How to use Shrimpy [Full Guide]

Welcome to Shrimpy!

We presume you clicked on this full guide because you want to learn everything there is to know about Shrimpy.

This full guide will do just that - teach you everything about Shrimpy.

Now, when we say everything, we mean everything. This guide is long. Really long. If you only want information about a specific button or feature, I would encourage you to use the Shrimpy Help Center.

We also encourage customers to ask questions in our Telegram Community. It’s a great place to relax, discuss cryptocurrency, and learn about Shrimpy.

Before we begin, don’t forget to hydrate and take frequent breaks. You are about to be thrown into the belly of the beast. If you would prefer to watch the video tutorial of Shrimpy. Check out our video guide below.

Here we go!

Dashboard

The purpose of the dashboard is to provide an overview of your entire cryptocurrency portfolio. Each exchange that is connected to Shrimpy gets a separate dashboard that can be used to monitor the value of the portfolio over time.

Multiple Portfolios

Multi-portfolio is a feature in Shrimpy that allows you to manage multiple portfolios for a single exchange account. That means if you currently only have 1 Binance exchange account linked, you can break that one exchange account into multiple portfolios and manage each one separately.

Each portfolio can be managed by selecting the “Manage Portfolios” button at the top of your dashboard. This is the place where portfolios are created and funds can be transferred between portfolios.

Default Portfolio

A default portfolio is the portfolio that tracks the changes made outside of Shrimpy. Whenever a change is detected, the default portfolio is the first portfolio that will be affected.

For example, if a deposit was made to an exchange account, the new funds will show up in the default portfolio. When funds are removed from an exchange account, they will first be removed from the default portfolio.

Transfer Funds

Transferring funds allows people to move funds from one portfolio to another portfolio. Funds that have been transferred to another portfolio can then be managed by the automation strategies that are defined for the alternative portfolio.

Actions

On the dashboard next to each portfolio, you will find a button labeled “Actions”. This button will provide access to a few actions that can be taken on a portfolio. These actions are immediate actions rather than being scheduled or automated.

Rebalance Now

At any time, you can execute a rebalance by selecting the “Rebalance Now” option in the “Actions” dropdown. Selecting this option will take you through the process of executing an immediate rebalance.

When using the “Rebalance Now” option, Shrimpy will execute trades to align your current allocations with the target allocations defined in your “Automation” strategy that is currently active for the selected portfolio. If there is no automation strategy active, then the “Rebalance Now” button will be grayed out and unavailable.

Portfolio Stop Loss

A portfolio stop-loss can be triggered at any time using the “Actions” dropdown if a Stop Loss has already been configured on your Automations tab. As soon as a stop-loss is executed, your automation for the affected portfolio will be detached from the portfolio. That means you will need to manually re-activate the automation when you are ready to resume rebalancing.

To learn more about Stop-Losses, you can read the following article or continue to the section on “Automation”.

Asset Information Side-Bar

The asset information side-bar on the dashboard is used to access a variety of different information and features. This side-bar is opened when you select an asset on the dashboard or use the search functionality (available by clicking the magnifying glass icon on the top right corner of the dashboard).

Your Position

This section shows the current value and amount of the asset that is held in your exchange account. Notice that this section aggregates across all of your portfolios for each individual exchange account. That means if you have multiple portfolios on an exchange, this will sum the numbers for the specific asset across each portfolio.

For example, if you had Bitcoin in 2 different portfolios, the “Value” would be the value of Bitcoin held in both portfolios combined.

Asset Stats

The asset stats are the price change of the asset over different time periods. We currently show 1H, 1D, 1W, and 1M change.

Amount Graph

The amount graph shows the amount of the asset that was held over time. Similar to the “Your Position” section, this graph accumulates across all of your portfolios.

This graph can be used to track how much of an asset you have held over time.

Cold Storage

Shrimpy supports cold storage balances on the dashboard side bar in the application. Looking at this example portfolio below, we can see how each cold storage balance was added to specific portfolios.

In Shrimpy, the balance bar graphs are gray for “Cold Storage” amounts and blue for assets on the exchange.

