Cryptocurrency Trading 101: Exchange Market Slippage

In our “Cryptocurrency Trading 101” series, we are exploring the basic principles of cryptocurrency trading. A few recent topics we discussed include the following.

In this article, we will turn our attention towards crypto exchange market slippage. As we equip ourselves with the necessary tools to effectively trade, understanding slippage and how it impacts our portfolio is a critical step in mastering crypto trading. Don’t forget to sign up for Shrimpy to stay up to date with all our latest content.

Before we can begin to understand market slippage, we should first build our foundation by fully grasping the concepts related to the exchange order book.

In a previous article, we discussed the various elements of the exchange order book, how to read an order book, and how order books are used to select trades.

You can find this article here.

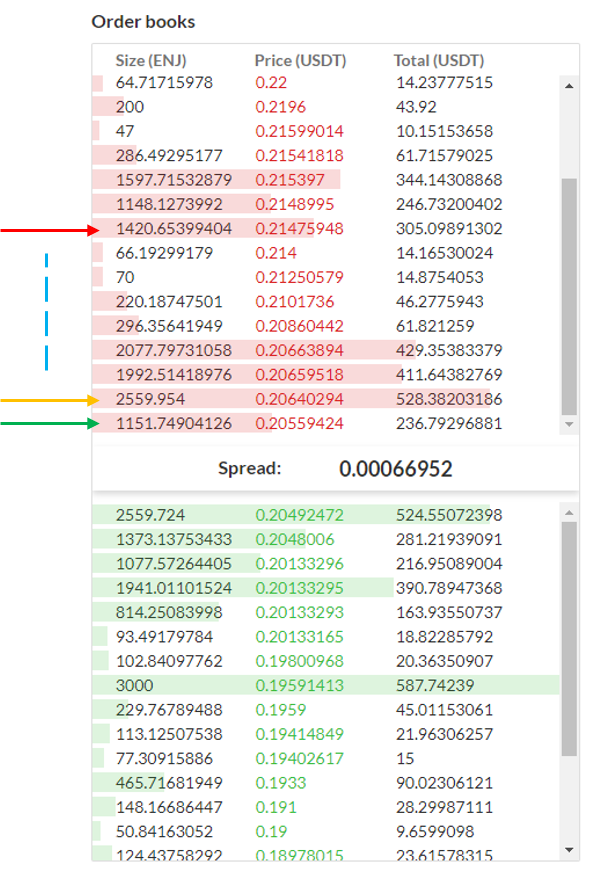

Figure 1: This illustration demonstrates how slippage happens when sequential orders are taken, which makes the exchange rate increasingly worse for us.

What is slippage?

Slippage takes place when a single order or multiple sequential orders are placed with the exchange that consumes consecutive levels of open orders on the exchange.

As a demonstration of market slippage, we can take a look at Figure 1. We can see in this image that there is a green arrow that marks the current best asking price for buying ENJ. The price in terms of USDT for ENJ at the best rate is 0.20559424.

Since the current best asking rate has 1151.74904126 ENJ available for purchase, we could buy up to that amount without experiencing any slippage. In total, that would equal about $236.79 worth of ENJ, as shown in the Total column.

If we want to purchase more than the total amount of ENJ available at the best price (green arrow), we will need to take the open order at the next best price. This next best price is designated with the yellow arrow in Figure 1. The second best price for ENJ is 0.20640294 USDT in this example.

As we place more and more consecutive orders to purchase ENJ, we will continue to move up the order book. Each time we slip from one price level to the next, we are receiving a worse rate for our trades. That means we will pay more money for each ENJ we buy.

Note: Although we use the ENJ/USDT trading pair in this example, the same concepts apply to every trading pair.

Slippage Calculations

Now that we have an understanding of how slippage works, let’s put this knowledge to use. There are a few simple calculations we can use to gather useful information about how slippage would impact our trading.

Calculating Percent Slippage

Figure 2: An illustration of a single market order of $2,000

The slippage percent can be calculated using the following formula:

Slippage = |Pf - Pi| / Pi x 100

Where,

Pf is the final price

Pi is the initial price

Take the absolute value of (Pf - Pi)

Times 100 to convert from decimal to percent

Example: Imagine we place a 2,000 USDT market order to buy ENJ on the order book depicted in Figure 2.

Result: The 2,000 USDT order would consume the order book up until the price of 0.21475948 USDT for each ENJ. The blue box over the order book shows the amount of slippage we would experience.

We determine this by adding up the Total amount of ENJ available at each level. Summing the rows in the blue box comes out to a total of 2048.39236379 USDT. Therefore, we would buy everything in the blue box except for 48.39236379 USDT that would be left in the top row (0.21475948 USDT price level) in the highlighted box.

Plugging these values into our equation we can determine the amount of slippage this order would experience.

Slippage = |Pf - Pi| / Pi = (0.21475948 - 0.20559424) / 0.20559424 x 100 = 4.46%

Calculating Weighted Average Order Price

Now that we understand how much slippage our order experienced, we can also calculate the weighted average price of the ENJ that was purchased.

