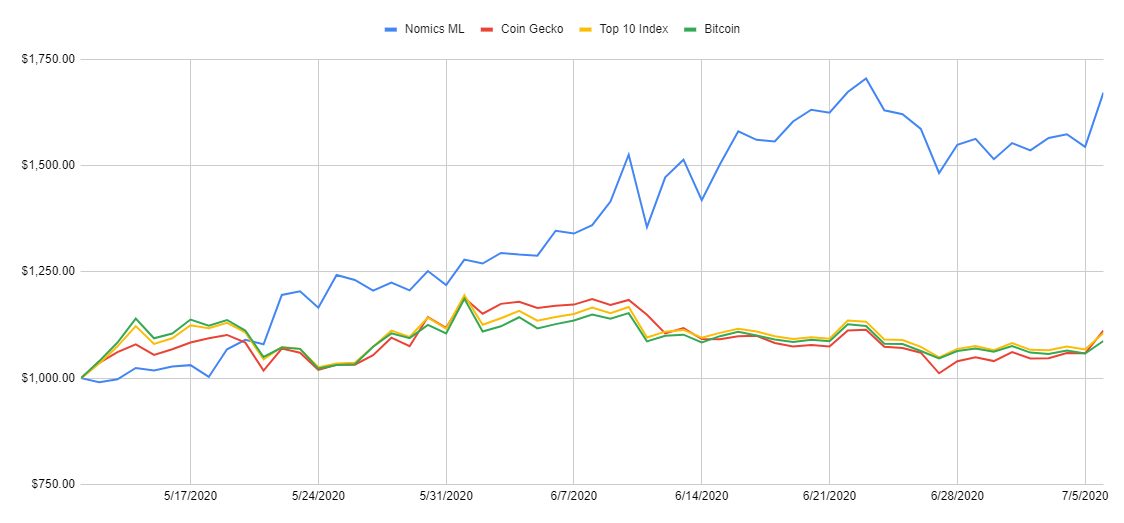

Over the last month, our team has been tracking the performance of 4 different portfolio strategies. These include portfolios selected using Nomics Machine Learning, CoinGecko, market-cap indexing, and a simple Bitcoin HODL.

Up until this point, we have been thoroughly impressed by the results of the Nomics Machine Learning strategy. It has separated itself from the pack with steady performance results over the last 8 weeks.

That’s enough about Nomics for now, let’s start digging into the results from the last week and see what we have lined up for our 9th week of the study!

Reminder: The methodology for this study was first outlined in our previous article.

Follow the progress of this study on Shrimpy.

Week 8 Results

The study has only been running for eight weeks so far, but every week so far has been a shocker! While the first week showed a strong preference for Bitcoin, the Nomics ML strategy has taken the reigns and crowned itself king. The question remains: will it last?

#1 Bitcoin

Bitcoin saw poor performance in the last week when compared to the other portfolio strategies. We only began to see some upward trending movements towards the end of the week, so we might be able to see some fun price action next week.

After the 8th week of our study, Bitcoin is now the worst performing portfolio of any we are testing.

Final Bitcoin portfolio value: $1,077.70.

#2 Top 10 Index

Due to the mediocre performance of Bitcoin, it was expected that a portfolio based on a market-weighted index would also experience similar performance over the course of the last week since Bitcoin held approximately 75% of the value in the portfolio.

As the portfolio continues to rebalance, we will be able to better understand how the portfolio will deviate from the simple Bitcoin HODL portfolio.

Final Top 10 Index portfolio value: $1,097.31.

#3 Coin Gecko

The Coin Gecko portfolio experienced moderate performance results over the week.

There were no major losers, but the biggest winners selected by the Coin Gecko strategy included:

EOS (EOS): +7.69% Last 7 days

Stellar (XLM): +7.20% Last 7 days

Tron (TRX): +4.78% Last 7 days

There were no major losers selected by the Coin Gecko strategy. Coin Gecko is now outperforming the BTC HODL portfolio, which is a positive sign for this portfolio option.

Final Coin Gecko portfolio value: $1,096.36.

#4 Nomics ML

The Nomics Machine Learning strategy has maintained a healthy lead against the competition. The projected profit from last week was +15.47% across all of the selected assets. With a final portfolio performance of +11.05%, the portfolio was able to track the projections relatively well and was also the best performing portfolio this last week.