This figure demonstrates how offline assets (Cold Storage) are added to the Shrimpy application. Simply click on the asset on the dashboard you want to add a cold storage to, select the text for "Add Cold Storage", and input the information into the appropriate fields.

Asset Dominance

Asset dominance is the average percentage of the asset which is held across all Shrimpy user portfolios. This includes both users who have 0% allocated to this asset as well as those who have 100% allocated to this asset.

Asset Popularity

Asset popularity is defined in Shrimpy as the percentage of user portfolios which hold this asset. This means whether the user portfolio holds 1% of this asset or 100% of this asset, they are both treated the same. These portfolios would both be treated as holding the asset.

Automation

The automation tab is where a lot of the magic happens. This is where you will configure your automated strategy. The strategy that you attach to a portfolio will then begin automating the selected portfolio.

Notice that until you specifically select “Start Automation” and then select a portfolio on the popup that comes up, Shrimpy will not make trades for your portfolio.

At any time, you can also stop an automation by clicking “Stop Automation”. This will remove the automation from a portfolio. At that point, Shrimpy will stop trading for that portfolio until you resume the same automation or a new automation.

Adding Assets (Custom Allocations)

Adding a custom portfolio of assets is possible by clicking the “Add Assets” button on the “Automation” tab.

Notice: You cannot use the “Create Index” and “Add Asset” feature at the same time for a single automation (but of course you can create multiple automations). If you add custom assets, you can’t create a dynamic index for the same automation strategy.

Once you click the “Add Assets” button, you will be able to browse the different currencies available on the exchange, select which ones you would like in your portfolio, and then pick the percentages you want allocated to each.

Generally, this is the easiest way to start using Shrimpy. Picking a custom selection of assets is quick, easy, and will produce the results you expect.

Create Index (Dynamic Allocations)

The “Create Index” button is a bit more complex than the “Add Assets” button. Creating an index requires more knowledge about how dynamic indexes work with Shrimpy.

There are a number of ways to implement your cryptocurrency indexing strategy. Each aspect of your index can be configured on Shrimpy. The process of configuring an index is explained in great detail in this article.

Weight by Market Cap

Weighting an index by market cap is the most common strategy people take when allocating funds. Using a market cap weighting means the index is as close as possible to tracking the actual value held in the market being tracked. In this case, cryptocurrency.

Weight by Square Root Market Cap

An index fund can also be weighted using the square root of the market cap. Often, this method is used when there are some assets which massively shift the weighting of the index when using a market cap weighting. These are typically assets with significantly higher market caps than any other asset in the index. An example of an asset that currently fits this description is Bitcoin. At the time of writing, Bitcoin holds nearly 70% of all value in the market, making it the largest contributor to global cryptocurrency market cap by a significant margin.

Weight Equally

The most simple allocation weighting strategy for a fund is to evenly weight each asset in the portfolio. Each asset having the exact same value of funds allocated. While this strategy is far less common than market cap weighted strategies, some recent research has found evenly allocated indexes have tended to outperform market cap weighted indexes historically. This suggests evenly allocated index funds are worth the attention when considering which strategy is best for your personalized index fund.

Asset Range

Before getting into the technical details of the index fund, the first thing we need to do is decide on the assets which should be in the index. This is fundamentally what matters more than anything else we will do with our index.

In general, the most common way to select assets for a cryptocurrency index is to prioritize those with the highest market cap. That means calculating the cryptocurrencies with the highest market cap and selecting the top 10, 20, or 30.

Min Allocation Percentage

The cryptocurrency market is still dominated by a few major players. The top two assets alone comprise of 75% of the market cap. The tenth asset only holds .5% of the market cap. This vast disparity can lead to a lack of diversification in an index fund when allocating by market cap. Instead of using a square root market cap or evenly allocated index fund, another option is to implement a minimum weight for the index. That way every asset can provide a healthy contribution to the index.

Max Allocation Percentage

Similar to the discussion in the above section about minimum weighted allocations, there are also times when you want to provide a cap on the maximum amount a single asset can be allocated. This is ideal for asset classes like cryptocurrency where a single asset like Bitcoin can consume as much as 70% of the market cap. Under these conditions, it may be ideal to provide a maximum percent which can be allocated to a single asset.