The formula looks like the following:

Weighted Average Order Price = Σ(P x A) / T

where,

Σ is the sum of each level

P is the price at each level

A is the amount purchased at each level

T is the total amount purchased in the order

By summing the Totals in each level inside the highlighted box, we come to a total of 2048.39236379 USDT worth of ENJ. The single market order of 2,000 USDT would, therefore, leave exactly 48.39236379 USDT worth of ENJ at the last level in the order book (at the top of the highlighted box). In other words, we would have enough to purchase 256.70654923 USDT worth of ENJ at the top level in the highlighted box (which has a price of 0.21475948 USDT for each ENJ).

Each of the rows below the top row in the highlighted box would be purchased completely. That means the weighted average calculation would look something like the following:

Weighted Average Order Price = [(0.20559424 x 236.79296881) + (0.20640294 x 528.38203186) + (0.20659518 x 411.64382769) + (0.20663894 x 429.35383379) + (0.20860442 x 61.821259) + (0.2101736 x 46.2775943) + (0.21250579 x 14.8754053) + (0.214 x 14.146530024) + (0.21475948 x 256.70654923)] / 2,000 = 0.20772443786 USDT

That means we would pay an average of 0.20772443786 USDT for each ENJ, even though the best available price was 0.20559424 USDT on the order book.

How can we identify slippage in the market

Slippage is most popularly found on low volume trading pairs where the order books are generally more thin. On these trading pairs it’s easy for a fat fingered market order to turn into a tragedy.

In the above image, we see an example of what was likely a market order that was too large for the thin order books on KuCoin for the SNX/ETH trading pair.

The market order consumed every price level of the order book from 0.0081 ETH all the way down to 0.0072 ETH. That meant the person who placed the order was selling SNX at a price that was over 10% lower than the market rate for the asset.

As a result of this trade, the person who placed the order could have lost a significant amount of money. This highlights the importance of double checking your trades, cautiously evaluating the open orders that are available on the order book, and refraining from using market orders on large volume trades.

How can we minimize the slippage

At first glance, the concept of slippage can be a scary thought. The idea that you could pay a higher price than expected for an asset is daunting. Thankfully, we can prevent slippage from having a substantial impact on our portfolio by strategically executing our trading strategy.

Trade incrementally

When trying to purchase large amounts of an asset, consider placing multiple smaller trades over time to reduce the amount of slippage you experience. This strategy can take the form of TWAP (Time-Weighted Average Price) or VWAP (Volume-Weighted Average Price) orders. These two order types will systematically place orders over time to reduce the impact an order has on the market.

An example would be if you wanted to purchase $1,000,000 in Bitcoin. Instead of simply placing a market order on an exchange to buy $1,000,000 BTC (which would most definitely cause slippage), the order can be broken up into many smaller trades that likely won’t experience slippage.

As an example, a TWAP order can be placed to purchase $50 in Bitcoin every minute until it has purchased $1,000,000 in Bitcoin. Although this would take almost 2 weeks to purchase all $1,000,000 in Bitcoin, it would not cause any noticeable slippage in the market.

Note: This is for example purposes only. Before purchasing significant amounts of any asset, traders should thoroughly investigate the markets and come up with a strategy that works the best for them.

Trade on popular exchanges

Most popular exchanges tend to have deeper liquidity pools. Trading on an exchange with significant liquidity will decrease the chances of an order slipping.

Figure 3 provides a clear example of how this is the case. On Binance, we see the order books can frequently reach thousands of dollars at each individual level.

The provided figure shows how it would require an order of over $54,817 to start experiencing any slippage for the BTC/USDT trading pair on Binance at the moment this image was taken.

Not all exchanges have this amount of liquidity. When evaluating exchanges, examine the order books to ensure they can support the volume you expect to trade.

Trade on popular pairs

In general, the large market cap assets have higher liquidity on their trading pairs than small-cap assets. In some cases, the difference in liquidity can be substantial, even for assets in similar market cap ranges.

As an example, we can look at the trading volume for Bitcoin, which has a rank of #1 in market cap and CRO (Crypto.com Coin), which has a rank of #12 in market cap. We see that Bitcoin has trading volumes that are almost 550x higher than CRO. This suggests that Bitcoin will certainly have better liquidity and fuller order books than CRO.

When deciding what trading pairs to use for your strategy, consider the volume they can support. Accidentally using a trading pair with low liquidity can drastically change the performance of a trade.

Additional Good Reads

Case Study: Using Machine Learning for Portfolio Management

Cryptocurrency Trading Bots - The Complete Guide

Threshold Rebalancing for Crypto Portfolio Management

Python Scripts for Crypto Trading Bots

Script for Bitcoin Price Live Ticker (Using Websockets)

About Us

Shrimpy is an account aggregating platform for cryptocurrency. It is designed for both professional and novice traders to come and learn about the growing crypto industry. Trade with ease, track your performance, and analyze the market. Shrimpy is the trusted platform for trading over $13B in digital assets.

Follow us on Twitter for updates!

Thanks for stopping by!

The Shrimpy Team