The biggest winners selected by the Nomics ML strategy include:

Bancor (BNT): +48.81% Last 7 days

Chainlink (LINK): +22.85% Last 7 days

Ren (REN): +21.47% Last 7 days

The biggest loser selected by the Nomics ML strategy was:

Bitcoin Gold (BTG): -14.39% Last 7 days

Overall, this week saw mostly great asset selections. Bitcoin Gold was the only asset that had a negative return this week.

Final Nomics ML portfolio value: $1,690.59.

Conclusions

The Nomics ML strategy has maintained a steady lead over the other strategies since the second week of this study. We cannot use this to predict future performance, but the results are promising.

Note: The purpose of this study is to evaluate each of these strategies over the long-term. We cannot yet draw any conclusions for the long-term potential of these strategies after only a few weeks. As a result, we should take these results with a grain of salt.

Week 9 Strategy Changes

Now that we have covered the results from the last week, it’s time to break down how we will change each of these portfolios for the coming week.

Nomics ML Strategy

The Nomics ML Strategy leverages the 7-day price predictions generated by the Nomics ML engine. These price predictions are then used to determine which assets should be placed into our portfolio for this week. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The following assets were allocated exactly 10% of the portfolio value for the second week of this study.

1. VeChain (VET)

Projected 7-day profit: +63.76%

2. Aave (LEND)

Projected 7-day profit: +55.8%

3. Bancor (BNT)

Projected 7-day profit: +45.11%

4. Kyber Network (KNC)

Projected 7-day profit: +40.2%

5. Loopring (LRC)

Projected 7-day profit: +31.87%

6. Elrond (ERD)

Projected 7-day profit: +31.38%

7. Cardano (ADA)

Projected 7-day profit: +22.93%

8. Ren (REN)

Projected 7-day profit: +21.08%

9. ICON (ICX)

Projected 7-day profit: +16.8%

10. IOST (IOST)

Projected 7-day profit: +15.91%

Reminder: We are only including the assets that are available on Binance in this portfolio.

The average performance estimate is 34.48% for the next 7 days for this portfolio.

Coin Gecko Score Strategy

The Coin Gecko Score Strategy uses the “Gecko” score that is calculated by the popular data site “CoinGecko”. These asset scores are used to determine the most promising long-term assets that should be included in a portfolio. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The following assets were allocated exactly 10% of the portfolio value for the first week of this study.

1. Bitcoin (BTC) - Score: 85%

2. Ethereum (ETH) - Score: 78%

3. XRP (XRP) - Score: 70%

4. Bitcoin Cash (BCH) - Score: 70%

5. TRON (TRX) - Score: 68%

6. EOS (EOS) - Score: 68%

7. Stellar (XLM) - Score: 67%

8. NEO (NEO) - Score: 66%

9. Litecoin (LTC) - Score: 66%

10. Cardano (ADA) - Score: 66% [New Asset in Index]

Note: The only change to the index was Cardano (ADA) which was added to the index and Monero (XMR) was removed from the index. All assets will maintain a 10% allocation and rebalance to allocate the new asset and re-align current allocations with the target allocations.

Coin Market Cap Index Strategy

The Coin Market Cap Index Strategy uses the asset market caps that are calculated by “CoinMarketCap” to determine which assets should be included in the portfolio. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

The allocations for the Top 10 Index portfolio strategy will be the following this week.

1. Bitcoin (BTC): 75.55% Allocation

2. Ethereum (ETH): 11.78% Allocation

3. XRP (XRP): 4.31% Allocation

4. Bitcoin Cash (BCH): 1.93% Allocation

5. Cardano (ADA): 1.31% Allocation

6. Litecoin (LTC): 1.24% Allocation

7. Binance Coin (BNB): 1.14% Allocation

8. EOS (EOS): 1.05% Allocation

9. Chainlink (LINK): 0.88% Allocation

10. Tezos (XTZ): 0.81% Allocation

Note: No new assets were added or removed from last week’s index. We will just adjust the allocations to match the new percentages and execute a single rebalance operation.

Bitcoin Hold Strategy

The most simple of the strategies we will be exploring is a simple Bitcoin HODL. The Bitcoin HODL strategy will allow us to benchmark these other strategies against the price performance of Bitcoin. Additional information regarding the methodology can be found in our previous article.

Portfolio Allocations

100% Bitcoin

Note: There will be no changes or rebalances for the Bitcoin HODL portfolio.

Follow Along with Shrimpy

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Disclaimer

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Shrimpy or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Shrimpy, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.