Buffer Zone

This defines a threshold at which point an incoming asset should be considered for addition into the index. A common example is the use of a 5% ‘buffer zone’. When a new asset increases in market cap to become 5% higher than another asset in the index, the new asset is then added to the index, removing the asset which was beat out.

Include List

There are times when you might want to include specific assets in an index, even if they don’t abide by their asset selection methodology. While this wouldn’t be possible when using services like Bitwise or Crypto20, building our own index fund provides us the flexibility to adjust our index to include assets which don’t abide by a strict selection criteria.

Exclude List

Similar to ‘inclusions’, there are times when you may want to exclude an asset from an index, even when the asset strictly meets the criteria to be included in the index. Constructing a personalized index allows us to make these decisions without impacting our entire indexing strategy.

Select Allocation Percentages

Selecting your own allocation percentages is only available when using the “Add Assets” button. If you selected to use the “Create Index” button, the allocations for each asset will be defined by the configuration of your index.

After you have added the assets to your automation, you will see that each asset has a slider. This slider defines how much of the asset you will allocate in the portfolio when you activate the automation.

For example, if you select 30% Bitcoin for your automation, that means when you activate this automation for a portfolio and rebalance, Shrimpy will buy and sell your assets such that 30% of your funds will be in Bitcoin.

Your allocation percentages for any automation must sum to exactly 100%. In addition, all assets in your allocations must be allocated more than 0% of your portfolio. If you no longer want an asset in your allocations, click the trash can icon to remove it from the portfolio.

Rebalance Period

The simplest of these strategies is periodic rebalancing, which uses a fixed amount of time between each rebalance. This amount of time is usually shorter for cryptocurrencies than for other asset classes, due to rapid price fluctuations. For example, it would be reasonable to select a portfolio rebalance time of 1 day. This would mean that at the same time every day, your portfolio would be rebalanced.

Rebalance Threshold

Threshold based rebalancing is a portfolio management strategy used to maintain a set of desired allocations, without allowing the asset weightings from deviating excessively. When one of the individual constituents of the portfolio crosses outside the bounds of their desired allocations, the entire portfolio is rebalanced to realign with the target allocations.

The bounds around each allocation are the “threshold”. Set by the user, the threshold prevents excessive deviation from the target allocations.

Read our study that compares the performance of periodic and threshold rebalancing.

Dollar Cost Averaging

Dollar-cost averaging (DCA) is a strategy used by investors to reduce downside risk of placing large sums of money into the market at one time.

While this can be in the form of purchasing a single asset on a regular interval, we will be focusing on the strategy from the portfolio perspective. Considering it as a way to regularly inject new funds into a portfolio.

A dollar-cost averaging strategy will effectively distribute the injected funds across the portfolio based on a set list of target allocations.

Portfolio Stop-Loss

Although stop losses are often used by traders to manage a strategy across a single market pair, the remainder of the discussion will center around the idea of a portfolio stop loss. When we say “portfolio stop loss”, we are referring to the entire portfolio of assets currently held by the investor.

Rather than being concerned with each individual asset, portfolio stop losses pull the entire portfolio out of the market when a stop loss is triggered.

The funds that were held in the portfolio will all be converted to a stable currency or coins like USDT. Completely pulling the portfolio out of the market reduces the risk of a portfolio continuing to drop as the market declines.

Threshold Percentage

The threshold is the percent at which the stop loss is triggered. This threshold is applied over the time period that is specified in the previous box. A threshold of -5% with a time period of one day would mean the stop loss will trigger when the value of the portfolio decreases by 5% in one day.

Time Period

The time period defines the length of time that is evaluated for the stop loss. A time period of one day would mean Shrimpy will evaluate the last one day of portfolio performance to determine if the stop loss should trigger.

Currency

The currency is the asset that will be purchased when the stop loss is triggered. Every asset in the portfolio will be sold to buy this asset during a stop loss. The selection of currencies is limited to only stablecoins and fiat currencies.

Fee Optimization with Maker Trades

A maker order is similar to a taker order except instead of being placed at the current best bid or ask price across the spread, it is placed as an open limit order (or “maker”).

Maker Order - A sell order placed above the current best buy order, or a buy order placed below the current best sell order. In either case, the order is left open on the exchange for another person to take. Maker orders incur maker fees.

The process for completing a maker only rebalance can be done a number of different ways, but the most simple way would be to follow these simple steps:

Max Spread Percentage

Inputting a value for the maximum spread percent control will mean Shrimpy will not execute a trade over a spread that is larger than that amount. So, if you set a spread of 10% for example, Shrimpy will not cross a spread that is more than 10%.

Max Slippage Percentage

When being a "taker", you are executing the order immediately and removing that order from the order book. If your order was large enough to consume the entire order at that price, that means the next available price will be worse than the previously purchased price. This movement is called slippage. As we continue to consume the order book and move the price further away from the original purchase price, the Shrimpy application tracks this as slippage.

So, if we have a max slippage percentage of 5% set, that means the Shrimpy application will only allow the price to drift 5% before we cease execution. The slippage is calculated from the first executed trade to the current trade that is being evaluated. That way we always know the original price at which we executed our first order and can compare that to the next price we will attempt to place an order.

Trading

The Shrimpy trading terminal comes with a complete set of features that allow both advanced and novice traders to begin executing orders through the Shrimpy application.

Market Order

Placing market orders in the Shrimpy Trading Terminal is simple. Rather than configuring a list of settings, all you need to enter is the amount you would like to trade. You can see an example in the above image.

Limit Order

Unlike market orders where traders only need to specify an amount they would like to trade of an asset, limit orders require the input of a precise order price and amount.

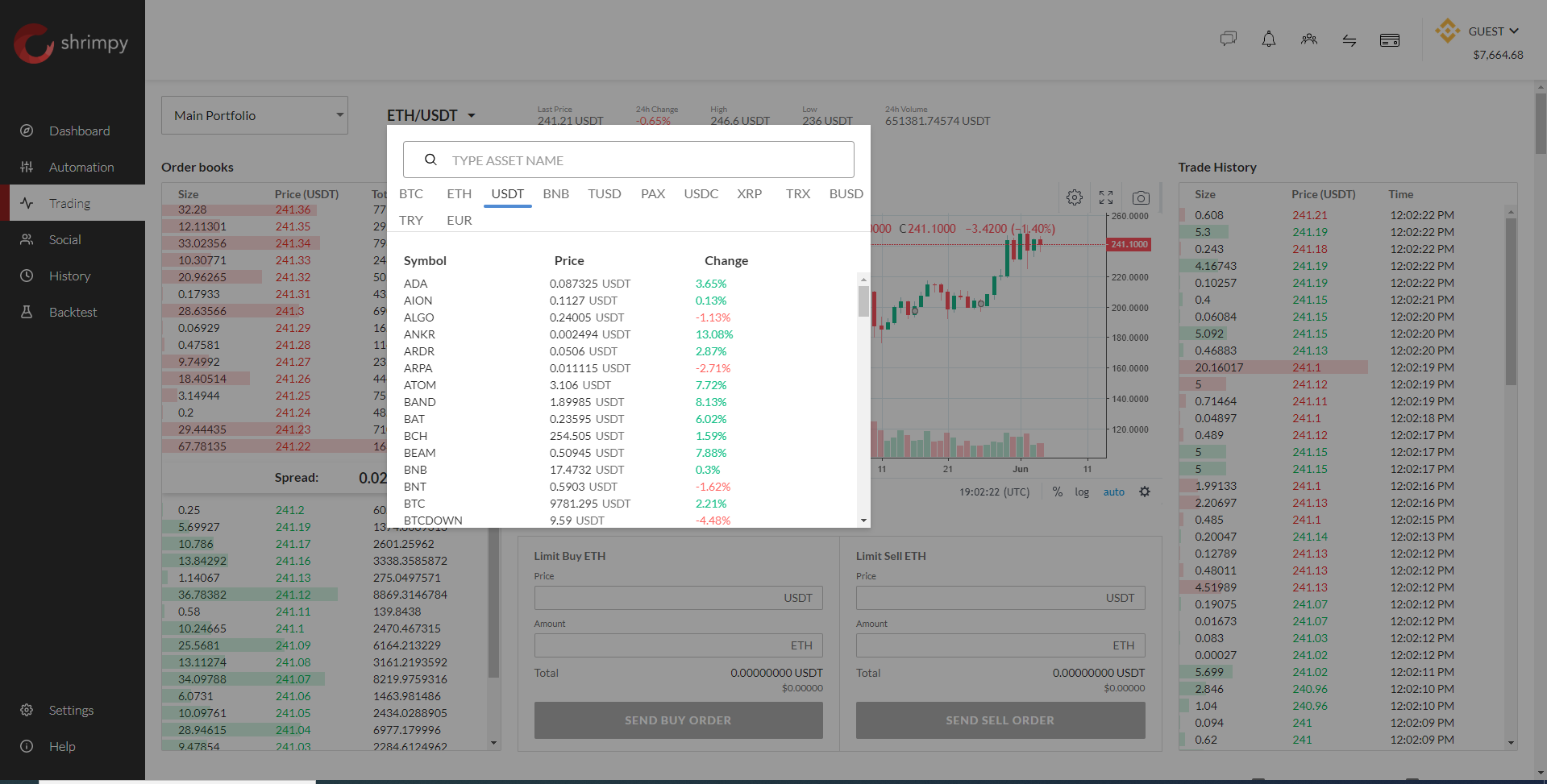

Trading Pairs

One of the first things you might want to know when visiting the trading tab is how to change the trading pair you are evaluating.

In Shrimpy, there is a simple drop-down that allows you to select the trading pair which you are viewing. This drop-down selector is in the top left corner of the trading tab. An example of this drop-down is found below:

Balances

One important aspect of trading is knowing how much funds you have available to make a trade. In the Shrimpy trading tab, all of your asset balances are available for viewing at the bottom of the trading tab. These balances are displayed for each asset in your portfolio.

Open Orders

In the tab next to "Balances" at the bottom of the trading tab, you will find "Open Orders". In this tab, Shrimpy will display the current open orders you have left on the exchange. At any time, you will be able to cancel an order that is not yet filled, so you can either place a new order or change your strategy.

Order History

Similar to the other order tabs, the order history is located next to "Open Orders" at the bottom of the trading tab. This tab will outline all of the orders you have placed on the exchange through Shrimpy.

Trade History

The last tab in the order table is for "Trade History". This tab will provide a detailed break down of every trade that was executed for your Shrimpy portfolio.

Portfolio Selector

The portfolio selector allows you to pick the portfolio that you would like to use for trading on the trading tab. Since Shrimpy will maintain a separation of the funds between each of your portfolios, this allows you to switch between portfolios in a convenient way.

On the funds in each individual portfolio will be used when executing trades on the trading tab.

This Portfolio Only Filter

The option to filter by “This portfolio only” will remove any trades, orders, or history that is not specific to the portfolio that is selected in the drop-down in the top left.

BTC/USD Only Filter

Similar to the “This portfolio only” filter, the trading pair filter allows you to only filter on events or assets that are relevant to the current trading pair that you are viewing. For example, if you are viewing the “ETH/USD” trading pair, this option will say “ETH/USD Only”.

History

The history tab is where we can view everything that Shrimpy has done for our account. We can see things like rebalances, when we start and stop following a leader, and much more.

The goal for this tab is to track everything that ever happens with your Shrimpy account.

Rebalance Trades

The trades that are executed during a rebalance will show up in your history. Trades will be grouped by asset when they are displayed. For example, Shrimpy might make 10 trades for Bitcoin, but they will be aggregated and shown under a single Bitcoin button. The value and price numbers use a weighted average to arrive at those results.

You can click the asset to see the individual trades that were executed for the asset.

Automation Updates

Whenever you update an automation that is currently attached to a portfolio, you will see that automation update in your history. The history item will include information about your strategy selection and rebalance period.

Currency Filter

On the history tab, you can filter by an asset by typing in an assets name or symbol into the search box. For example, if you type in BTC, Shrimpy will filter for trades that happened with BTC.

Trade Breakdown

The breakdown of individual trades that were executed can be found by clicking on a single asset in a rebalance history item. Once selected, you will see a popup with all of the individual trades that were executed for that asset during the rebalance.

Backtest

Backtesting allows customers the ability to evaluate how a strategy would have performed historically. That way it’s possible to get a general expectation for what might be possible with a specific strategy.

Asset Selection

The assets that should be included in the backtest can be selected under the section that is titled “Select Assets”. This will add each selected asset to the right side where allocations can be specified.

Each asset that is selected must be allocated more than 0% allocation. The allocations must add up to exactly 100% before the backtest can be run.

Backtest Configuration

On the left side you can see a section titled “Backtest Settings”. In this section, we can configure our rebalance strategy and trading fee. Notice that only one rebalancing strategy can be evaluated at a time.

Trading Fee

The trading fee setting is used to calculate how much should be taken in fees for each trade that is executed during the backtest.

Rebalance Period

The rebalance period indicates how frequently a rebalance should be executed to re-align the portfolio to the target allocations. The frequency can range from every 1 hour to over a year.

Rebalance Threshold

The rebalance threshold can be used to specify at what threshold the portfolio should be rebalanced to re-align the assets to their target allocations. The threshold is based on the deviation each asset has from their target allocations. To learn more about threshold rebalancing, see the above section on “Threshold Rebalancing”.

Fee Optimization

Enabling fee optimization will allow you to simulate how Shrimpy would perform with or without “Fee Optimization” enabled. You can learn more about fee optimization in the section above about “Fee Optimization with Maker Trades.”

Backtest Results

Once you select “Run” for the backtest, you will start to see the results of the backtest. This will include the population of the main graph along with other stats that can be used to indicate how well rebalancing performed compared to holding the same assets.

Shrimpy Final

“Shrimpy Final” refers to the amount of funds you would have had at the end of the backtesting period if you rebalanced using the portfolio allocations and rebalancing settings defined in the backtest.

Holding Final

“Holding Final” is the amount of funds you would have had at the end of the backtesting period if you didn’t execute any rebalances during the period. Instead, if you had held the same assets in a portfolio that didn’t rebalance.

Difference

Difference is the amount better or worse that Shrimpy Final performed compared to Holding Final.

Copy Portfolio

Clicking on the “Copy Portfolio” button will copy the portfolio you have been backtesting into your “Automation” tab.

Settings

Settings are the options that will be applied across all of your exchange accounts. Anything that is important for your Shrimpy account is put into the “Settings” tab. This includes options for Multi-Factor Authentication, linking exchange accounts, and your subscription.

General Settings

The general settings tab is a miscellaneous assortment of options that are available to Shrimpy users.

Shrimpy supports an easy way to change your email at any time. To start the process, begin by navigating to the "Settings" tab and locating the section marked as "General Settings". Under this heading, you will find the input box for "Email".

Chat Name

The chat name is used for when you communicate with other traders in the social aspects of Shrimpy. For example, when you make posts on a leader’s journal or discuss with the leader in their chat group. In these instances, your chat name will either show your custom selection or an anonymous name.

Display Currency

Shrimpy supports a handful of currencies for display purposes. When switching between these display currencies, your balances, prices, and other data will be converted to show in terms of your selected display currency.

Weekly Account Summary Email

This weekly report will provide a brief summary of the notable events which took place over the last week. That way you can get a quick snapshot of big market changes, new asset listings, social stats, and more.

Security

Security is always the top priority for the Shrimpy team. That means we are constantly being proactive in providing the latest and greatest security features.

IP Whitelist

IP Whitelisting is a feature which exchanges use to restrict access to your cryptocurrency exchange account. Setting up IP Whitelists means the exchange will only accept requests when they are sent from the specific IPs that are input into the exchange. This prevents unauthorized access to your exchange account from any other IP.

Multi-Factor Authentication

Two-Step Authentication (AKA Multi-Factor Authentication) provides a way that even if a password is stolen, the user's phone or secret key is still required to log into their Shrimpy account. We highly recommend everyone enables 2FA.

API

The Portfolio Management APIs allow customers to manage their Shrimpy account through APIs. These simple APIs provide ways for customers to automate custom strategies, adjust allocations with scripts, and easily interface with their portfolio.

The docs for the APIs can be found here.

Exchanges

Connecting to exchanges is the core feature that is offered by Shrimpy. We provide one of the easiest exchange linking experiences in the market.

Link Exchange

In order to begin trading on Shrimpy, you will need to connect your exchange APIs to the Shrimpy application. This is done through the "Exchanges" tab in "Settings". You can see a drop down with each of the exchanges we support along with text boxes to input the relevant information about your API keys.

Rename Exchange Account

In Shrimpy, it's possible to provide a custom name for your exchange accounts. That way you can differentiate between exchange accounts when you have a number of different accounts linked for the same exchange. This is done simply by going to "Settings", "Exchange", then selecting the exchange you would like to rename. At the top, you will see an edit icon that can be used to rename the exchange account.

Referral Link

Shrimpy pays customers for referring new users to Shrimpy. By sharing your custom referral link that is found inside your "Settings" tab, Shrimpy can track when a new customer signs up and pays using your referral link.

Make a Payment

Before you can begin using the trading features in Shrimpy or follow a leader, you must first connect a payment method and select a subscription plan. If you select to use PayPal or credit card payments, Shrimpy will automatically renew your subscription each month until you cancel your subscription.

Cryptocurrency payment must be manually made by visiting the “Payment” tab in “Settings”.

Your Commissions

Once you start referring new users and gathered a following in the social program, you will want to get paid. In Shrimpy, the payment process is easy. Navigate to “Settings”, then click on “Payment”. This will show you how much money you have earned in Shrimpy so far.

Link PayPal

Commissions are paid to leaders and people who refer customers through PayPal. Once a PayPal account has been linked to Shrimpy, leaders and affiliates can begin getting paid.

Navigation Bar

The navigation bar provides quick access to a few key actions that can be taken in the Shrimpy application.

Chat

There are a few different ways you can begin discussing with people in Shrimpy. The first option is apparent from the start. Everyone will have access to the main Shrimpy chat lobby. This is where anyone can ask questions, learn more about Shrimpy, or talk with other users about strategies.

Notifications

Notifications provide a way for Shrimpy to update you on specific events that might require your attention. These events can be anything from social notifications to announcements from the development team. Generally, notifications can be clicked to automatically navigate you to relevant areas of the application.

Notice that these notifications are specific to each individual exchange account.

Rebalance Status

Rebalancing is one of the most important events that can happen on Shrimpy. As a result, we provide an easy indicator to let you know when Shrimpy is completing a rebalance. If the icon turns orange, that means a rebalance is in progress. When using “Fee Optimization with Maker Trades”, you will also see the rebalance progress bar and the ability to cancel the rebalance in this drop-down. At any time, you can also pause trading on your entire exchange account.

Subscription Status

The credit card icon will display the current status of your subscription. If your subscription payment is due, you will find the icon will change color and warn you that a payment is due.

Exchange Accounts Menu

On the furthest to the right, we can find the exchange accounts menu. This menu is used to switch between the different exchange accounts you have linked to Shrimpy.

Remember, each exchange account is completely separate in Shrimpy. That means if you link multiple exchange accounts, you must set up automations for each exchange account.

Each exchange account will also have its own dashboard, trading tab, backtesting page, and more. Everything is specific to the exchange that is selected.

Contacting the Shrimpy Team

The Shrimpy team is always ready to help any way we can. If you have any questions at all, the quickest way to reach our team is through the Shrimpy Support Chat. This chat is available to all customers by clicking on the “Chat” icon in the top navigation bar in Shrimpy. After you click the “Chat” icon, you will see a blue button for the support chat.

Use the support chat to ask us any questions, give feedback on ways we can improve, or request new features.

Links to our other social channels include:

We’re looking forward to having you on Shrimpy and building the best cryptocurrency trading community possible!